Bitwise Files S-1 for Aptos ETF, CEO Cites Momentum in Aptos Ecosystem

Crypto asset manager Bitwise has taken a significant step towards launching an Aptos ETF by submitting an S-1 registration with the US Securities and Exchange Commission (SEC). This move marks the beginning of a formal process to bring the ETF to market, although the approval timeline can be lengthy, often taking several months or more.

A S-1 registration is a comprehensive document required by the SEC for new securities, such as a crypto ETF, that are intended to be offered to the public. The SEC will carefully review the application, considering factors such as market risk, investor protection, and regulatory compliance before making a decision.

Bitwise CEO Hunter Horsley confirmed the submission in a recent post, highlighting the significant development activity in the Aptos ecosystem, with an increase of over 897% among new blockchain participants. Horsley noted that the Aptos Layer-1 blockchain has seen substantial growth, which could contribute to its appeal for an ETF.

SEC Review and Potential Impact on Aptos Price

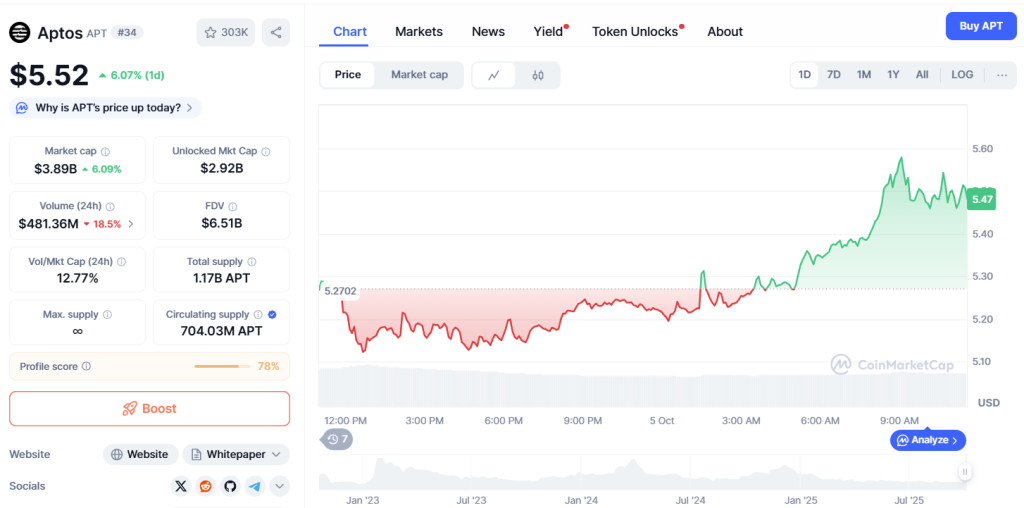

The SEC’s review process will involve a thorough examination of the application to ensure compliance with regulatory requirements. The outcome of this review could have a significant impact on the price of Aptos, as seen in the past when similar announcements have led to price swings. Following the announcement, Aptos rose from $4.63 to a high of $5.65 before settling around $5.52 at the time of writing.

Source: Coinmarketcap

Aptos Ecosystem Growth and Institutional Interest

The Aptos ecosystem has shown significant growth, with transaction volumes exceeding $3.98 billion and marking a three-month high for both price and volume. The native USDT activity on Aptos has also surpassed a volume of $30 billion, making it the fourth-largest layer 1 blockchain by net circulation of native USDT worth around $830 million.

Institutional interest in Aptos is also on the rise, with Blackrock, the world’s largest asset manager, expanding access to its tokenized real asset fund, the Blackrock USD Institutional Digital Liquidity Fund (Buidl), to include Aptos. This move is seen as a significant endorsement of the Aptos ecosystem and could pave the way for further institutional investment.

For more information on the development, visit https://cryptonews.com/news/bitwise-files-s-1-for-aptos-etf-ceo-cites-momentum-in-aptos-ecosystem/