Pi Network’s price has stabilized at $0.20, following a significant oversold bounce, with buyers defending this key support level on the high time frame. The question on everyone’s mind is whether this level can trigger a sustained upward recovery. To understand the potential trajectory of Pi Network’s price, it’s essential to delve into the technical analysis and market dynamics at play.

Understanding the Technical Setup

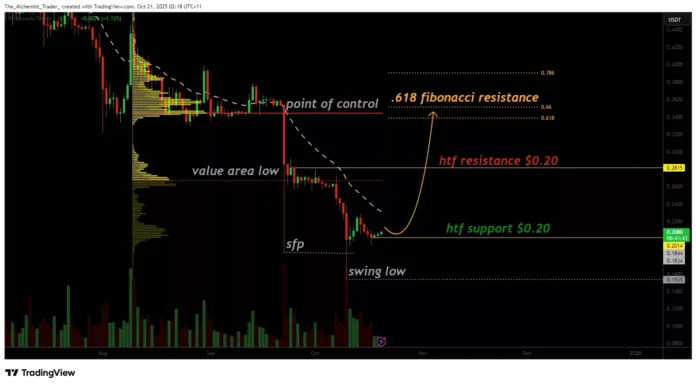

Pi Network (PI) has found stability near the $0.20 support area after experiencing a strong oversold bounce. This rally was precipitated by a confirmed Swing Failure Pattern (SFP), a technical setup that often signals the end of a sell-off and the possible start of a trend reversal. The SFP was confirmed when the price broke above the previous low before reversing, capturing the attention of traders and investors alike.

The $0.20 level serves as an important structural support, where demand continues to be evident. The break of the previous low confirmed an SFP setup, signaling buyer re-entry into the market. With several potential catalysts looming on the horizon that could reignite bullish momentum on the Pi Network, market participants are closely watching to see whether the recovery can extend beyond this key support area.

Key Technical Points and Future Outlook

From a technical standpoint, the high time frame support at $0.20 is crucial. Holding this level will support an upward move towards the $0.26 resistance level. Consistent upward volume is key to sustained upward momentum. The presence of multiple daily closes above the $0.20 region highlights that this area is now acting as a valid support zone, indicating that demand has returned to the market.

The next critical area for Pi Network’s price is around the low of the value area, which coincides with an important volume cluster and serves as the first test of an uptrend continuation. A successful recapture of this resistance would position the Point of Control (POC) as the next technical magnet, coinciding with the 0.618 Fibonacci retracement level. If price action reaches this area and maintains momentum towards this zone, it would confirm that the $0.20 level has established a firm market bottom.

PIETWORK (1D) chart, source: TradingView

PIETWORK (1D) chart, source: TradingView

However, for this move to materialize meaningfully, upside volume must continually increase to confirm buyer participation. Without increasing volume, the setup risks dissolving into a sideways accumulation range rather than a full bullish reversal. As long as Pi Network holds above the high time frame support at $0.20, the bias is cautiously bullish. A continued series of daily closes above this level would confirm stability and increase the likelihood of a rotation towards higher resistance.

In conclusion, the future price development of Pi Network will depend on its ability to hold above the $0.20 support level and demonstrate increasing buyer participation through rising volume. As market dynamics and technical setups continue to evolve, investors and traders will be closely monitoring the situation to capitalize on potential opportunities. For the most accurate and up-to-date information, visit https://crypto.news/pi-network-price-holds-0-20-support-following-oversold-bounce-can-bulls-return/