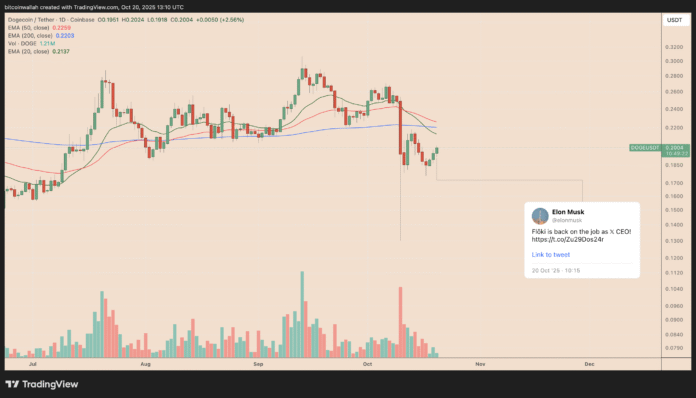

Dogecoin (DOGE) has been making headlines in recent days, thanks to a significant surge in its price. The memecoin rose by 2.5% to $0.20, following a post by Elon Musk on X, which featured the Shiba Inu mascot. This development led to a 29% increase in the DOGE price, sparking renewed interest in the cryptocurrency.

The recent price movement has extended DOGE’s strong rally from its recent low of $0.13, which was its lowest point since April. This marks a 55% recovery in just two weeks, demonstrating the cryptocurrency’s resilience and potential for growth.

Elon Musk’s tweets have historically had a significant impact on DOGE’s price. In 2021, his tweets fueled an explosive rally, which saw the cryptocurrency’s price rise from a few cents to nearly $0.73. With sentiment improving and several technical indicators signaling bullish signals, DOGE appears poised to continue its recovery in the second half of October.

Technical Analysis: DOGE’s A&E Indicator Points to a 25% Increase

Dogecoin is forming an Adam and Eve double bottom pattern, a bullish reversal setup that signals easing selling pressure and buyers regaining control. The pattern’s neckline is close to $0.216, and a confirmed breakout above this level could trigger a move towards $0.260, representing a 25% increase from current prices.

The target price of $0.260 matches the measured motion projection of the pattern and coincides with an important technical confluence zone. It also corresponds to the 0.382 Fibonacci retracement level on DOGE’s weekly chart, as shown below.

Short Squeeze: A Potential Catalyst for DOGE’s Price Increase

Futures data reveals a greater concentration of short liquidations between $0.215 and $0.27, while long liquidation levels remain relatively flat below $0.18. This imbalance suggests less downside risk, as less leveraged long positions could trigger significant selling pressure. Conversely, there is a dense liquidity wall of shorts on the upside waiting to be pressured.

A break above the $0.216 neckline could trigger a wave of short liquidations, accelerating a move towards $0.26 as bearish traders are forced to join the rally. With DOGE holders buying on dips, the question remains whether a price target of $1.60 is realistic by 2026.

Investment Advice and Risks

This article does not contain investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information on Dogecoin’s price movement and analysis, visit https://cointelegraph.com/news/dogecoin-25-percent-jump-elon-musk-new-cryptic-doge?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound