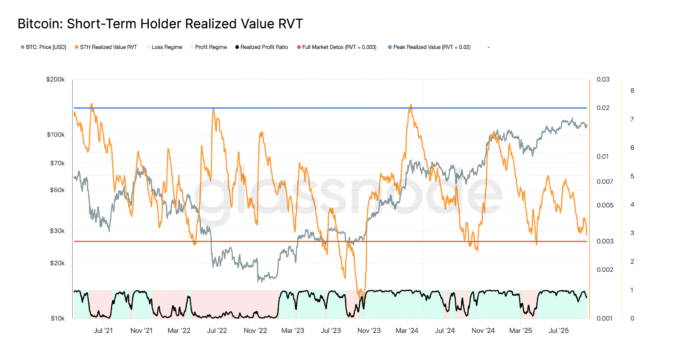

Bitcoin (BTC) has recently broken through the $120,000 barrier, marking a significant milestone for the cryptocurrency. On-chain data suggests that the market may be entering a new accumulation phase, with long-term holders (LTHs) playing a crucial role in relieving pressure. According to Glassnode, the short-term holder realized value ratio has been consistently compressing since May, indicating a cooling of speculative excesses.

Long-term Holders and Market Stabilization

This contraction in the ratio has historically been associated with “complete market detoxification,” where short-term traders make fewer profits compared to total network activity. If this trend continues, it could lay the foundation for renewed accumulation as investors await a clearer market direction. The balance between long-term holders and institutional inflows remains critical, with the metric of LTH net position change shifting to the neutral area after months of consistent distribution.

This neutralization of LTH flows could set the stage for a decisive breakout, with $120,000 emerging as a crucial threshold. The demolition of LTH distribution and short-term surpluses suggests that the market is preparing for a decisive attempt to break out, similar to the consolidation phase observed in March and April.

Short-term Owners and Market Resilience

Short-term owner behavior has also provided important signals, with Cryptoquant data showing that short-term holders (STHs) have recently undergone a stressful period. The STH-SOPR (Short-Term Holder Spent Output Profit Ratio) fell to 0.992 in September, marking a phase where speculative wallets consistently realized losses. However, the metric has since recovered slightly to 0.995, indicating early stabilization.

Historically, such provisions tend to be followed by either extended loss realization driving correction phases or a “healthy reset” in which sales pressure is quickly absorbed. Given BTC’s consolidation above $115,000, the recovery in STH-SOPR could be a potential marker for resilience in market templates ahead of a new bullish leg.

This article does not contain investment advice or recommendations. Every investment and trade movement involves risk, and readers should conduct their own research before making a decision. For more information on Bitcoin’s price analysis and market trends, visit https://cointelegraph.com/news/bitcoin-clears-dollar120k-as-onchain-data-points-to-a-new-btc-accumulation-phase?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound