Introduction to Stablecoins and Their Risks

Stablecoins have gained significant attention in the cryptocurrency market, with a total market cap of over $300 billion as of October 6, 2025, according to CoinMarketCap. Despite their rapid growth, stablecoins have not yet achieved widespread adoption due to the risks associated with depegging, collateral, and trust. In this article, we will delve into the world of stablecoins, exploring their history, the reasons behind their depegging, and the risks investors should be aware of.

Historical Overview of Stablecoin Depeggings

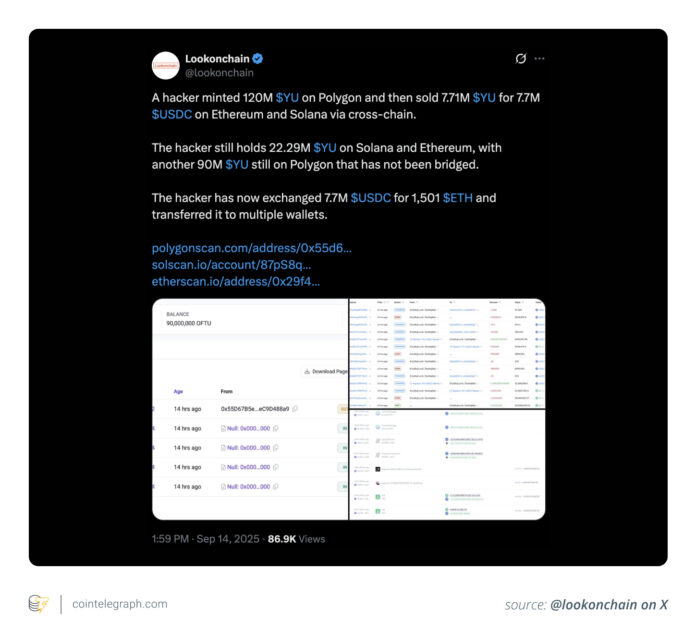

The depegging of stablecoins such as NuBits (2018), TerraUSD (2022), and USDC (2023) has exposed vulnerabilities in both algorithmic and fiat-backed models. The collapse of TerraUSD, for example, wiped out around $50 billion in value and highlighted the systemic fragility of algorithmic designs. Similarly, Yala’s Bitcoin-backed YU lost its peg due to an exploit, highlighting issues with low liquidity and cross-chain security. These events demonstrate the importance of understanding the risks associated with stablecoins and the need for investors to be cautious.

Case Study: The Collapse of TerraUSD

The collapse of TerraUSD (UST) in May 2022 was a major blow to the crypto market, setting off a chain reaction across the industry and exposing the risks of algorithmic stablecoins. Unlike traditional fiat-backed versions, UST attempted to maintain its $1 peg through an arbitrage mechanism with its sister token LUNA. The launch of TerraUSD was driven by the Anchor Protocol, which offered UST depositors unsustainable, subsidized returns of nearly 20%. As doubts about this model grew and crypto markets weakened, confidence plummeted, triggering a bank run-like spiral.

Why Stablecoins Can’t Maintain Their $1 Peg

Stablecoins aim to maintain stable prices, but past events show that they can lose their $1 peg in stressful situations. Errors arise from design weaknesses, market sentiment, and external pressures that reveal flaws even in robust systems. The main reasons for depegging include liquidity bottlenecks, loss of confidence and runs, algorithm errors, and external pressure. For example, Yala’s small Ether pool and Terra’s Curve swaps show how limited liquidity leads to instability.

The Risks Investors Can’t Ignore

Stablecoins are intended to provide reliability, but if they lose their peg, they can pose serious risks for investors and the entire crypto market. Some of the key risks investors should be aware of include financial losses, security defects, regulatory and reputational concerns, and systemic effects. A single stablecoin failure can trigger widespread market disruption, as seen in the collapse of Terra, which destabilized related DeFi systems and showed how interconnected risks can amplify damage across the crypto ecosystem.

Lessons from the Collapse of Stablecoins

Repeated stablecoin failures have demonstrated both the potential and fragility of dollar-pegged digital assets. Each collapse showed how liquidity gaps, weak collateral, and an overreliance on algorithms can quickly erode trust. To address these risks, issuers can focus on stronger collateral, transparency, and evidence of reserves. Backstop funds can also absorb sudden sell-offs and stabilize the bond. On the technical side, thorough contract audits, multi-signature controls, and limited cross-chain disclosure reduce security risks.

Conclusion

In conclusion, stablecoins have the potential to provide stability in the crypto market, but their risks should not be ignored. Investors should conduct their own research and be aware of the potential risks associated with stablecoins. By understanding the history of stablecoin depeggings, the reasons behind their depegging, and the risks investors should be aware of, we can work towards creating a more stable and secure crypto market. For more information on stablecoins and their risks, visit https://cointelegraph.com/news/from-terrausd-to-yu-why-stablecoins-fail-to-hold-1-and-the-risks-investors-can-t-ignore?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound