Cryptocurrency Markets Decline Despite Positive Developments in US Politics

Despite the highly anticipated political developments in the US, the decline in cryptocurrency markets has increased. On Wednesday, President Donald Trump signed a funding bill to end the record-breaking 43-day government shutdown in the U.S. after the bill passed the Senate on Monday and was approved by the House of Representatives on Wednesday.

The bill provides funding to the government through January 30, 2026, giving Democrats and Republicans more time to reach agreement on broader funding plans for the coming year. However, the end of the shutdown failed to increase demand among buyers of Bitcoin (BTC) exchange-traded funds (ETFs). Spot BTC ETFs enjoyed a brief bounce on Tuesday, recording $524 million in inflows, but outflows quickly resumed, with a whopping $866 million in daily net outflows on Thursday, according to Farside Investors.

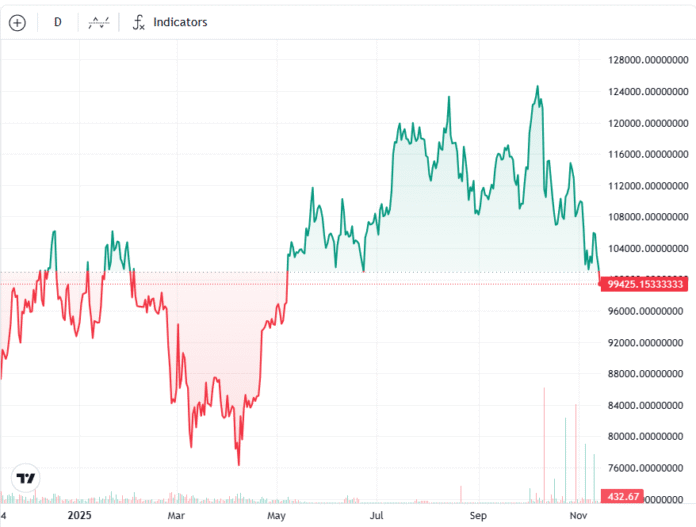

Bitcoin fell to a six-month low of $95,900 on Friday, a level last reached in May, as its biggest demand drivers continued to lack momentum. According to Ki Young Ju, founder and CEO of crypto analytics platform CryptoQuant, investing in ETFs and Michael Saylor’s strategy were the two main tools that drove demand for Bitcoin prices this year.

BTC/USD, one-year chart. Source: Cointelegraph

Demand for Bitcoin ETFs Stagnates

The lack of demand for spot Bitcoin ETFs raises concerns about Bitcoin’s prospects for the rest of the year. On Monday, the U.S. Senate approved the funding bill, bringing Congress one step closer to ending the shutdown. The bill faced a full vote in the House of Representatives on Wednesday. Despite bullish news from the US, spot Bitcoin ETF investments remained flat on Monday, with just $1.2 million in inflows, according to data from Farside Investors.

Bitcoin ETF flows, US dollars (in millions). Source: Farside Investors

“Despite the US shutdown seemingly coming to an end and S&P and gold recovering strongly, there was NO Bitcoin ETF offering yesterday,” said Charles Edwards, founder of Capriole Investments, adding that we do not want this momentum to continue. “Risk assets typically experience strong supply in the weeks following the shutdown. There is still time to turn this ship around, but it must turn around,” Edwards wrote in a Tuesday X post.

Expert Insights on Crypto Markets

Bitwise Chief Investment Officer Matt Hougan is more confident that crypto markets will boom in 2026, especially since there was no rally at the end of 2025. Speaking to Cointelegraph on Wednesday at the Bridge conference in New York City, Hougan said a crypto market rally in late 2025 would have fit the four-year cycle thesis, meaning 2026 would mark the start of a bear market, similar to 2022 and 2018.

Matt Hougan at the Bridge conference in New York City. Source: Cointelegraph

Hougan said interest in Bitcoin depreciation trading, stablecoins and tokenization will continue to grow, while arguing that Uniswap’s fee transition proposal unveiled on Monday would revitalize interest in decentralized finance protocols in the coming year. “I think the underlying fundamentals are just very solid,” Hougan said. “I think these previous forces, institutional investment, regulatory advancements, stablecoins, tokenization, I just think they’re too big to contain. So I think 2026 is going to be a good year.”

Privacy Coin Sector Back in Spotlight

The privacy coin sector came back into the spotlight after BitMEX co-founder Arthur Hayes urged Zcash holders to withdraw their assets from centralized exchanges (CEXs). On Wednesday, Hayes urged holders to “protect” their assets, a feature that allows private transactions within the Zcash network. “If you hold $ZEC on a CEX, withdraw it to a self-custody wallet and protect it,” Hayes wrote on X.

Zcash 7-day price chart. Source: CoinGecko

Zcash (ZEC) experienced sharp price fluctuations over the past few days. The token rose to $723 on Saturday before falling to $504 on Sunday. It then rose to a high of $677 on Monday, only to see another sharp decline. At the time of writing, ZEC is trading at around $450, down 37% from Saturday’s high.

Decentralization in the Spotlight

Ethereum co-founder Vitalik Buterin has written and signed the new “Manifesto Without Trust,” which aims to uphold the core values of decentralization and resistance to censorship and urge builders to abandon the addition of intermediaries and checkpoints for the sake of acceptance. The “Trustless Manifesto,” also written by Ethereum Foundation researchers Yoav Weiss and Marissa Posner, states that crypto platforms sacrifice trustlessness from the first moment they integrate a hosted node or centralized relayer.

Excerpt from the “Trustless Manifesto”. Source: Trustlessness.eth

“Trustlessness is not a feature to be added as an afterthought. It is the thing itself,” Ethereum Foundation members said in the manifesto released Wednesday. “Without it, everything else – efficiency, UX, scalability – is decoration on a fragile core.”

Sonic Labs Shifts Focus to Business-First Strategy

Sonic Labs, the organization behind the Sonic Layer-1 blockchain, announced a major strategic shift that aims to move from emphasizing transaction speed to building long-term business value and sustainability of tokens. After Sonic Labs announced industry-leading performance last year, the next chapter will focus on upgrades that deliver measurable financial results, including new Ethereum and Sonic enhancement proposals (EIPs and SIPs), token supply reductions, and revised rewards for network participants.

Source: Mitchell Demeter

“Every decision we make moving forward will be guided by the principles of creating real value, with price, growth and sustainability always at the core,” said Mitchell Demeter, the new CEO of Sonic Labs. The focus is to create “measurable, lasting value” for developers, validators and token holders, Demeter wrote in a post on Tuesday.

DeFi Market Overview

Most of the top 100 cryptocurrencies by market capitalization ended the week in the red, according to data from Cointelegraph Markets Pro and TradingView. The privacy-preserving Dash (DASH) token fell 45%, recording the largest decline in the top 100, followed by the Internet Computer (ICP) token, which lost over 27% on the weekly chart.

Total value locked in DeFi. Source: DefiLlama

Thank you for reading our roundup of the most influential DeFi developments this week. Join us next Friday for more stories, insights and information on this dynamically evolving field. For more information, visit https://cointelegraph.com/news/bitcoin-falls-6-month-low-etf-demand-collapses-finance-redefined