Grayscale Highlights Chainlink’s Crucial Role in Blockchain Adoption

Grayscale, a prominent asset manager, has emphasized the significance of Chainlink in the next major phase of blockchain adoption, referring to the project as “critical connective tissue” that bridges the gap between cryptocurrency and traditional finance. According to Grayscale, Chainlink’s expanding suite of software tools is becoming essential infrastructure for tokenization, cross-chain settlement, and the integration of real-world assets on blockchain rails.

A recent research report by Grayscale notes that Chainlink’s growing presence has helped make its native token, LINK, the largest non-Layer 1 crypto asset (excluding stablecoins) by market capitalization. This provides investors with access to multiple ecosystems rather than a single chain. The company describes Chainlink as “modular middleware that enables on-chain applications to securely consume off-chain data, interact across blockchains, and meet enterprise-level compliance requirements.”

Tokenization and Chainlink’s Central Role

Grayscale believes that tokenization is an area where Chainlink’s value becomes particularly apparent. Currently, most financial assets, including securities and real estate, are recorded on off-chain ledgers. To achieve the efficiency and programmability of blockchains, these assets must be tokenized, verified, and connected to external data sources. Chainlink is expected to play a central role in orchestrating this tokenization process, with partnerships such as those with S&P Global and FTSE/Russel, facilitating its involvement.

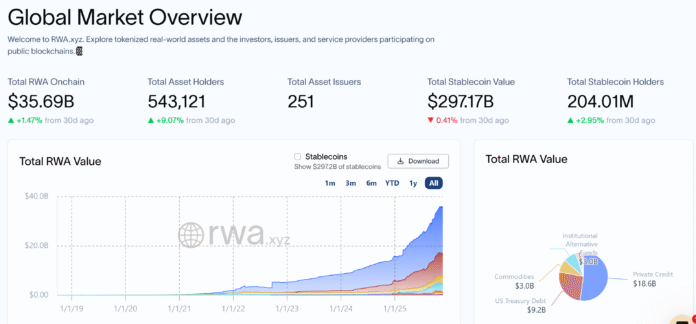

According to data from RWA.xyz, the tokenized asset market has experienced significant growth, expanding from $5 billion to over $35.6 billion since the beginning of 2023. This growth underscores the increasing importance of tokenization and the potential role of Chainlink in this process.

Total RWA in the chain. Source: RWA.xyz

Chainlink’s Involvement in Cross-Chain Protocols

In June, Chainlink, along with JPMorgan’s Kinexys Network and Ondo Finance, completed a cross-chain delivery versus payment (DvP) agreement between a permissioned bank payment system and a public blockchain testnet. This pilot connected Kinexys Digital Payments with Ondo Chain’s testnet, which specializes in tokenized real-world assets, using Chainlink’s Runtime Environment (CRE) as a coordination layer. The settlement involved the exchange of Ondo’s tokenized U.S. Treasury fund OUSG for fiat payments without the assets leaving their native chains.

This development highlights Chainlink’s capability to facilitate complex cross-chain transactions, further solidifying its position as critical infrastructure in the blockchain ecosystem. As the blockchain and cryptocurrency space continues to evolve, the role of Chainlink and similar projects in enabling the integration of traditional finance with blockchain technology will be closely watched.

For more information on Grayscale’s insights into Chainlink and its role in the future of blockchain, visit https://cointelegraph.com/news/grayscale-chainlink-critical-connective-tissue-tokenized-finance?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound