Introduction to the DEX Wars

The landscape of decentralized exchanges (DEXs) has undergone a significant transformation, shifting from a focus on token incentives to a more comprehensive approach that prioritizes speed, leverage, and sustainable infrastructure. This evolution has led to the emergence of key players in the market, including Hyperliquid, Aster, and Lighter, each with its unique strengths and strategies. In this article, we will delve into the current state of the DEX wars, exploring the factors that drive their growth and the implications for the future of on-chain trading.

Key Insights into the DEX Market

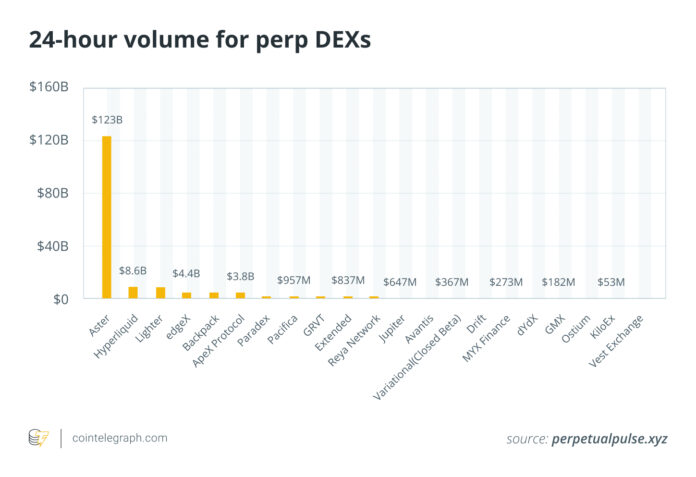

A new wave of DEX wars has shifted from token incentives to a focus on speed, leverage, and sustainable infrastructure. Hyperliquid continues to lead the market with over $300 billion in monthly volume, strong liquidity, and increasing institutional adoption. Aster’s growth is based on airdrops, Binance-backed credibility, and leverage that attracts professional traders. Lighter is gaining momentum due to its Ethereum Layer 2 speed, zero-fee trading model, and exclusive points-based yield farming system.

Platforms like SushiSwap, PancakeSwap, and Curve used yield farming and governance token incentives to attract liquidity. This approach triggered rapid capital formation, bringing billions of dollars onto the chain in a short period. However, the focus has now shifted to more sustainable models that prioritize infrastructure and execution quality.

Inside the DEX Liquidity Wars

Hyperliquid, a DEX built on its own powerful blockchain infrastructure, experienced strong growth in 2025. The exchange handled more than $300 billion in trading volume around mid-2025, with daily activity occasionally reaching nearly $17 billion. Its high liquidity and fast execution have helped it gain strong appeal among active and professional traders.

One of the key drivers of Hyperliquid’s strong growth has been the company’s ability to increase liquidity and user activity through a points-based rewards program. The effort ultimately resulted in a large airdrop, with 27.5% of the token supply distributed to 94,000 addresses, rewarding early and active participants. The value of the airdrop is currently around $7 billion to $8 billion.

Aster’s High-Stakes Game for DEX Dominance

Aster is a fast-growing DEX built on the BNB Smart Chain and has positioned itself as one of Hyperliquid’s main competitors. On some days, reported trading volumes rose to tens of billions of dollars, occasionally exceeding Hyperliquid’s numbers. The project’s connection to Changpeng “CZ” Zhao, the co-founder of Binance, has also attracted significant attention in the market.

Aster’s momentum comes from its close relationship with CZ, which is now advising on the project. His involvement has led many online users to refer to Aster as “Binance’s DEX.” The exchange has launched tokenized stocks, allowing users to trade key assets on-chain with up to 1,000x leverage. The introduction of its own Layer 1 blockchain is also planned.

Airdrops and Exclusivity are Driving Lighter’s Rise

Lighter has quickly established itself as one of the more technically sophisticated stacks in the DeFi space. It is based on custom Ethereum Layer 2 with zero-knowledge circuits and supports matching latency of less than five milliseconds. The goal is to approximate the speed of centralized exchanges (CEX). The platform offers no trading fees to retail users, while API and institutional transactions incur premium fees.

Lighter has driven rapid growth through its Lighter Liquidity Pool (LLP) program, which has become one of the most attractive yield opportunities in the DeFi space. The pool currently offers an annual percentage yield (APY) of around 60% on more than $400 million in deposits. Access to the LLP is tied to a user’s points balance, making higher allocation limits available to more active traders.

Institutional Liquidity Comes into the Chat

A growing subplot in this battle is the gradual but notable influx of institutional liquidity. Funds that previously avoided on-chain derivatives due to slippage, latency, or compliance concerns are now providing test capital to these platforms.

Hyperliquid’s speed-focused, transparent design has sparked growing interest among professional traders, while Aster’s Binance-related narrative is attracting widespread attention in Asian trading communities.

According to Calder White, chief technology officer of Vigil Labs, the apparent surge has very different underpinnings depending on the platform. “Our system shows that Aster’s growth is very narrative-driven, with traders recycling capital to increase volumes, while Hyperliquid continues to deliver the largest organic inflow from serious participants. Both Aster and Lighter rely on the same points-to-airdrop playbook to drive liquidity and activity to Hyperliquid to compete for market share,” White said.

Infrastructure vs. Narrative: Who Will Win in the Long Term?

As the competition between Lighter, Aster, and Hyperliquid continues to heat up, Hyperliquid continues to set the benchmark in on-chain derivatives, supported by unmatched open interest, strong execution quality, and growing institutional traction.

Instead of slowing down, the exchange has stepped up its efforts and launched HIP-3, allowing anyone to launch a perp-DEX on Hyperliquid’s rails, launch their USDH stablecoin, and quickly move to listing perpetuals for competing tokens like ASTER to capture narrative flows.

For more information on the DEX wars and the future of on-chain trading, visit Cointelegraph.