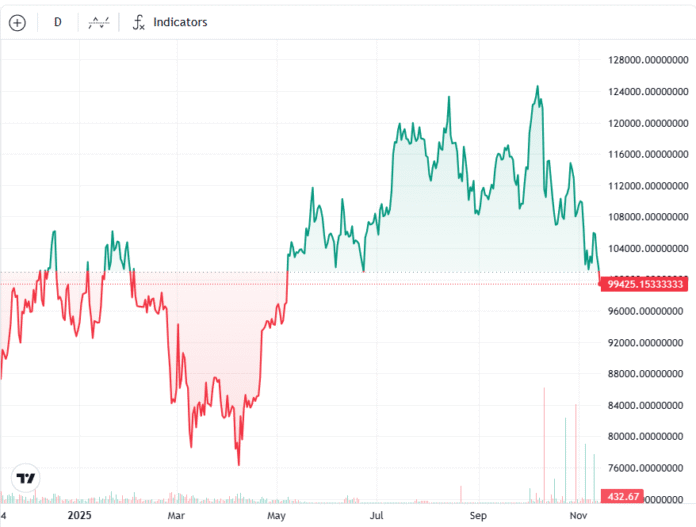

Bitcoin’s Price Plummets to Six-Month Low as ETF Demand Collapses

Despite the highly anticipated political developments in the US, the decline in cryptocurrency markets has intensified. The recent end of the record-breaking 43-day government shutdown in the US, marked by President Donald Trump signing a funding bill, has failed to boost demand for Bitcoin (BTC) exchange-traded funds (ETFs). Spot BTC ETFs experienced a brief surge on Tuesday, with $524 million in inflows, but this was short-lived, as outflows resumed with a significant $866 million in daily net outflows on Thursday, according to data from Farside Investors.

Bitcoin’s price has fallen to a six-month low of $95,900, a level last seen in May, as its key demand drivers continue to lack momentum. Ki Young Ju, founder and CEO of crypto analytics platform CryptoQuant, noted that investing in ETFs and Michael Saylor’s strategy were the primary drivers of Bitcoin’s price this year. The lack of demand for spot Bitcoin ETFs raises concerns about Bitcoin’s prospects for the rest of the year.

The US Senate’s approval of the funding bill on Monday brought Congress one step closer to ending the shutdown, but this bullish news from the US has not translated to an increase in spot Bitcoin ETF investments, which remained flat on Monday with only $1.2 million in inflows, according to data from Farside Investors. Charles Edwards, founder of Capriole Investments, expressed concern that the lack of momentum in Bitcoin ETFs could continue, stating that “risk assets typically experience strong supply in the weeks following the shutdown.”

Expert Insights: 2026 to Be Crypto’s True Bull Year

Bitwise Chief Investment Officer Matt Hougan is more confident that the crypto market will boom in 2026, especially since there was no rally at the end of 2025. Hougan believes that a crypto market rally in late 2025 would have fit the four-year cycle thesis, meaning 2026 would mark the start of a bear market, similar to 2022 and 2018. He expects interest in Bitcoin, stablecoins, and tokenization to continue growing, while arguing that Uniswap’s fee transition proposal will revitalize interest in decentralized finance protocols in the coming year.

Arthur Hayes Urges Zcash Holders to Withdraw Assets from Centralized Exchanges

The privacy coin sector has come back into the spotlight after BitMEX co-founder Arthur Hayes urged Zcash holders to withdraw their assets from centralized exchanges (CEXs). Hayes advised holders to “protect” their assets, a feature that allows private transactions within the Zcash network. The comments came as Zcash (ZEC) experienced sharp price fluctuations over the past few days, rising to $723 on Saturday before falling to $504 on Sunday.

Vitalik Buterin Advocates for Decentralization in the “Trustless Manifesto”

Ethereum co-founder Vitalik Buterin has written and signed the new “Manifesto Without Trust,” which aims to uphold the core values of decentralization and resistance to censorship. The manifesto, also written by Ethereum Foundation researchers Yoav Weiss and Marissa Posner, states that crypto platforms sacrifice trustlessness from the first moment they integrate a hosted node or centralized relayer. Buterin emphasized that “trustlessness is not a feature to be added as an afterthought. It is the thing itself.”

Sonic Labs Shifts Focus from Speed to Survival with Business-First Strategy

Sonic Labs, the organization behind the Sonic Layer-1 blockchain, has announced a major strategic shift from emphasizing transaction speed to building long-term business value and sustainability of tokens. The new approach will focus on upgrades that deliver measurable financial results, including new Ethereum and Sonic enhancement proposals (EIPs and SIPs), token supply reductions, and revised rewards for network participants.

DeFi Market Overview

Most of the top 100 cryptocurrencies by market capitalization ended the week in the red, according to data from Cointelegraph Markets Pro and TradingView. The privacy-preserving Dash (DASH) token fell 45%, recording the largest decline in the top 100, followed by the Internet Computer (ICP) token, which lost over 27% on the weekly chart.

For more information, visit https://cointelegraph.com/news/bitcoin-falls-6-month-low-etf-demand-collapses-finance-redefined