Grayscale Eliminates Management Fees for Solana Trust ETF to Boost Adoption

In a bid to attract new investors and increase adoption, Grayscale has decided to temporarily remove management fees for its Solana Trust ETF. This move is seen as a strategic effort to encourage investment in the fund, which tracks the performance of Solana (SOL) and provides investors with access to the token through the stock market.

The campaign, which will last for three months or until the fund reaches $1 billion in assets under management, aims to deliver real long-term benefits to investors. According to Grayscale, the fund will deploy up to 100% of its SOL at a reward rate of 7%. This means that investors can potentially benefit from the staking rewards, which will be reflected in the appreciation of the trust’s stock value.

Key Features of the Grayscale Solana Trust ETF

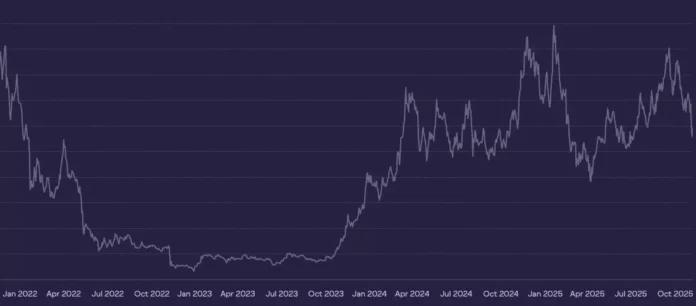

The Grayscale Solana Trust ETF (GSOL) is designed to track the performance of SOL and provide investors with a convenient way to invest in the token. The fund currently has $93.983 million in assets under management and holds 578,144 SOL. GSOL operates as an exchange-traded product and not a US-registered ETF. The fund’s net asset value per share is a key indicator of its performance, as shown in the graph below.

Net asset value per share of Grayscale Solana Trust ETF | Source: Grayscale

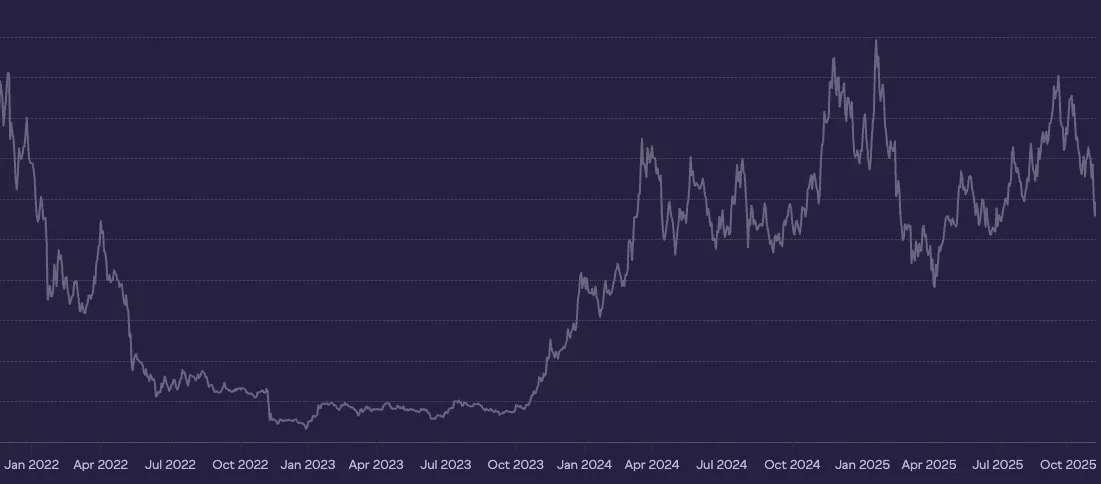

Net asset value per share of Grayscale Solana Trust ETF | Source: Grayscale

Grayscale’s decision to eliminate management fees for its Solana Trust ETF is a significant move, as it will allow more of the economic benefits to flow to investors. According to Inkoo Kang, senior vice president, ETFs, at Grayscale, “We have been participating in GSOL since October 6, even before it became an ETP. GSOL aims to deliver real long-term benefits to investors, underscored by our diversified validator approach, a key aspect of the staking program deployed in GSOL.” This move is seen as a strategic effort to attract new investors and increase adoption, as the asset manager faces increasing competition from other ETFs, including VanEck, 21Shares, and Ark.

Conclusion

In conclusion, Grayscale’s decision to eliminate management fees for its Solana Trust ETF is a significant move that aims to attract new investors and increase adoption. With its diversified validator approach and staking program, the fund offers a convenient way for investors to invest in SOL. As the cryptocurrency market continues to evolve, it will be interesting to see how this move impacts the adoption of the Grayscale Solana Trust ETF. For more information, visit https://crypto.news/grayscale-waves-fees-solana-etf-attract-new-investors/