Bitcoin’s On-Chain Inflows Signal Robust Demand Despite Market Sentiment

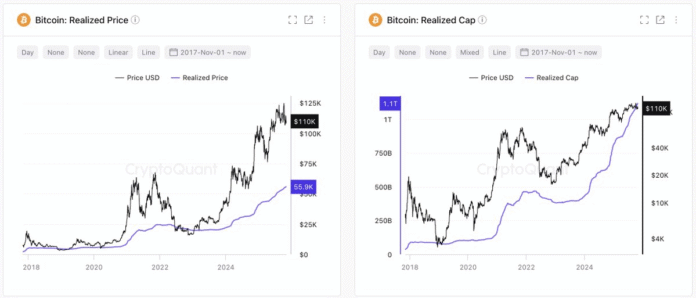

Despite the recent $19 billion crypto crash, Bitcoin’s on-chain inflows are indicating a strong demand for the world’s largest cryptocurrency. Both investors and miners are increasing their activity, with Bitcoin’s realized cap rising by over $8 billion to surpass $1.1 trillion in the past week. The realized cap measures the dollar value of all coins at their last moved price, revealing the total investment held by Bitcoin holders. This significant increase suggests that investors are confident in Bitcoin’s potential for growth.

The new inflows are mainly attributed to Bitcoin treasury firms and exchange-traded funds (ETFs), according to Ki Young Ju, the founder and CEO of crypto analytics platform CryptoQuant. However, Ju notes that Bitcoin’s price recovery will remain limited until Bitcoin ETFs and Michael Saylor’s Strategy restart their large-scale acquisitions. “Demand is now driven mostly by ETFs and MicroStrategy, both slowing buys recently. If these two channels recover, market momentum likely returns,” Ju wrote in a Sunday X post.

Meanwhile, Bitcoin miners are expanding their operations, leading to a rising hashrate, which is a “clear long-term bullish signal” for the continued growth of the “Bitcoin money vessel,” explained Ju. Multiple large Bitcoin miners have recently expanded their mining fleets, including the Trump family-linked American Bitcoin, which purchased 17,280 application-specific integrated circuits (ASICs) for about $314 million, as reported by Cointelegraph in August.

Analysts Predict Bitcoin Price Surge to $140,000 in November

Despite the $8 billion in new inflows, crypto investor sentiment was unable to recover from “fear” territory since the record $19 billion market crash at the beginning of October. However, a resurgence in ETF inflows and potential monetary easing announcement from the Federal Reserve may propel Bitcoin’s price to $140,000 in November, analysts from Bitfinex exchange told Cointelegraph. “Our base case sees Bitcoin rising towards $140,000, with total ETF inflows between $10 and $15 billion not being surprising,” they added.

“Catalysts include Fed easing with two cuts in Q4, ETF inflows doubling, and seasonal Q4 strength, while risks remain around tariffs and geopolitics,” the analysts noted. This prediction is supported by the recent statement from the White House outlining the trade agreement reached between President Trump and Chinese President Xi Jinping, which may have a positive impact on the crypto market.

Conclusion

In conclusion, Bitcoin’s on-chain inflows are signaling robust demand for the cryptocurrency, despite the negative market sentiment. The increase in realized cap and hashrate, combined with the potential resurgence in ETF inflows, may propel Bitcoin’s price to $140,000 in November. As the crypto market continues to evolve, it is essential to stay informed about the latest developments and trends. For more information, visit the original source link: https://cointelegraph.com/news/bitcoin-money-vessel-8b-recovery-lacks-etf?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound