Canary Capital, a prominent asset manager, is on the cusp of securing approval for its Litecoin and HBAR exchange-traded funds (ETFs) after submitting crucial final details. Although the US government shutdown may hinder the immediate listing of these ETFs, industry experts believe that the recent filings are a significant step towards their eventual approval.

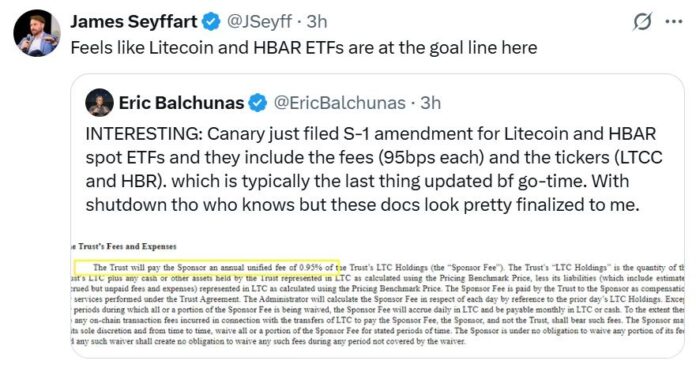

On Tuesday, Canary filed changes to its spot ETFs for Litecoin (LTC) and Hedera (HBAR), adding a 0.95% fee and the ticker symbols LTCC and HBR, respectively. According to Eric Balchunas, an ETF analyst at Bloomberg, these additions are typically among the last updates before approval. Balchunas noted that while the US government shutdown and the Securities and Exchange Commission’s (SEC) reduced operations may delay the approval process, the filings appear to be comprehensive.

Experts Weigh in on ETF Approval and Fees

James Seyffart, another ETF analyst at Bloomberg, shared a similar sentiment, stating that the changes suggest the Litecoin and HBAR ETFs are nearing the finish line. The predicted approval of these altcoin-linked ETFs could potentially spark a new altcoin rally, as it would provide investors with greater access to these tokens. Analysts at crypto exchange Bitfinex made a similar prediction in August, highlighting the potential impact of altcoin ETF approvals on the market.

The fees associated with the Litecoin and HBAR ETFs, at 0.95%, are higher than those of spot Bitcoin ETFs, which average between 0.15% and 0.25%. However, Balchunas pointed out that this is not unusual, as newer and more niche areas of the ETF space often come with higher fees. He added that if the LTC and HBAR ETFs attract sufficient inflows and interest, other issuers may attempt to offer competing products with lower fees.

Triple Leverage ETFs and the US Government Shutdown

Despite the US government shutdown, companies continue to file for new ETFs, with a focus on triple leverage funds. A 3x ETF is a fund that tracks various assets and uses leverage to deliver 3x daily or monthly returns. The SEC has previously rejected or disapproved highly leveraged crypto ETFs due to concerns about investor protection and volatility. Tuttle Capital has filed for 60 new 3x ETFs, while GraniteShares and ProShares have also submitted series of ETF applications, including those containing Bitcoin (BTC) and Ether (ETH).

Balchunas estimates that there are nearly 250 3x ETF filings, with issuers “spaghetti-shaming” so many at once because they are “making good money.” He explained that such ETFs achieve 2x leverage using swaps and then “use options to seek an additional 1x leverage.” The government shutdown has left the approval of these ETFs in limbo, with deadlines passing and no action taken.

Implications of the Government Shutdown on ETF Approvals

The crypto industry was expecting a wave of new crypto ETFs in October, with the SEC set to make final decisions on 16 crypto ETFs later in the month. New listing standards announced in September could potentially speed up the approval of spot crypto ETFs by eliminating the need for individual application reviews. However, the government shutdown has halted all progress, leaving the industry in a state of uncertainty.

For more information on the developments in the crypto ETF space, visit Cointelegraph.