Ether Price Forecast: Can ETH Bounce Back to $3,200?

Ether (ETH) has experienced a significant decline, falling to $2,625, its lowest level since July. This sharp 15% decline from Wednesday to Friday wiped out $460 million in leveraged bullish ETH positions in two days, extending the decline from the August 24 all-time high to 47%. Despite this, major traders are increasing their long exposure, indicating a possible recovery upswing to $3,200.

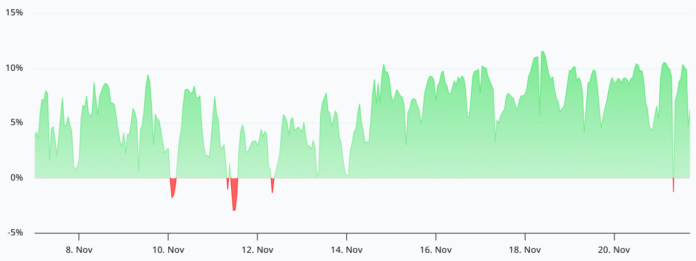

Demand from ETH bulls is still largely absent in the derivatives markets, although sentiment is slowly moving towards a possible recovery. The annual funding rate for ETH perpetual futures settled near 6% on Friday, rising from 4% the previous week. Under balanced conditions, the indicator typically fluctuates around 6% to 12% to cover the cost of capital.

The annual funding rate of ETH Perpetual Futures. Source: laevitas.ch

US Economic Stress and Its Impact on ETH

A University of Michigan survey shows that 69% of consumers now expect unemployment to rise in the coming year, more than double the number a year ago. Joanne Hsu, the consumer survey director, reportedly said: “Cost of living concerns and income concerns dominate consumers’ views on the economy across the country.” This increasing economic stress is likely to impact ETH prices.

Home Depot CEO Ted Decker said the company continues to “experience lower exposure to larger discretionary projects,” primarily due to continued weakness in the real estate market. Decker said housing sales as a percentage of total available supply have approached a 40-year low, while home prices have begun to adjust, according to Yahoo Finance.

Daily net outflows of the Spot Ethereum ETF, USD. Source: Farside Investors

ETH Derivatives and US Dollar Index

Part of Ether traders’ waning confidence can be attributed to nine straight sessions of net outflows into spot Ether exchange-traded funds (ETFs). About $1.33 billion exited these products during this period, in part as institutional investors reduced their exposure to risky assets. The US dollar gained against major foreign currencies as concerns about the artificial intelligence sector grew.

US Dollar Index (DXY). Source: TradingView / Cointelegraph

The US Dollar Index (DXY) climbed to its highest level in six months as investors sought the safety of cash holdings. It may seem counterintuitive given how intertwined the US economy is with the tech sector, but traders are simply holding reserves until employment data becomes clearer and whether consumer demand will recover following the extended government shutdown in the US.

The long-to-short positions of the top ETH traders on OKX. Source: CoinGlass

BitMine Announces ETH Staking Plans and Market Outlook

Top traders on OKX increased their long positions even as Ether fell from $3,200 to $2,700 on Sunday. Confidence is starting to improve after strong quarterly results and year-end guidance from Nvidia (NVDA US) and after Federal Reserve Bank of New York President John Williams said he sees room for rate cuts in the near term as the labor market weakens.

BitMine Immersion (BMNR US) and ShapeLink Gaming (SBET US) are among the companies that have built up large ETH reserves through debt and equity issuances. These stocks are currently trading at discounts of 16% or more compared to their ETH holdings, highlighting investors’ lack of security.

From a derivatives perspective, whales and market makers are increasingly convinced that $2,650 is the bottom. Still, bullish belief likely hinges on renewed spot inflows from Ether ETFs and clearer signals of less restrictive monetary policy, meaning Ether’s potential return to $3,200 could take a few weeks.

This article is for general information purposes and is not intended to constitute, and should not be construed as, legal or investment advice. The views, thoughts and opinions expressed herein are those of the author alone and do not necessarily reflect the views and opinions of Cointelegraph. For more information, visit https://cointelegraph.com/news/eth-futures-data-forecasts-bounce-to-dollar3-2k