MicroStrategy’s Stock Price Plummets as Bitcoin Continues Downward Trend

The stock price of MicroStrategy, trading under the ticker symbol MSTR, gapped lower on Monday as the price of Bitcoin continued its strong downward trend, despite the company’s ongoing buying spree. This move has significant implications for investors and market watchers, given MicroStrategy’s substantial holdings in Bitcoin.

MicroStrategy, led by Michael Saylor, has been at the forefront of corporate investment in Bitcoin, with a strategy that involves buying and holding the cryptocurrency as a reserve asset. Recently, the company bought 8,178 Bitcoins, valued at over $835 million, bringing its total holdings to 649,870 Bitcoins, worth over $61.7 billion at current prices.

Market Analysis and Trends

The MSTR stock price has retreated to its lowest level since October 14, dropping to $192, which is 57% below its highest level this year. This significant decline has resulted in a $72 billion wipeout, with the market capitalization falling from $128 billion in August to $57 billion. The Bitcoin price crash, which formed a death cross pattern on the daily chart, has been a major factor in this downturn.

Despite the current volatility, Michael Saylor remains bullish on Bitcoin, citing its strong fundamentals, including rising institutional demand and falling supply. In a recent appearance on CNBC, Saylor noted that the ongoing volatility is part of the natural cycle of cryptocurrency markets, pointing to past drawdowns as evidence that Bitcoin can rebound. He believes that the current price retreat is due to investor deleveraging, as indicated by falling futures open interest.

Technical Analysis of MSTR Stock

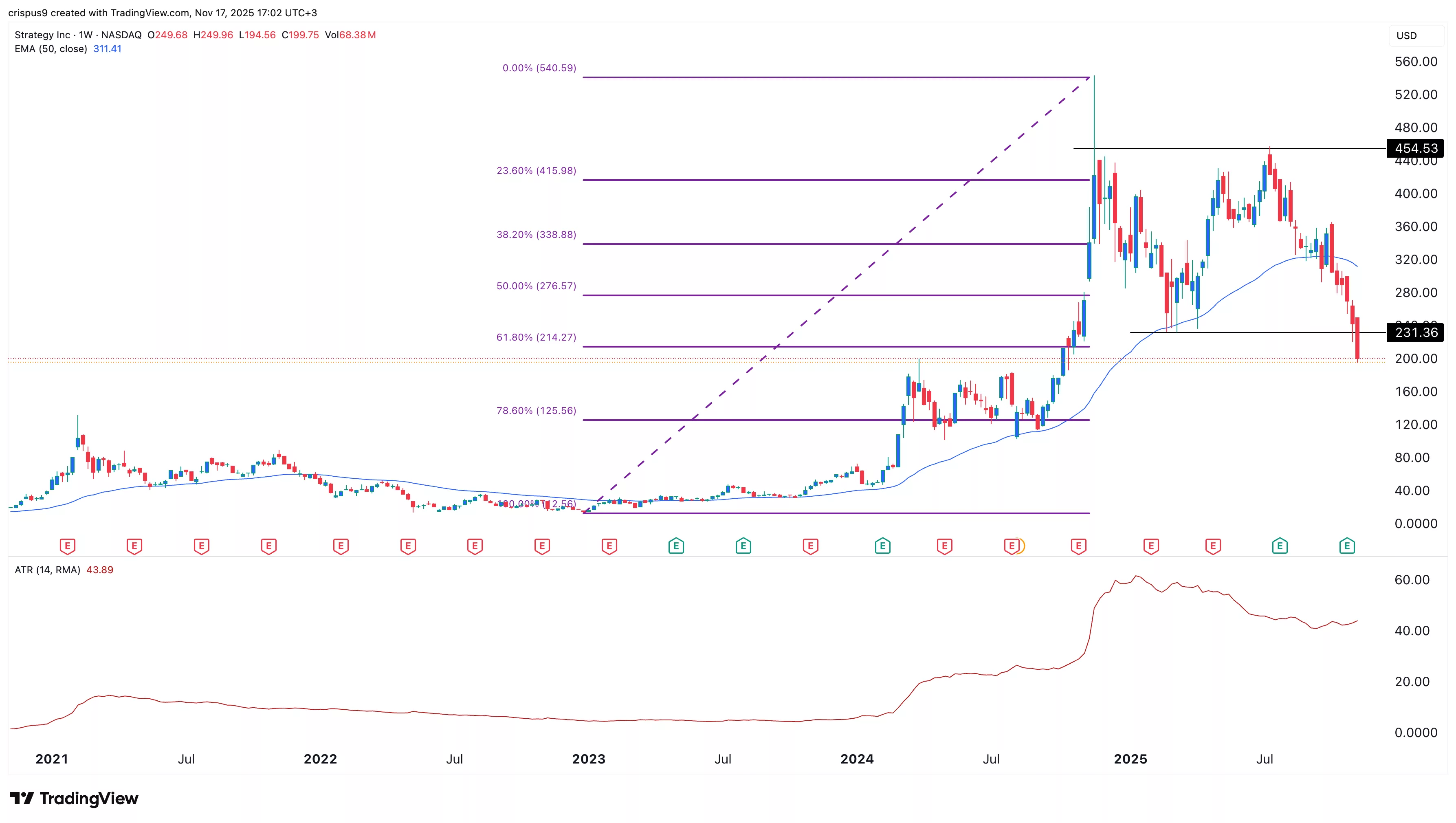

The technical analysis of MSTR stock suggests that it will likely remain under pressure in the near term, given the formation of a death cross pattern where the 50-day Exponential Moving Average has dropped below the 200-day average. The weekly timeframe chart shows a double-top pattern at $455 and a neckline at $231, indicating intense pressure on the stock price.

Strategy stock chart | Source: crypto.news

The stock has plunged below the important 61.8% Fibonacci Retracement level at $214, confirming the bearish outlook. Additionally, the Average Directional Index (ADX) has remained above 40, signaling that the downtrend is continuing. Therefore, the stock is expected to continue falling, with bears targeting the 78.6% retracement level at $125. However, if the stock moves above the resistance level at $230, it could invalidate the bearish outlook and point to more upside in the near term.

For more information on MicroStrategy’s Bitcoin holdings and the impact on its stock price, visit the original source: https://crypto.news/will-mstr-stock-recover-as-saylors-strategy-8178-btc/