Understanding Cryptocurrency Taxation: Key Insights and Implications

Tax authorities worldwide, including the Internal Revenue Service (IRS), Her Majesty’s Revenue and Customs (HMRC), and the Australian Taxation Office (ATO), classify cryptocurrencies as capital assets. This classification means that sales, trades, and even swaps of cryptocurrencies are considered taxable events, similar to the sale of stocks or real estate. The implications of this classification are far-reaching, affecting how individuals and businesses approach cryptocurrency transactions and tax reporting.

A critical aspect of cryptocurrency taxation is the coordination among tax authorities globally. Frameworks such as the Financial Action Task Force (FATF) and the Organisation for Economic Co-operation and Development’s (OECD) Crypto-Asset Reporting Framework (CARF) facilitate the tracking of transactions, including those across borders and involving privacy coins. This international cooperation significantly enhances the ability of authorities to monitor and regulate cryptocurrency activities.

The Role of Blockchain Analytics in Tax Compliance

Blockchain analytics companies, such as Chainalysis, play a pivotal role in linking wallet addresses to real identities and tracking complex transactions, including those in decentralized finance (DeFi) and cross-chain transactions. This capability allows tax authorities to enforce compliance more effectively, making it increasingly difficult for individuals to avoid taxes on their cryptocurrency holdings.

Maintaining detailed logs of trades, staking bonuses, and gas fees is essential for calculating accurate profits and ensuring smoother tax reporting. This record-keeping is crucial for individuals and businesses to comply with tax regulations, which are subject to change and can vary significantly by jurisdiction.

Why Cryptocurrency is Taxable

Cryptocurrency is considered taxable because it is treated as property or a capital asset, rather than as a currency. This treatment means that selling, trading, or issuing cryptocurrency may trigger a taxable event. Income from activities such as staking, mining, airdrops, or yield farming must also be reported based on its fair value at the time it is received. Even exchanging one cryptocurrency for another can result in capital gains or losses, depending on the price difference between acquisition and disposal.

Complying with tax regulations requires individuals to maintain detailed records of all transactions, including timestamps, amounts, and market values at the time of each trade. Accurate documentation is essential for filing annual tax returns, calculating profits, and maintaining transparency. It also helps prevent penalties for under-reporting or tax evasion, as cryptocurrency tax rules are constantly evolving.

Common Reasons for Non-Compliance

Individuals may fail to pay taxes on their cryptocurrency transactions due to confusion, lack of information, or the complexity of compliance. Some common reasons include the assumption of anonymity, the use of private platforms, confusion about taxable events, and the complexity of compliance. It is essential for taxpayers to understand that simply purchasing and holding cryptocurrencies (often referred to as “hodling”) is usually not a taxable transaction. Taxes apply if the cryptocurrency is sold, traded, or spent, resulting in a profit.

How Authorities Track Cryptocurrency Transactions

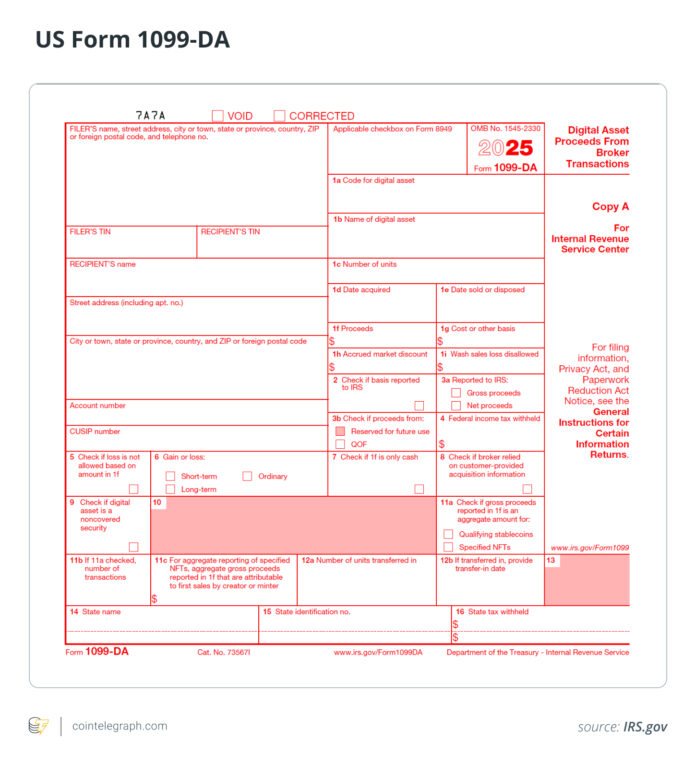

Governments use advanced technology and global data exchange systems to monitor cryptocurrency transactions. Agencies such as the IRS, HMRC, and ATO work with companies like Chainalysis and Elliptic to track wallet addresses, analyze transaction histories, and link anonymous accounts to real identities. Exchanges share user data on crypto transactions and holdings through reports such as the US Form 1099-DA and international frameworks like the Common Reporting Standard (CRS).

Consequences of Non-Payment

Failure to pay taxes on cryptocurrency holdings can have serious legal and financial consequences. Tax authorities may impose civil penalties, including fines for late payments, under-reporting, and accrued interest. Continued non-compliance can lead to audits and frozen accounts as tax authorities uncover unreported crypto transactions through their databases. In serious cases, intentional tax evasion can result in criminal charges, leading to prosecution, large fines, or even imprisonment.

Global Efforts to Enforce Compliance

Global efforts to enforce cryptocurrency tax compliance are intensifying as regulators increase cooperation. The Group of Twenty (G20) countries, along with the FATF and the OECD, support standards for the supervision and taxation of digital assets. The OECD’s CARF will enable the automatic exchange of taxpayer data between different jurisdictions, reducing opportunities for offshore tax evasion. Authorities are paying more attention to offshore crypto wallets, non-compliant exchanges, and privacy coins that hide transaction details.

Corrective Actions for Non-Compliance

If an individual has not reported their cryptocurrency taxes, it is crucial to act quickly to minimize potential penalties. This involves checking the entire transaction history from exchanges, wallets, and DeFi platforms, and using blockchain explorers or crypto tax tools to accurately calculate capital gains and losses. Filing amended tax returns can correct previous failures, and several countries offer voluntary disclosure or leniency programs that can reduce fines or prevent criminal charges if reported proactively.

Compliance Strategies

To avoid cryptocurrency tax issues, it is essential to stay compliant and maintain thorough documentation. Keeping detailed records of all transactions, including trades, swaps, staking bonuses, and gas fees, affects taxable gains or losses. Using regulated exchanges can provide easy access to transaction data and ensure compliance with local reporting rules. Checking a country’s crypto tax policies regularly is also crucial, as rules and definitions change frequently.

This article does not contain investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making decisions.

For more information on cryptocurrency taxation and compliance, visit https://cointelegraph.com/news/what-happens-if-you-don-t-pay-taxes-on-your-crypto-holdings?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound