Crypto Market Collapse: Risk of Panic Selling Tests Bitcoin, ETH, XRP, and SOL

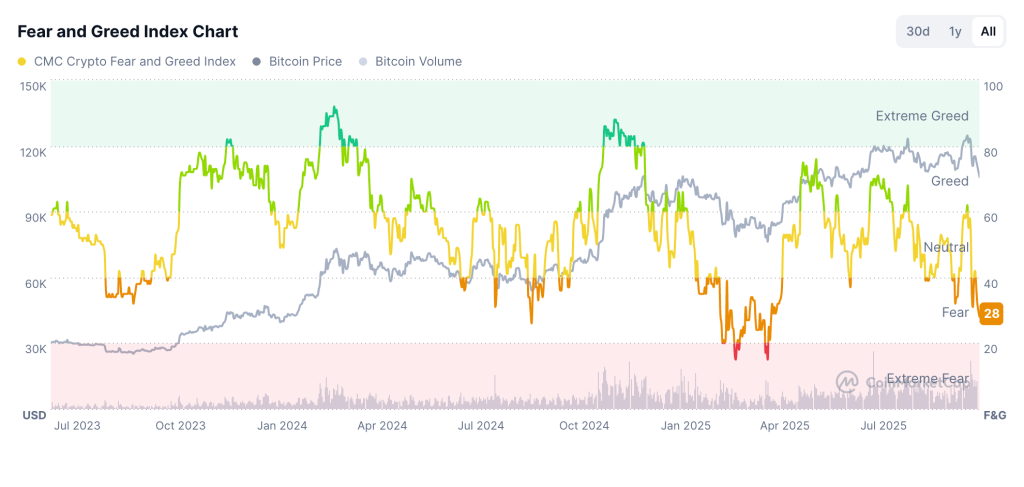

The cryptocurrency market has taken a turn for the worse, with the total capitalization nearing the mid-range of $3.6 trillion and 24-hour volume jumps indicating forced selling rather than patient bidding. This has led to a shift in sentiment, with the Crypto Fear and Greed Index trending towards extreme fear. As a result, a self-reinforcing narrative about the crypto market crash has begun to emerge.

The mood in the market is one of fear, with the Crypto Fear and Greed Index indicating extreme fear. This background feeds a self-reinforcing narrative about the crypto market crash. According to CoinMarketCap, the total market capitalization is currently around $3.62 trillion, with a decisive decline through this range potentially keeping sellers in control and prolonging the crypto market crash.

Market Collapse Scenario

A Bitcoin crash would likely accelerate if the price loses the 200-day range again and closes below it on increasing volume. Barrons has drawn attention to this breach and warned of trend damage during this decline. Macro stress increases the risk, with Reuters noting a rise in the Cboe Volatility Index (VIX) toward recent highs, a sign that often reflects de-risking moves in assets.

Fear and Greed Index (Source: CoinMarketCap)

Bitcoin, XRP, ETH, and SOL Levels

Bitcoin is currently trading at around $106,000, rebounding from the previous level of $105,000 today. Look out for $100,000 for defense and $110,000 for support. A recovery requires steady spot demand with calmer dynamics, rather than a funding push. Ethereum is currently trading around $3,800, and the $3,600-$3,700 area has looked like a pivot point this month.

Bitcoin price (Source: CoinMarketCap)

XRP is trading near the $2.3 level, with $2.00 being key support after recent volatility. Values below this line would increase rumors of an XRP crash towards the upper $1 mark. Solana is currently trading near the low of $180, although CoinMarketCap showed $181-$190 in recent transactions. $170 is the first support, then $160. A close above $195 would initiate a short repair.

Instead of Panicking, What to Do Now

Start with price and size. A steady recovery towards $3.7 trillion with increasing spot volume on green days suggests that buyers are active and not just shorting. Confirm this with managers. Bitcoin, near $106,000, and Ethereum, near $3,800, need firm daily closes above nearby resistance.

Measure stress through feelings. The fear and greed index in the low 20s suggests caution. A drift into the high 30s with stronger closes often indicates panicked exhaustion. Treat spikes on red days differently than spikes on green days. Track volume quality, with increasing spot volume on down days indicating distribution and increasing spot volume on up days indicating accumulation.

For more information, visit https://cryptonews.com/news/crypto-market-collapse-risk-panic-selling-tests-bitcoin-eth-xrp-sol/