Introduction to Solana ETFs

The cryptocurrency market has witnessed the launch of the first US Solana spot ETF, Bitwise Solana ETF, which has seen a significant influx of investments on its debut day. With net inflows of $69.45 million, the ETF has outperformed other altcoin ETFs that saw no inflows. This development is a testament to the growing interest in Solana-based investment products.

Bitwise Solana ETF Performance

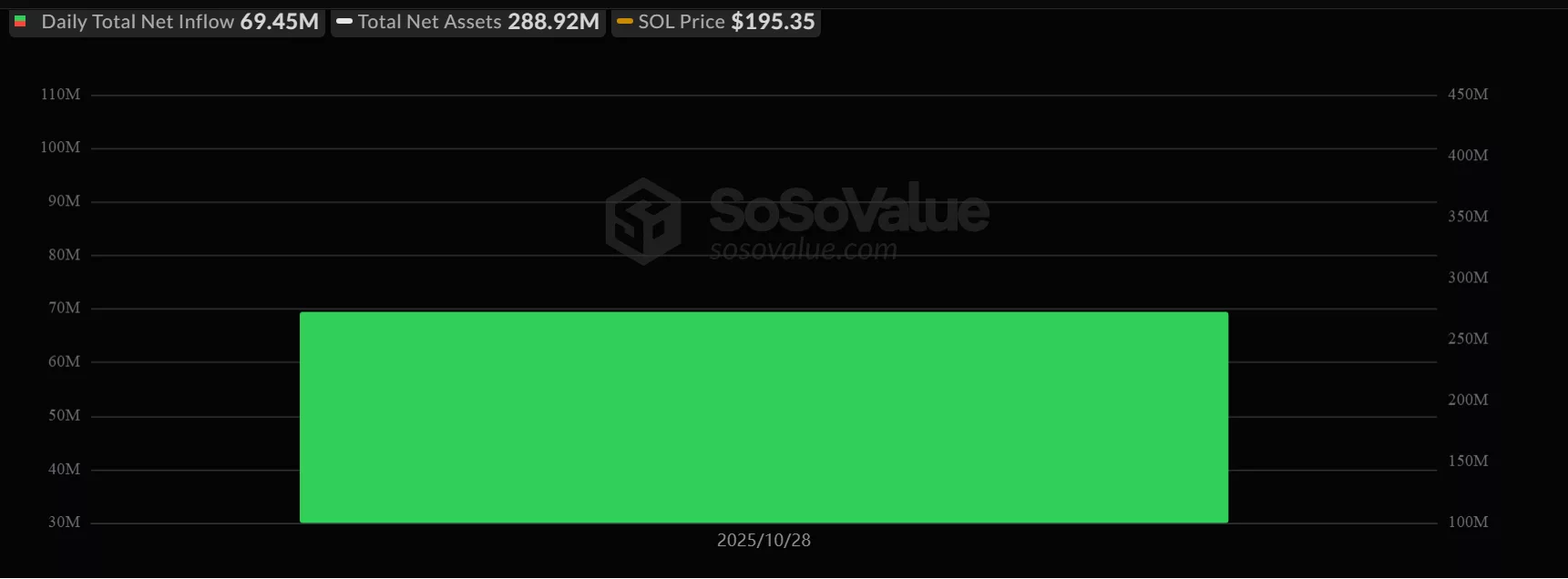

The Bitwise Solana ETF (BSOL) has enjoyed a strong market debut, with first-day inflows of $69.45 million, bringing its total assets to $288.92 million. This increase in net inflows signals a growing demand for Solana-based investment products. According to SoSoValue, the ETF has recorded a total daily net inflow of $69.45 million, with its total trading value reaching $57.91 million since its launch.

The fund’s total net assets now stand at $288.92 million, which is approximately 0.01% of the SOL market value. At the time of writing, Solana’s market cap is down slightly by 2.8% to $107.4 billion. The ETF’s management fee is 0.20%, which is relatively lower than Bitcoin (BTC) and Ethereum (ETH) ETFs, which range between 0.21% and 0.25%.

Comparison with Other ETFs

In comparison to other crypto ETFs that launched on the same day, the Bitwise Solana ETF is the only one that saw a significant influx of investments. The Canary Litecoin ETF and the Canary HBAR ETF did not experience any net inflows or outflows on their trading day. This suggests that investors are showing a preference for Solana-based investment products.

The Bitwise Solana Staking ETF is designed to track both the price of SOL and the staking rewards generated by the network. The product is fully backed by SOL tokens held in institutional cold storage and aligned to the Compass Solana Total Return Monthly Index, net of fees and costs.

Future of Solana ETFs

The strong debut of the Bitwise Solana ETF could signal a positive trend for other Solana ETFs preparing to enter the US market. Grayscale’s Solana Trust ETF is set to launch on the New York Stock Exchange Arca, making it the second Solana ETF to launch this week. Other companies, such as Canary, are also preparing to launch their own Solana ETF products.

According to Bitget principal analyst Ryan Lee, Solana stake ETFs could bring in $3 billion to $6 billion in new inflows within the first year. He notes that the fund’s 5% return on investment provides investors with an additional source of passive income, a feature that could increase institutional interest in Solana. This could potentially open the door to larger capital flows into the broader altcoin market, beyond traditional ETF offerings.

For more information, visit https://crypto.news/bitwise-solana-etf-records-debut-with-69-5m-in-inflows/