Solana ETFs Record 13 Consecutive Days of Inflows Despite SOL Price Drop

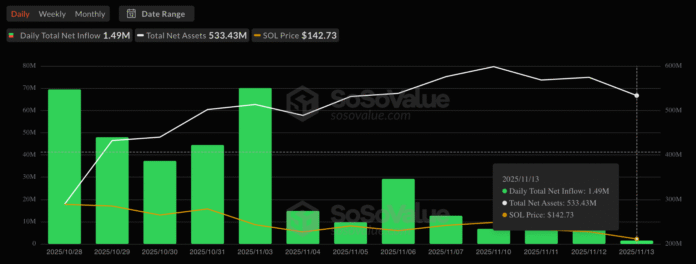

Spot Solana exchange-traded funds (SOL) have continued to attract investor interest, with inflows recorded for the thirteenth consecutive day, highlighting institutional demand for the network’s native asset. According to data from SoSoValue, Solana ETFs saw an increase of $1.49 million on Thursday, bringing cumulative inflows to $370 million and total assets to over $533 million.

The Bitwise Solana ETF (BSOL) was the only one to see inflows on Thursday, marking the weakest since its launch on October 28. Solana ETF inflows. Source: SoSoValue

Weaker SOL ETF inflows reflected bearish sentiment across the market, with spot Bitcoin (BTC) ETFs recording daily net outflows of $866 million on the same day, their second-worst day since launch. Spot Ether (ETH) ETFs also saw $259.2 million in outflows, reducing their cumulative inflows to $13.3 billion.

SOL Price Breaks Key Support Levels

Despite sustained demand for Solana ETFs, the SOL price has failed to stay above key levels, with technical conditions pointing to the potential for a deeper correction. In line with slowing ETF inflows, SOL price action turned sharply lower last week, falling over 34% over the past two weeks to $142 on Friday, its lowest level since June 23.

The correction also broke a 100-week SMA and the multi-year uptrend that began in January 2023, with the $95 level serving as a yearly low. According to data from Glassnode, Solana is currently testing a daily order block around $140, a level with limited support. SOL: UTXO realized price distribution (URPD). Source: Glassnode

If the price falls below this level, it could decline towards the 200-week SMA at $100, which is the last line of defense for SOL price. Solana one-day chart: Source: Cointelegraph/TradingView

Technical Analysis and Outlook

Solana’s downtrend is supported by weakness in the relative strength index, which has reached its lowest level since April 2025. As Cointelegraph reported, a break below $150 will see the SOL/USDT pair extend its decline to $126 and then to the solid support at $100.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks and readers should conduct their own research when making their decision.

For more information, visit the original article at https://cointelegraph.com/news/sol-drops-to-5-month-low-despite-solana-spot-etf-success-is-dollar100-next