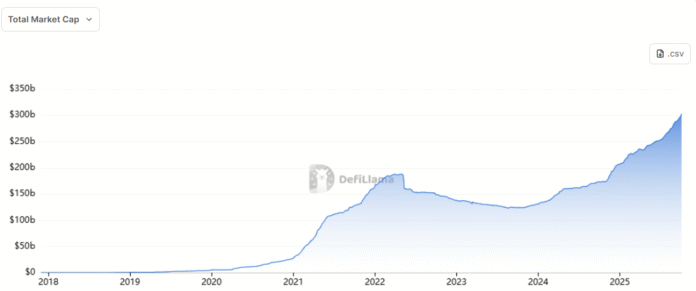

Stablecoin Market Reaches New Heights: $300 Billion Milestone

The stablecoin market has reached a record-breaking $300 billion in market capitalization, signaling a potential surge in investor capital flowing into the cryptocurrency market. This milestone may act as “rocket fuel” for cryptocurrency valuations, according to market analysts. The total stablecoin supply has grown by 46.8% year-to-date, outpacing the previous year’s growth rate.

Historically, October has been the second-best month for Bitcoin (BTC), and the record stablecoin supply has reinforced investor optimism around a potential “Uptober” rally. Andrei Grachev, founding partner at synthetic dollar protocol Falcon Finance, notes that the stablecoin supply is not idle capital, but rather “capital at work, not capital on hold.” Stablecoins are being used for settling trades, funding positions, and providing users with dollar access where banks fall short.

Source: DeFiLlama.com

Stablecoins have various use cases beyond investment, including payments, remittances, merchant payments, and savings. The growing supply may indicate increased stablecoin usage for daily payments or institutional settlements. Ricardo Santos, chief technical officer at stablecoin-based fintech payment company Mansa Finance, believes that the $300 billion milestone may signal a “rebound in digital assets” and growing integration of stablecoins in global finance.

Stablecoin Adoption on the Rise

Santos points to stablecoin adoption in countries such as Nigeria, Turkey, and Argentina, where residents use US dollar-pegged tokens as “de facto dollars” for everyday transactions. Stablecoins are also being integrated into payment systems by global financial players such as Visa, further embedding them into mainstream financial infrastructure. During the past month, Circle minted $8 billion worth of USDC (USDC) on the Solana network alone, with $750 million minted on Thursday, according to blockchain data platform Lookonchain’s X post.

Source: Lookonchain

Technical analyst and popular crypto trader Kyle Doops expects the record stablecoin supply to start flowing into the cryptocurrency market, as “capital doesn’t stay idle for long.” The growing stablecoin market may have a significant impact on the cryptocurrency market, and investors are watching closely to see how this will play out.

For more information on the stablecoin market and its potential impact on cryptocurrency valuations, visit the original source.