Introduction to DePINs: The Next Trillion-Dollar Infrastructure Revolution

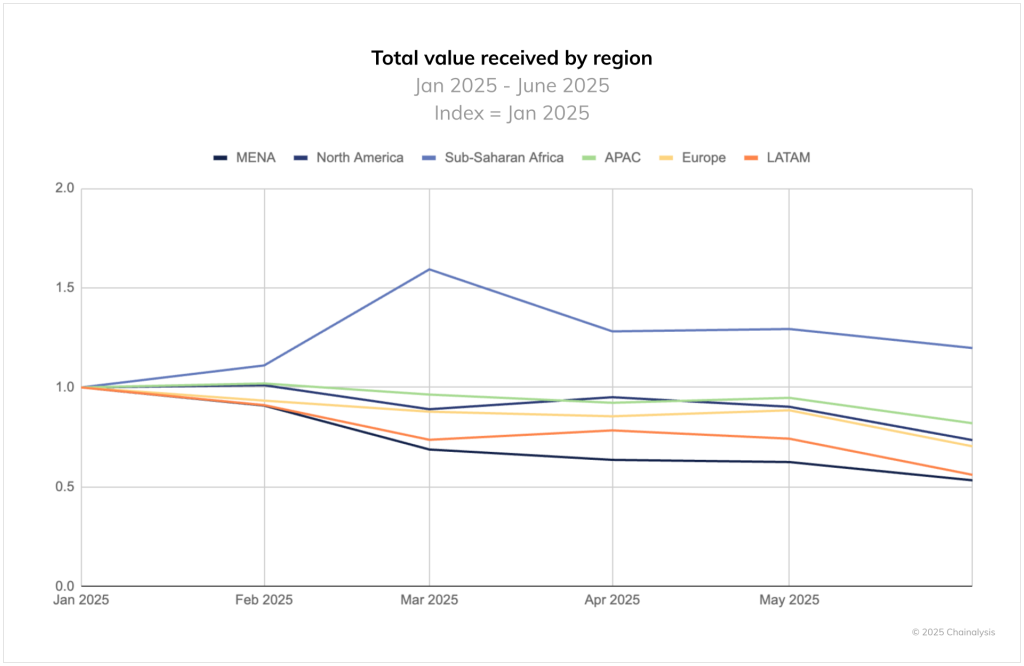

The next trillion-dollar infrastructure revolution is expected to take place in emerging markets, such as Nairobi, Manila, or Medellín, rather than in Silicon Valley. Developers focused on these markets are building decentralized physical infrastructure networks (DePINs) that enable real-world connectivity, energy, and data access. While the world is excited about the adoption of AI, robotics, and crypto, more attention needs to be paid to the networks used to deploy these technologies for practical purposes to improve the lives of real people.

![]()

DePINs: A New Phase of Growth

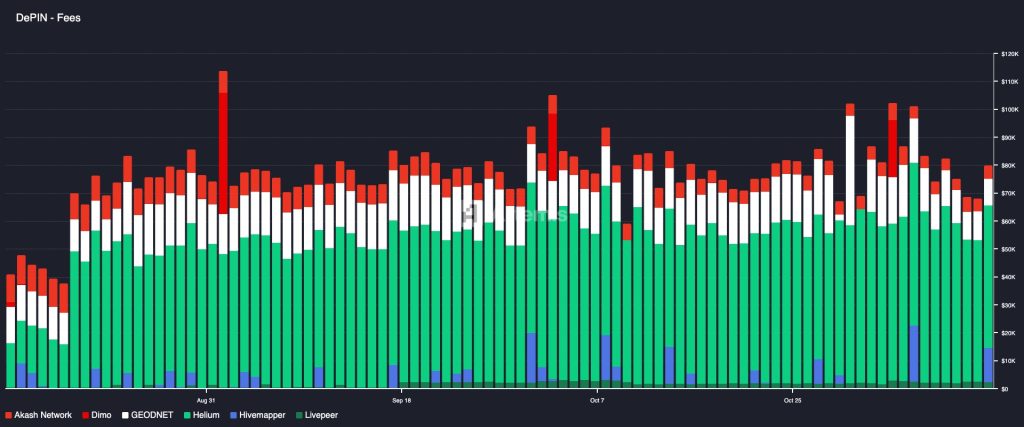

In 2026, DePINs are expected to enter a new phase of growth. The industry has seen record activity in recent years, with DePIN tokens accounting for over 75% of monthly network fees, increasing from $1.3 million in July to $2.3 million in September. This recent growth is a clear sign that people are not only trading tokens but also using them to access the services provided by DePINs.

Emerging Markets: DePIN’s Natural Habitat

Emerging markets are becoming DePIN’s natural habitat. In regions like Nigeria, the Philippines, or Colombia, decentralized networks can grow without facing the same massive gatekeepers. According to a16z’s 2024 State of Crypto report, OpenAI and Anthropic hold 88% of the revenue share of native AI companies, while Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) hold 63% of the global cloud infrastructure market share.

2026: The Year DePIN Goes Mainstream

Experts believe the DePIN space could reach $3.5 trillion by 2028, and the groundwork for this was quietly laid last year. Regulatory clarity, technological maturity, and increasing participation are now converging, creating the conditions for DePIN’s global resurgence. A turning point came when the US Securities and Exchange Commission’s Corporate Finance Division issued a no-action letter on DoubleZero’s token distributions, effectively acknowledging that activity-based rewards in DePINs are different from securities.

Much of this new dynamic is related to the growing need for decentralized computing and data systems that support AI and robotics. By distributing these resources via DePINs, developers are creating smarter and more secure networks, allowing intelligent systems to learn and act on verified information. This shift is critical as intelligence continues to shift from centralized data centers to the physical world.

For more information, visit https://cryptonews.com/exclusives/depins-2026-will-start-in-developing-markets-not-silicon-valley/