The Crypto Industry’s Shift to “Real Value” Metrics: A Closer Look

The cryptocurrency industry has undergone a significant transformation in recent years, with a growing emphasis on demonstrating “real value” and “adoption” rather than relying solely on speculation. This shift is evident in the way projects now prioritize metrics such as daily active users, transaction volumes, and real-world use cases. However, beneath the surface, it appears that the industry is still grappling with the same fundamental issues that have plagued it since its inception.

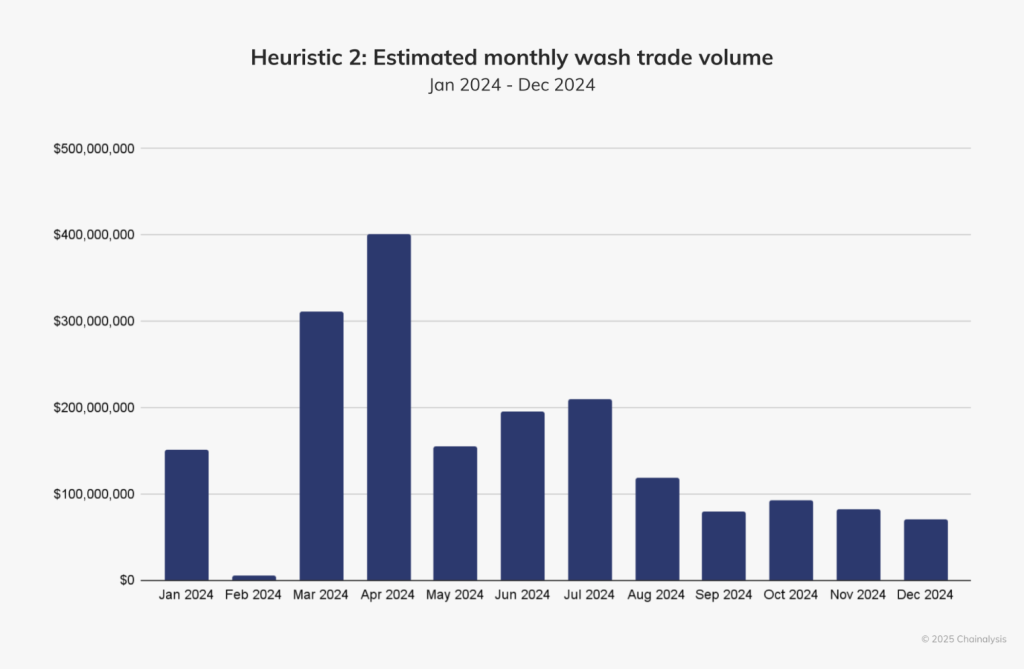

A recent study by Chainalysis found that approximately $2.57 billion in suspected wash trading activity occurred on major decentralized exchanges in 2024 alone. This phenomenon, where a single entity creates the illusion of widespread adoption by controlling multiple wallets, raises important questions about the validity of these metrics. If a handful of individuals can create the appearance of a thriving community, what does “adoption” really mean in the context of cryptocurrency?

Airdrop Economics and the Mirage of Engagement

The airdrop farming phenomenon has further exacerbated the issue of inflated metrics. Projects often tout impressive user numbers without acknowledging that a significant portion of their “community” is comprised of individuals seeking free tokens across multiple protocols. According to industry data, over 52.7% of all cryptocurrencies listed on major tracking platforms have already failed, with the majority of these collapses occurring in 2024 and early 2025. This highlights the fleeting nature of these “communities” and the lack of genuine engagement.

Red Flags: Identifying the Warning Signs

Several red flags indicate that a project’s metrics may be inflated or misleading. These include suspicious transaction patterns, bot-driven metrics, and token-gated functionality. If a project’s “utility” requires users to hold, stake, or spend their token for basic functionality, it may be creating artificial demand rather than solving a genuine problem. Furthermore, if a project’s metrics disappear after the airdrop, it suggests that the “community” was merely a collection of individuals seeking free tokens.

What Real Utility Looks Like

True utility in cryptocurrency is not dependent on sophisticated token mechanisms or speculative valuation. Rather, it solves a concrete problem, generates revenue from actual service delivery, and attracts users who remain engaged even after incentives have dried up. Real utility creates measurable value that can be verified without relying on easily manipulated on-chain metrics. By focusing on building legitimate, useful products, the industry can create a more sustainable and trustworthy ecosystem.

The Reckoning: A Call to Action

The cryptocurrency industry’s rush to rebrand itself as “user-centric” has been driven by the need to attract new investors and justify valuations. However, this shift has also created an opportunity for the industry to build something legitimate and meaningful. By acknowledging the flaws in the current system and working to create genuine value, projects can create a more sustainable and trustworthy ecosystem. As the industry continues to evolve, it is essential to prioritize transparency, accountability, and a focus on building useful, real-world applications. For more information, visit https://cryptonews.com/exclusives/the-utility-mirage-how-cryptos-new-metrics-are-just-old-tricks-in-disguise/