Crypto Market Surges: Understanding the Current Uptrend

The cryptocurrency market has experienced a notable increase, with the market capitalization rising by 1.3% to $4.01 trillion. This surge has been accompanied by an increase in trading volume, reaching $173 billion. The top 100 coins have shown significant appreciation over the past 24 hours, with Ethereum (ETH) leading the pack with a 2.4% increase, followed closely by Bitcoin (BTC) with a 2.1% rise.

Crypto Winners and Losers

Among the top 10 coins by market capitalization, all have shown increases over the past 24 hours. Bitcoin (BTC) is currently trading at $113,992, while Ethereum (ETH) is changing hands at $4,191. Binance Coin (BNB) has risen 1.4% to $1,022. However, not all coins have fared as well, with Plasma (XPL), Provenance Blockchain (HASH), and Story (IP) experiencing double-digit drops.

On the other hand, Figure Heloc (FIGR_HELOC) has appreciated the most, with a 6.7% increase to $1.05, followed by MemeCore (M) with a 3% rise to $2.37. These fluctuations demonstrate the volatile nature of the cryptocurrency market, where prices can change rapidly.

Market Analysis and Trends

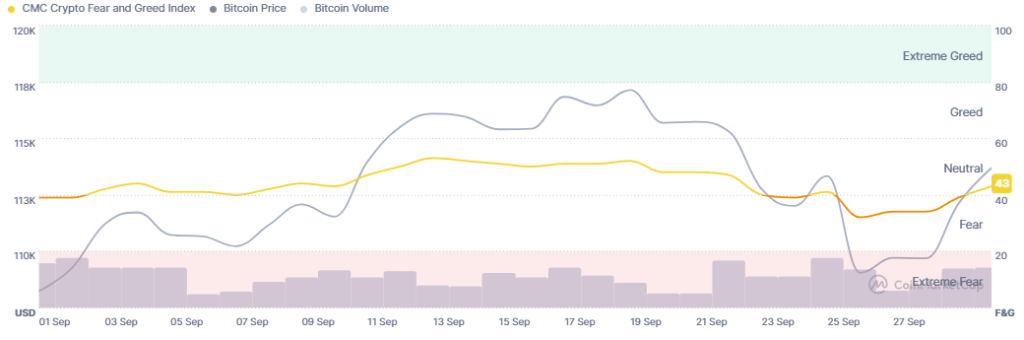

According to Bitfinex analysts, Bitcoin has entered a corrective phase following its US FOMC-driven rally, displaying classic “buy the rumor, sell the news” dynamics. The broader market structure shows fading momentum, with price action suggesting consolidation rather than continuation in the immediate term.

Bitcoin and Ethereum Price Movements

Bitcoin is currently trading at $113,992, with a notable surge earlier in the day from the low of $111,808 to the intraday high of $114,762. Ethereum, on the other hand, is trading at $4,191, having experienced a choppier trading day than BTC.

US BTC and ETH Spot ETFs

The US BTC spot exchange-traded funds (ETFs) broke their brief red streak on Monday, with $521.95 million in inflows. The cumulative net inflow now stands at $57.34 billion. Similarly, the US ETH ETFs also broke an outflow streak, recording $546.96 million in inflows on September 29.

BlackRock’s iShares Bitcoin Trust (IBIT)

BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed Deribit as the leading venue for Bitcoin options, with open interest in options linked to IBIT standing at nearly $38 billion after Friday’s expiry.