Bitcoin Price Under Pressure as Mature Whales Continue to Sell

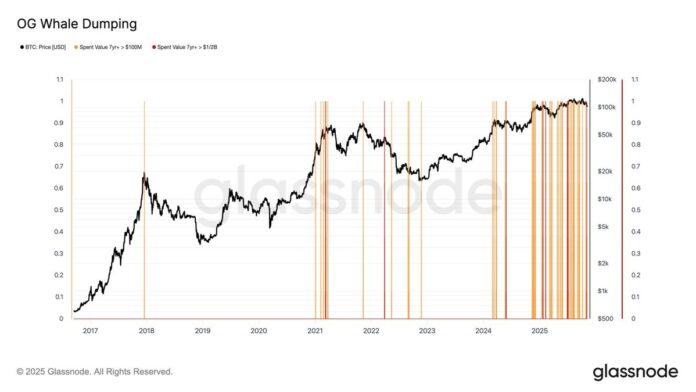

The Bitcoin (BTC) market is facing significant selling pressure as mature whales, also known as “OG” whales, continue to offload their holdings. According to data from Capriole Investments co-founder Charles Edwards, these long-term investors have been selling their assets at an alarming rate, with some events seeing over 1,000 BTC being spent per hour. This trend has been ongoing since November 2024 and has intensified in 2025, with Edwards noting that “OGs cash in.”

Bitcoin AND whale dumping. Source: Glassnode

Additional data from Glassnode shows that these high-spending events have become more frequent over time, indicating continued distribution. One notable example is “Bitcoin OG Owen Gunden,” who moved 3,600 BTC worth approximately $372 million on Saturday, with 500 BTC ($51.68 million) already deposited into Kraken. This trend has raised concerns about the potential impact on the Bitcoin price, with some predicting a decline to $89,600.

Bitcoin’s Bear Pennant Pattern Suggests Further Decline

Data from Cointelegraph Markets Pro and TradingView indicates that BTC is trading within a bear pennant, a downward continuation pattern that occurs after a significant decline followed by a period of consolidation. A break below the pennant’s support line at $100,650 could potentially lead to Bitcoin’s next downtrend, measured at $89,600, or a 12% decline from current price levels.

BTC/USD six-hour chart. Source: Cointelegraph/TradingView

However, not all experts are convinced that this selling pressure is a cause for concern. Willy Woo argues that what constitutes an “OG dump” is simply BTC moving away from an address that has remained untouched for seven years, and that these transfers may be intended for moving to Taproot addresses for quantum-safe transactions. Instead of actual sales, these could also involve custody rotations or the creation of BTC financial companies.

Key Takeaways

Mature Bitcoin whales are selling heavily, issuing over 1,000 BTC/hour in 2025. Bitcoin’s bear pennant pattern predicts a possible decline to $89,600. The BTC/USD pair is trading 18.7% below its all-time high of $126,000 reached on October 6, a decline partly attributed to large outflows from legacy whale wallets.

For more information, visit https://cointelegraph.com/news/bitcoin-og-whales-keep-cashing-out-threatening-btc-price-drop-90k