The cryptocurrency market has been experiencing a significant amount of volatility in recent weeks, with several major coins struggling to maintain their value. For the first time in seven years, Bitcoin is at risk of ending October in the red, which could have a ripple effect on the rest of the market. In this article, we will take a closer look at the current state of the market and provide price predictions for some of the top cryptocurrencies.

Current Market Trends

According to CoinGlass data, November has an average return of 46.02%, which could be a sign that the market is due for a rebound. However, several analysts are bearish on Bitcoin, signaling a possible peak of the cycle due to the four-year halving cycle. On the other hand, some analysts, like BitMEX’s Arthur Hayes, believe that Bitcoin’s four-year cycle is dead. The net outflows of $959.1 million from spot BTC exchange-traded funds over the past two days suggest that institutional investors are cautious in the near term, according to data from Farside Investors.

Bitcoin Price Prediction

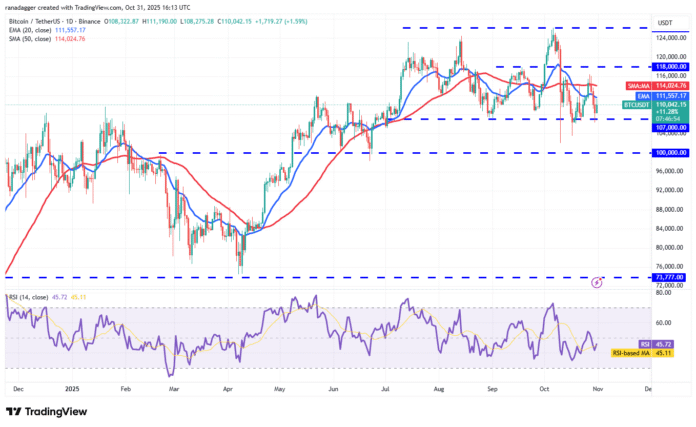

BTC rebounded from the bottom of the range near $107,000 on Thursday, suggesting that bulls are aggressively defending this level. The recovery rally is expected to be countered by selling at the 20-day exponential moving average ($111,557). If the price drops sharply from the 20-day EMA, the chances of a break below $107,000 will increase. If that happens, the BTC/USDT pair will complete a double top pattern and could crash to $100,000.

Conversely, a break and close above the 20-day EMA suggests that Bitcoin price could remain in the $107,000-$126,199 range for a while. It is essential to keep a close eye on the price movement and adjust your strategy accordingly.

Ether Price Prediction

Ether (ETH) bounced off the descending channel pattern’s support line on Thursday, signaling buying at lower levels. The recovery could be counteracted by selling at the moving averages. If that happens, the bears will try again to push the Ether price below the support line. If they succeed, the ETH/USDT pair could crash to $3,350.

Buyers need to push the price above the moving averages to keep the pair within the channel. The next leg of the upward move is likely to start with a breakout and close above the resistance line.

BNB Price Prediction

BNB (BNB) is witnessing a tough battle between bulls and bears at the 50-day simple moving average ($1,084). If the price turns down from the 20-day EMA ($1,113) and closes below the 50-day SMA, it will signal the start of a deeper correction. The BNB/USDT pair could fall to $1,021 and later to $932.

On the contrary, if the price closes above the 20-day EMA, it suggests that bulls are attempting a comeback. BNB price could then rise to the 38.2% Fibonacci retracement level at $1,156, which could attract sellers. A close above $1,156 opens the way for a rebound to the 61.8% retracement level at $1,239.

XRP Price Prediction

XRP (XRP) fell below the 20-day EMA ($2.54) on Thursday, suggesting that bears are trying to retain the advantage. Sellers will attempt to strengthen their position by pulling the XRP price towards the $2.32-$2.19 support zone. Buyers are expected to vigorously defend the support zone as a close below it could reinforce selling.

The XRP/USDT pair could then fall to $1.90. The cops are running out of time. You need to push the price above the moving averages quickly to gain strength. A possible trend change is signaled by a closing price above the downtrend line.

Solana Price Prediction

Solana (SOL) is trading within a symmetrical triangle pattern, indicating indecision regarding the next directional move. If the price slips below the uptrend line, the SOL/USDT pair could fall to the solid support at $155. Buyers are expected to vigorously defend the $155 level as a break below could send the pair down to $140.

If the price diverges from the uptrend line and breaks above the 20-day EMA ($194), it will suggest that the pair could remain within the triangle for some time. Buyers will be in charge again if they push Solana price above the resistance line.

Dogecoin Price Prediction

Buyers are trying to keep Dogecoin (DOGE) above the $0.17 support, but the shallow bounce suggests bears continue to apply pressure. If the $0.17 level is broken, the DOGE/USDT pair could fall to the $0.14 support. Buyers will try to keep the Dogecoin price within the range by defending the $0.14 level, but if their endeavor fails, the pair could fall to the $0.10 level.

The first sign of strength will be a break and close above the overhead resistance at $0.21. The pair could then climb to the 50-day SMA ($0.22) and later attempt a recovery to the stiff overhead resistance at $0.29.

Cardano Price Prediction

Cardano (ADA) continued to decline and broke below the $0.59 support on Thursday, signaling that bears remain in control. If the price holds below the $0.59 level, the ADA/USDT pair could fall to the solid support at $0.50. Buyers are expected to vigorously defend the $0.50 level as a decline below it could trigger a new downtrend.

On the other hand, a break and close above the 20-day EMA ($0.66) suggests that the bears are losing their control. Cardano price could then climb to the breakout level of $0.75 and then to the descending trend line.

Hyperliquid Price Prediction

Sellers again thwarted bulls’ attempts to push Hyperliquid (HYPE) price above overhead resistance at $51.50 on Thursday. This caused the price to fall to the 20-day EMA ($43.10). Buyers are trying to defend the 20-day EMA but bears are maintaining selling pressure. If the price breaks below the 20-day EMA, the HYPE/USDT pair could decline to the neck line and then to $35.50.

This negative view will be invalidated in the near term if the Hyperliquid price rises and breaks above $51.50. The pair could then rise to the all-time high of $59.41.

Chainlink Price Prediction

Buyers attempted to push Chainlink (LINK) above the 20-day EMA ($18.24) on Wednesday, but bears held their ground. The falling moving averages and the Relative Strength Index in