Ethereum Traders Ramp Up Positioning, Setting a Price Target at $3,390

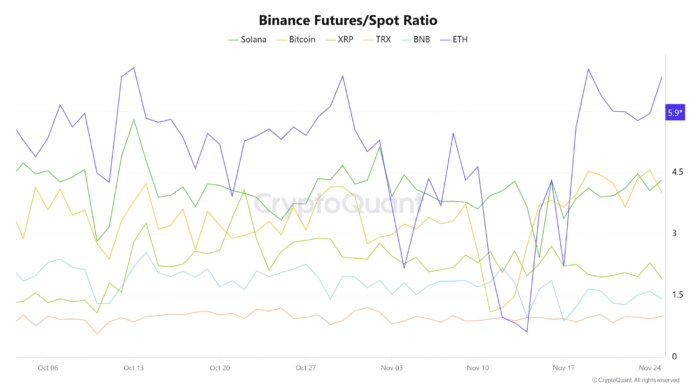

Ethereum (ETH) traders are quietly returning to leverage, with new futures data indicating a significant shift in market positioning as ETH approaches a critical technical zone. The recent surge in ETH’s futures-to-spot ratio on Binance has sparked intense interest among traders, with many betting heavily on derivatives to take advantage of directional moves. According to CryptoQuant, the futures-to-spot ratio for ETH has risen sharply from 5 to 6.84, the highest level in the fourth quarter, outpacing other major crypto assets like Bitcoin and Solana.

Binance Futures/Spot Ratio for BTC, ETH, XRP. Source: CryptoQuant

Shift in Market Behavior and Rising Expectations for ETH-Specific Volatility

The divergence in ETH’s futures-to-spot ratio compared to other large-cap assets suggests rising expectations for ETH-specific volatility or future catalysts. On-chain data from Binance further supports this shift, highlighting a significant decline in Bitcoin Open Interest (OI) over the past two weeks, while Ether’s OI has remained relatively stable with only a slight average decline of 0.47% per day. This trend indicates that market participants are shifting risk capital from BTC’s uptrend into the higher beta opportunity of ETH. As seen in the chart below, the change in open interest on Binance for BTC and ETH reflects this shift in market behavior.

Change in open interest on Binance for BTC, ETH. Source: CryptoQuant

ETH Traders Divided Over the Next Move

After ETH broke above $3,000, analysts debated whether ETH can convert rising derivatives pressure into a sustained breakout. Crypto trader Scient argued that ETH’s structure is already better than Bitcoin and pointed to a strengthened four-hour support base around $2,800. Bulls assumed that this area would attract new buyers upon each retest, triggering an initial push toward $3,050 and potentially the largest liquidity cluster at $3,390, an area consistent with high-time frame support/resistance, a fair value gap (FVG), and the annual open.

Ether’s four-hour chart analysis by Scient. Source: X

Contrasting Views on the Near-Term Trajectory

However, Lab Trading analyst Ken believes that the near-term trajectory is still bearish. ETH has consistently rejected the four-hour 100 EMA level throughout November, and the trader warned that the market risks a further downside extension if the $3,000 level fails to cross over into the support zone. Meanwhile, crypto analyst Kingpin Crypto said the “Thanksgiving lull” is a potential springboard. As price responds to the.618 retracement of the 2025 rally and several higher timeframe supports below, some are expecting a December “Ethereum Santa rally” towards the $3,300 level, especially as Bitcoin’s dominance continues to wane.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information on Ethereum and its market trends, visit https://cointelegraph.com/news/eth-traders-ramp-up-positioning-setting-a-price-target-at-dollar3-4k?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound