Crypto Funds Experience Significant Outflows Amidst US-Led Exodus

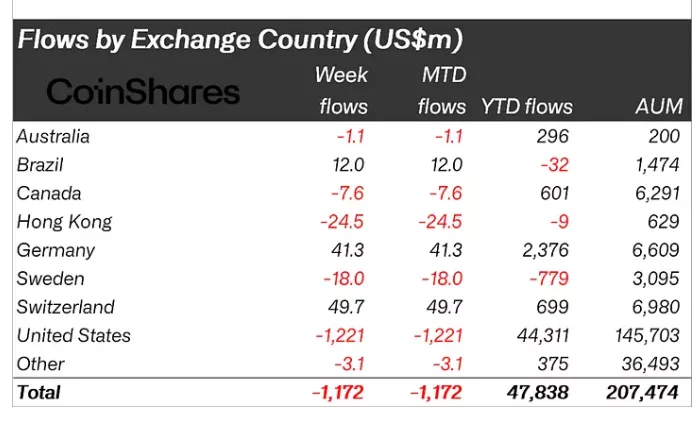

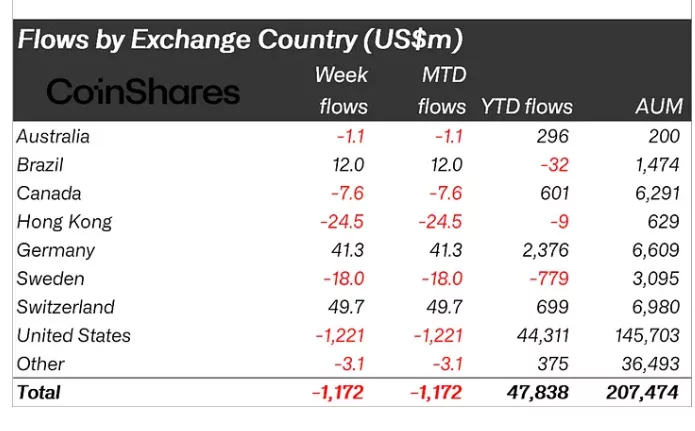

Crypto investment products have witnessed a substantial decline in investments, with outflows totaling $1.17 billion for the second consecutive week. This significant reduction in investment is primarily attributed to the US market, which accounted for $1.22 billion in exits. According to a report by CoinShares, a leading digital asset investment firm, the largest selloff was seen in US products, indicating a risk-averse sentiment among investors in the region.

The biggest losers in this downturn were Bitcoin and Ethereum, with $932 million and $438 million in withdrawals, respectively. However, short Bitcoin ETPs (Exchange-Traded Products) saw a slight increase, with $11.8 million in inflows, suggesting that some investors are preparing for further potential downturns in the market. In contrast, altcoins such as Solana (SOL) defied the trend, attracting $118 million in inflows, while other assets like Hedera (HBAR) and Hyperliquid (HYPE) also recorded significant gains.

Regional Disparities in Investment Trends

A notable disparity in investment trends was observed between the US and European markets. While the US witnessed substantial outflows, European countries such as Germany and Switzerland recorded inflows of $41.3 million and $49.7 million, respectively. This transatlantic divergence highlights the differing perspectives of investors in these regions, with European investors appearing more optimistic about the crypto market.

The report by CoinShares also noted that the negative sentiment in the US market was exacerbated by political uncertainty, including the brief intraday rebound on hopes of a resolution to the US government shutdown, which was quickly wiped out by Friday’s outflows. The ETP trading volume remained at $43 billion, indicating a significant level of activity in the market despite the overall decline in investments.

Implications of the Sustained Outflows

The sustained outflows from crypto investment products, particularly in the US, suggest a deepening of redemptions rather than a dispersal. This trend is likely to have significant implications for the crypto market, with potential effects on prices and investor sentiment. As the market continues to evolve, it is essential for investors to remain informed and adapt to changing trends and sentiment.

For more information on the crypto market and investment trends, visit https://crypto.news/crypto-funds-bleed-1-17b-in-sustained-u-s-led-exodus/. The article provides an in-depth analysis of the current market situation and offers valuable insights for investors and enthusiasts alike.

Weekly crypto fund flows by country. Image: CoinShares.

Weekly crypto fund flows by country. Image: CoinShares.