Ether (ETH) has experienced a significant decline in value over the past month, falling by 30% to a four-month low of $2,806. This downturn has raised concerns about the sustainability of Ether treasury companies, which are currently sitting on millions of dollars in unrealized losses. The sharp decline in ETH’s value has also led to a decrease in institutional demand, with technical indicators and market trends pointing to a potential further correction below $2,500.

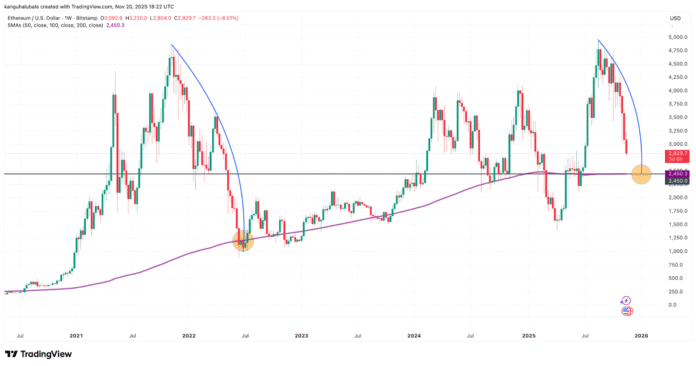

Ether Price Fractal Suggests Deeper Correction

A bearish fractal pattern, first observed in 2022, is repeating itself in the current market, suggesting a deeper correction for ETH. The fractal consists of a sharp decline from the 2021 all-time high of $4,800, with the price bottoming out around the 200-week Simple Moving Average (SMA). A similar scenario is playing out in 2025, with the price down 41% from its current all-time high of $4,955 in August. This indicates that the 200-week SMA at $2,450 may provide the last line of defense for bulls.

ETH/USD weekly chart. Source: Cointelegraph/TradingView

The supertrend indicator on ETH’s weekly chart has sent a “sell” signal, which has historically resulted in significant price declines. In March 2025, a similar signal led to a 66% price decline, while in January 2022, it resulted in an 82% decline. If history repeats itself, ETH could see a deeper correction to as high as $2,500, driven by lower institutional demand and declining on-chain activity.

Ethereum Treasury Companies Face Significant Losses

The sharp decline in ETH’s value has pushed the average Ether financial firm into the red, resulting in millions of dollars in paper losses. Data from Capriole Investments shows that these companies have generated negative returns of 25% to 48% on their ETH holdings. The top 10 DAT companies are in the red on the weekly and daily time frames, with BitMine Immersion Technologies holding 3.56 million ETH (2.94% of circulating supply) and facing returns of -28% and -45% on its investments over the last seven days and 30 days, respectively.

Performance of ETH Treasury companies. Source: Capriole Investments

BitMine is currently down $1,000 per ETH purchased, implying a cumulative unrealized loss of $3.7 billion on its total holdings. Other companies, such as SharpLink, The Ether Machine, and Galaxy Digital, are also facing losses in the millions, with their market value relative to net asset value (mNAV) falling below 1. This indicates an impaired ability to raise capital.

Institutional Demand Declines

Data from StrategicETHreserve.xyz shows that the total holdings of Strategic Reserves and ETFs have decreased by 280,414 ETH since November 11th. Global exchange-traded products, including US spot Ether ETFs, saw their largest weekly outflows since February, adding to the ongoing decline in institutional demand for ETH.

ETH government bonds and ETF holding reserve. Source: StrategicETHreserve.xyz

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/eth-dats-have-a-problem-ether-s-crash-below-dollar3k-vaporized-a-year-s-worth-of-gains?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound