OpenSea’s Transformation: From NFT Marketplace to Crypto Aggregator

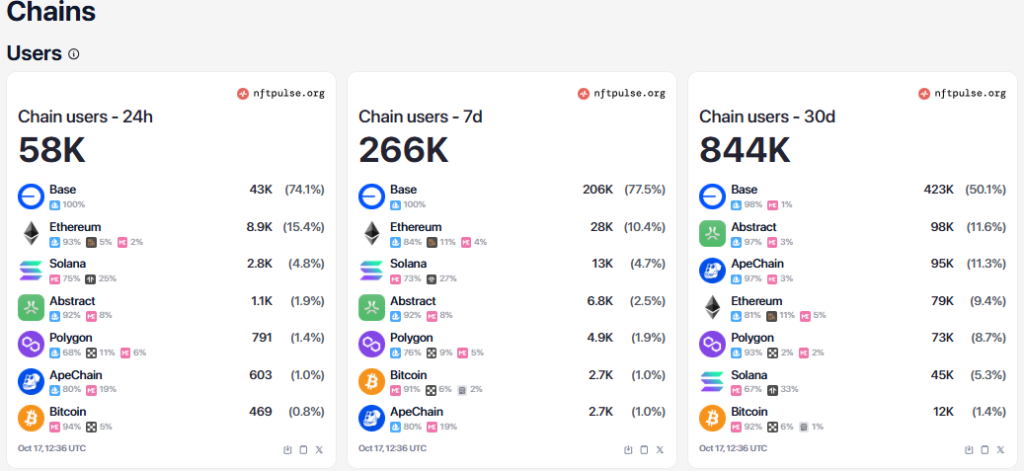

OpenSea, once the leading platform in the NFT boom, has undergone a significant transformation in response to the drastic decline in NFT trading volume, which has plummeted over 90% from its 2021 highs. Under the leadership of CEO Devin Finzer, OpenSea has expanded its services beyond digital collectibles to become a multi-chain crypto trading aggregator, supporting 22 blockchains.

The shift in strategy is a response to the changing crypto landscape, where the NFT sector’s capitalization has dropped from $20 billion in early 2022 to around $4.87 billion by October 2025, according to CoinGecko. Finzer views this transformation as both a survival strategy and a bet on the future direction of the industry, stating, “You can’t fight the macro trend. People want to trade everything – not just digital art.”

OpenSea’s New Business Model and Revenue

OpenSea’s new business model involves bundling buy and sell orders from decentralized exchanges like Uniswap and Meteora, generating around $16 million in revenue through a 0.9% transaction fee. The platform does not perform “know-your-customer” checks, citing incompatibility with its non-custodial model, but uses blockchain analytics to flag suspicious transactions.

The company’s evolution into a multi-asset aggregator reflects a broader trend among former NFT-focused companies adapting to the changing crypto economy. For instance, Solana-based marketplace Magic Eden acquired trading platform Slingshot to expand beyond NFTs.

OpenSea’s Trading Volume and Market Trends

OpenSea’s trading volume has reached its highest level in three years, with the platform processing $1.6 billion worth of crypto transactions and $230 million worth of NFT transactions in the first two weeks of October 2025. The company’s resurgence comes amid changing investor interest in the digital asset space, with Bitcoin and other cryptocurrencies rising, while NFT trading remains a fraction of its former volume.

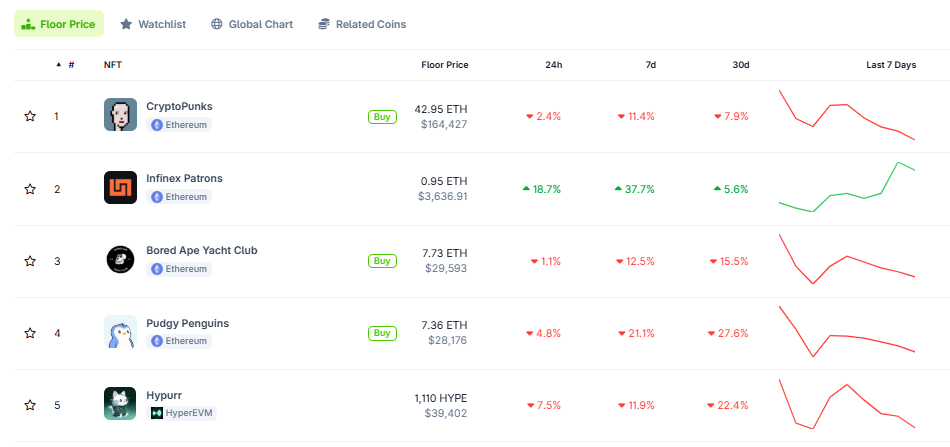

According to CoinGecko, the NFT market cap rose 94% to $6.6 billion in July, driven by renewed interest in blue-chip assets like CryptoPunks and Pudgy Penguins. However, trading volumes remain volatile, with daily volumes hovering around $8 million.

OpenSea’s Future Plans and Token Launch

OpenSea’s “2.0” vision includes plans for a mobile app and an independent foundation that will issue an OpenSea token. The goal is to make trading as intuitive as Robinhood, but completely self-governing, allowing users to maintain control of their assets across chains. According to Finzer, the company is committed to making trading accessible and secure for all users.

For more information on OpenSea’s transformation and the current state of the NFT market, visit Cryptonews.

Source: https://cryptonews.com/news/opensea-reinvents-itself-as-crypto-aggregator-amid-90-nft-volume-crash/