Altcoin Season Momentum Returns to Select DeFi Tokens

After a quiet start to the week, altcoin season momentum has returned to select DeFi tokens, with Uniswap, Aerodrome Finance, and SOON all trading higher. Market participation is focused on protocols that introduce structural or governance changes rather than the entire altcoin sector. This shift in focus suggests that traders are favoring established platforms with discernible utility and consistent revenue over speculative investments.

While overall liquidity remains patchy, the concentration of flow in DeFi names indicates that traders are seeking out protocols with measurable advances in network design and liquidity. UNI’s governance overhaul, AERO’s issuance adjustment, and SOON’s exchange-driven volume demonstrate how targeted developments continue to drive local strength, even in the absence of a clear trend in the broader altcoin market.

Uniswap Rises on Governance Realignment

Uniswap’s UNI is trading at around $8.50, up 23% in 24 hours, with volume increasing across major pairs and spot depth remaining stable. The surge follows the launch of the UNIfication proposal by Uniswap Labs and the Uniswap Foundation, which consolidates governance, enables protocol fee sharing, and introduces a structured annual growth budget that eliminates the need to collect app and wallet revenue separately.

According to Uniswap Labs, the UNIfication proposal is a joint effort with the Uniswap Foundation that introduces protocol fees and aligns incentives across the Uniswap ecosystem, positioning the Uniswap Protocol as a standard decentralized exchange. The model funnels a fraction of trading fees back to the protocol and funds UNI buybacks and community initiatives under governance control.

Aerodrome Finance Extends Its Advance

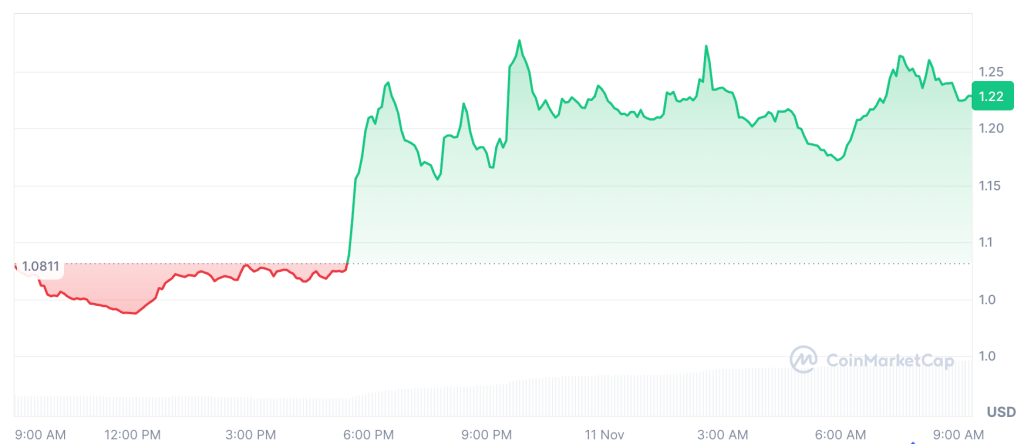

Aerodrome Finance’s AERO is currently trading at around $1.22, up around 13% in 24 hours. The project has attracted renewed attention from participants following the steady growth in protocol revenue and recent issuance adjustments. It appears to be an improved balance between token distribution and buyback activity, factors that have driven the token higher over the past week.

AERO price (Source: CoinMarketCap)

SOON Maintains Stability Amid Active Flows

SOON is trading at around $2.16, up around 4% in 24 hours, with volume remaining above recent averages and liquidity stable across all trading venues. The move follows recent listings on additional exchanges and the launch of the “10sSOON” asset creation feature coupled with the Solana Virtual Machine Roll-up framework, both of which attracted renewed attention from traders.

The project also introduced a feature that allows users to pay USDC for short-term market predictions, a move that has increased engagement and trading activity. On-chain metrics show higher validator participation and active staking, suggesting that the network’s current momentum is supported by functional growth rather than speculation.

DeFi Sets the Tone for Altcoin Seasonal Rotation

Recent moves at UNI, AERO, and SOON suggest that DeFi tokens with operational depth and functional governance continue to capture the flow, while sentiment elsewhere is still unclear. Altcoin activity has focused on measurable advances in network design and liquidity rather than unconfirmed speculation.

For more information on the current altcoin season and DeFi market trends, visit Cryptonews.