Introduction to Pump.Fun and its Dominance in Solana’s Memecoin Launches

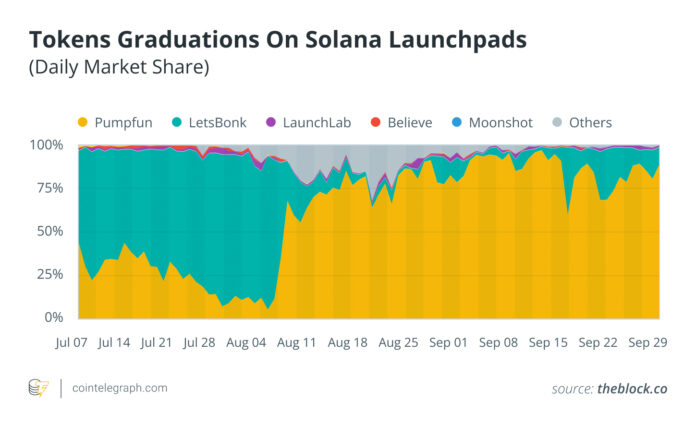

Pump.Fun, a Solana-native launchpad, has revolutionized the process of launching tokens, making it as simple as a few clicks. This platform has gained significant traction, capturing around 80% of Solana’s memecoin launches. But what sets Pump.Fun apart from its competitors, and can it maintain its edge in the market?

Key Features of Pump.Fun

Pump.Fun’s success can be attributed to its unique features, including a “completion” bond curve and locked LPS concentrated liquidity, which increases the pump. The proportion of fun at its peak is around 75%-80%. Additionally, the platform has a minimal cost for creators, with no fee for minting and a small, fixed fee of 0.015 Solana (SOL) for transactions. Once a token is completed, Pumpswap burns the liquidity provider (LP) associated with the trading pair, effectively locking the liquidity and reducing traditional rug-pull risks.

How Pump.Fun Achieved Dominance

Pump.Fun’s dominance in the Solana memecoin launch market can be attributed to its ability to couple ultra-low-tier token creation with a standardized path to liquidity. This design has made early price discovery more predictable and reduced the risk of creators pulling the carpet. As a result, Pump.Fun has recaptured around 73%-74% of LaunchPad activity over a seven-day period in mid-August 2025.

Rivals and Challenges

Despite its dominance, Pump.Fun faces challenges from rivals such as Letsbonk, Heavendex, and Raydium LaunchLab. These competitors have tried to compete on economics and liquidity, with some briefly stealing the spotlight. However, Pump.Fun’s strategic policy shifts, including aggressive revenue-funded buybacks, have helped the platform regain momentum.

Security, Legal Risk, and Market Cycles

Pump.Fun has faced security incidents, including a notable incident in May 2024 where a former employee used privileged access to withdraw around $1.9 million. The platform has also been subject to legal challenges, with several U.S. civil lawsuits alleging that Pump.Fun facilitates the sale of unregistered securities. Additionally, the platform’s revenue is cyclical, reflecting retail risk appetite, and has fallen sharply during periods of low demand.

Can Pump.Fun Maintain its Edge?

Pump.Fun’s ability to maintain its edge will depend on its ability to continue reinforcing its core loop of low friction, standardized “closing liquidity,” and trader concentration. If buybacks and creator incentives continue to support this cycle, dominance can persist through slower periods. However, the ongoing litigation and potential changes to listings, disclosures, or revenue programs add uncertainty to the platform’s future.

Key Metrics to Watch

To determine if Pump.Fun can maintain its edge, it’s essential to track key metrics, including launchpad share, buyback and incentive issues, fee and closing guidelines, Solana background, and legal milestones. These metrics will provide insight into the platform’s ability to adapt to changing market conditions and maintain its dominance in the Solana memecoin launch market.

Conclusion

In conclusion, Pump.Fun’s dominance in the Solana memecoin launch market can be attributed to its unique features, strategic policy shifts, and ability to adapt to changing market conditions. While the platform faces challenges from rivals and legal risks, its ability to maintain its edge will depend on its continued reinforcement of its core loop and adaptation to changing market conditions. For more information, visit https://cointelegraph.com/news/how-pump-fun-captured-80-of-solana-memecoins-and-can-it-last?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound