Unlocking the Potential of ChatGPT in Crypto Trading: A 10-Step Guide

The world of crypto trading is known for its volatility and unpredictability, making it challenging for traders to make informed decisions. However, with the advent of advanced technologies like ChatGPT, traders can now leverage the power of artificial intelligence to gain a competitive edge. In this article, we will explore how to transform ChatGPT into a personal crypto trading assistant, providing traders with a structured approach to identifying potential risks and opportunities in the market.

The key advantage of using ChatGPT in crypto trading lies in its ability to detect structural fragility, rather than predicting prices. By analyzing quantitative metrics and narrative data, ChatGPT can identify systemic risk clusters before they lead to volatility. To achieve this, it is essential to provide ChatGPT with high-quality, context-rich data that enables it to infer meaning and make accurate assessments.

Step 1: Define the Scope of Your ChatGPT Trading Assistant

To get started, it is crucial to define the role of ChatGPT in your trading strategy. ChatGPT’s primary function is to provide a structured risk assessment, covering three main areas: the structure of derivatives, on-chain flow, and narrative mood. This assessment should be treated as a hypothesis, requiring human validation before making any trading decisions.

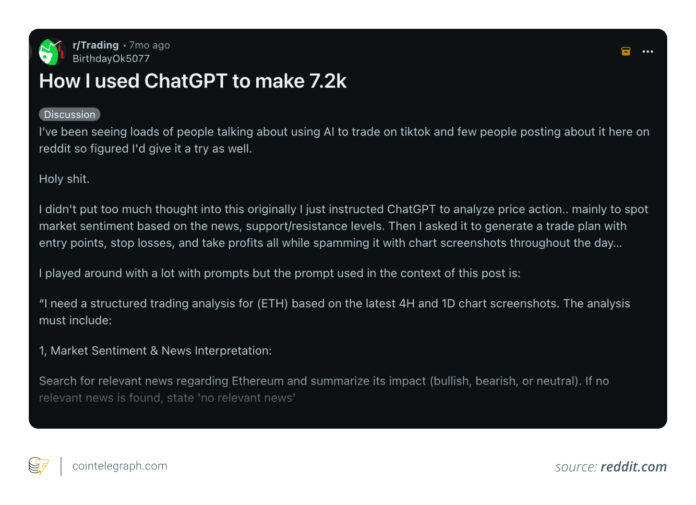

By establishing a clear mandate and persona statement, traders can ensure that ChatGPT provides consistent, objective analysis, and a professional tone. This approach is already being used in online trading communities, with traders reporting significant profits and improved trading decisions.

Step 2: Data Acquisition and Hygiene

ChatGPT’s accuracy depends entirely on the quality and context of its inputs. To prevent model hallucinations, it is essential to feed ChatGPT with pre-aggregated, high-context data. This includes providing context, not just numbers, and using clear, concise language to enable ChatGPT to infer meaning.

By prioritizing data hygiene, traders can ensure that ChatGPT provides accurate and reliable assessments, reducing the risk of emotional, impulsive decisions.

Step 3: Create the Core Synthesis Prompt and Output Schema

To ensure consistency and comparability, it is crucial to create a reusable synthesis prompt and output schema. This prompt should instruct ChatGPT to provide a structured risk bulletin, covering key areas such as systemic leverage, liquidity and flow analysis, and narrative-technical divergence.

By establishing a clear output schema, traders can ensure that ChatGPT provides actionable insights, enabling them to make informed trading decisions.

Step 4: Define Thresholds and the Risk Ladder

Quantification is critical in turning insights into discipline. By defining clear thresholds and a risk ladder, traders can connect observed data to specific actions, reducing the risk of emotional decisions.

By following this risk ladder, traders can ensure that their responses are rule-based, rather than emotional, leading to more consistent and disciplined trading decisions.

Step 5: Stress Test Trading Ideas

Before entering a trade, it is essential to stress test the idea using ChatGPT as a skeptical risk manager. This involves identifying critical non-price confirmations required for the trade to be valid and a trigger for invalidation.

By using ChatGPT in this way, traders can filter out weak setups, reducing the risk of losses and improving overall trading performance.

Step 6: Technical Structure Analysis with ChatGPT

ChatGPT can apply technical frameworks objectively when equipped with structured graph data or clear visual inputs. By analyzing market microstructure, traders can gain insights into potential support and resistance levels, enabling them to make more informed trading decisions.

By leveraging ChatGPT’s technical analysis capabilities, traders can expand their analytical capacity, without replacing human judgment.

Step 7: Post-Trade Evaluation

After a trade, it is essential to evaluate behavior and discipline, rather than profit and loss. By using ChatGPT to examine rule violations and emotional drivers, traders can identify areas for improvement, leading to more consistent and disciplined trading decisions.

Step 8: Integrate Logging and Feedback Loops

To ensure continuous improvement, it is crucial to integrate logging and feedback loops into the trading process. By storing each daily expense in a simple sheet and performing weekly validation, traders can identify which signals and thresholds worked, adjusting their rating weights accordingly.

By verifying each claim against primary data sources, traders can ensure the accuracy and reliability of their trading decisions.

Step 9: Daily Execution Log

A consistent daily cycle is essential for promoting rhythm and emotional distance. By performing a morning meeting, pre-trade, and post-trade analysis, traders can ensure that their decisions are based on a clear and structured approach, rather than emotions.

Step 10: Focus on Preparation, Not Prophecy

Finally, it is essential to focus on preparation, rather than prophecy. ChatGPT is not a crystal ball, but rather a tool for detecting stress signals and potential risks. By treating its warnings as probabilistic indicators of fragility, traders can prepare for potential outcomes, rather than trying to predict them.

By following these 10 steps, traders can transform ChatGPT into a powerful crypto trading assistant, providing them with a structured approach to identifying potential risks and opportunities in the market. Remember, the goal is not foresight, but discipline in the midst of complexity. For more information on how to leverage ChatGPT in crypto trading, visit https://cointelegraph.com/news/how-to-turn-chatgpt-into-your-personal-crypto-trading-assistant?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound