The recent cryptocurrency market crash has led to a surprising resurgence in privacy-focused coins, with Zcash (ZEC) and Dash (DASH) being the biggest gainers. This phenomenon has been dubbed the “dinosaur coin season,” where older coins that have underperformed the market for years are experiencing an upward trend. But what’s driving this rally, and which factors are contributing to the growth of these privacy coins?

Key Factors Contributing to the Rally

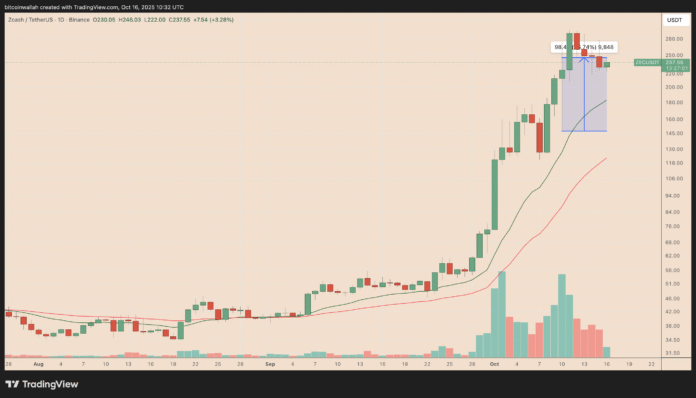

Zcash and Dash have broken out of their multi-year downtrends, marking a long-awaited reversal in momentum. ZEC has gained over 66% from its October 9 low to $246, with a year-to-date (YTD) increase of almost 350%. DASH has recovered over 65% since the crash and was trading at nearly $50 on Thursday, with a return of nearly 150% last month. The total market cap of privacy coins has increased by 36.70% since October 1, reaching over $7 billion.

ZEC/USDT daily chart. Source: TradingView

DASH/USDT daily chart. Source: TradingView

Naval Ravikant’s Influence and Market Conditions

Renowned investor Naval Ravikant’s endorsement of Zcash as “insurance against Bitcoin” on October 1 has been cited as a catalyst for the rally. The altcoin market’s highest oversold level since April, combined with the crash that wiped out billions in leveraged positions, created an attractive environment for dip buyers. As a result, Zcash’s strong rally signaled to traders that the privacy coin market was ready for a recovery, leading to a classic relief rally with privacy tokens enjoying a strong upswing.

Top performer in the privacy coin sector with 30-day gains. Source: Messari

The four-hour TOTAL altcoin market cap relative strength index. Source: TradingView

Technical Reversals and Future Prospects

Both Zcash and Dash have broken out of their multi-year falling wedge patterns, a bullish reversal setup that often precedes a strong uptrend continuation. ZEC has confirmed its breakout this month, marking the end of a seven-year downtrend and opening the door for a possible rally towards $490 in the coming months. DASH has already entered its own breakout phase, reclaiming the $50 mark for the first time since early 2024.

ZEC/USD monthly chart. Source: TradingView

DASH/USDT monthly chart. Source: TradingView

LTC remains within an ascending triangle pattern defined by a series of higher lows since 2022. A decisive break above the $100-$150 range could trigger a measured move towards the 1.0 Fibonacci retracement level near $375, which would mark a full recovery from previous cycle losses.

LTC/USD monthly chart. Source: TradingView

Monero (XMR), the leading privacy coin by market cap, has missed out on the strong rebound due to its opaque design, which has led to delistings on major exchanges, reducing its liquidity and visibility. However, the recent rally in Zcash and Dash has led some traders to declare a “dinosaur coin season,” where older coins experience an upward move.

Source: X

XMR/USD daily chart. Source TradingView

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/dinosaur-coins-season-why-are-zcash-dash-biggest-rebounds