Solana spot ETFs have broken a 21-day losing streak, recording $5.37 million in net inflows on November 28. This recovery is a significant development, especially considering the current market conditions. The price of Solana (SOL) has been under pressure, falling below $140 and reaching $137 amid general market weakness.

The inflows were led by Grayscale’s GSOL, which attracted $4.33 million, and Fidelity’s FSOL, which saw $2.42 million in inflows. However, 21Shares’ TSOL experienced outflows of $1.38 million, partially offsetting the gains. Other Solana ETFs, such as Bitwise’s BSOL, VanEck’s VSOL, and Canary’s SOLC, did not see any flow activity.

ETF Recovery and Its Impact on Solana Price

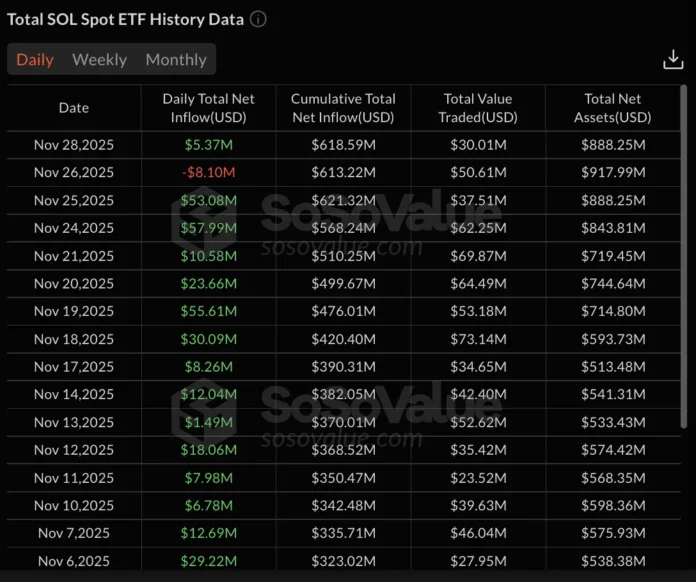

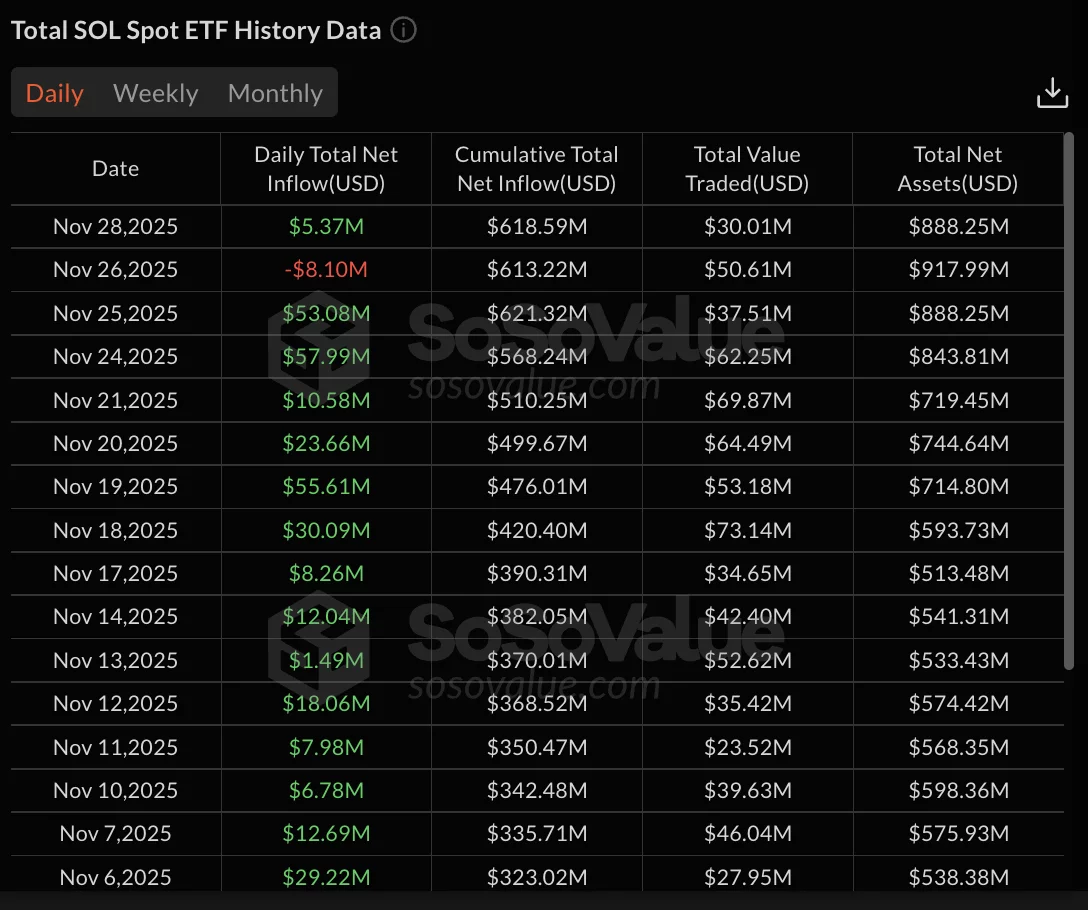

Despite the ETF inflows, the Solana price remained below $140 and continued its 30-day decline. The token traded as high as $143 in the last 24 hours before falling to its current level. SOL has gained 8% in the last seven days, but its overall trend remains bearish. The Nov. 28 inflows ended three weeks of sustained ETF outflows, with the last withdrawal of $8.10 million recorded on November 26th.

Previously, SOL ETFs attracted $53.08 million on November 25th and $57.99 million on November 24th. The cumulative total net inflow of all Solana ETFs reached $618.59 million on November 28th, with total net assets under management standing at $888.25 million. The total trading value reached $30.01 million on November 28th.

Cumulative Inflows and Institutional Accumulation

Grayscale’s GSOL has received cumulative net inflows of $77.83 million, while Bitwise’s BSOL leads all Solana ETFs with total inflows of $527.79 million. Fidelity’s FSOL has total assets of $32.30 million. 21Shares’ TSOL has seen net outflows of $27.60 million since its launch, and VanEck’s VSOL and Canary’s SOLC maintain smaller assets.

The mismatch between ETF inflows and price movements suggests institutional accumulation at lower levels. While SOL ETFs attracted capital on November 28, the token continued its 30-day decline, failing to reclaim $140 after the inflow recovery.

Current Market Situation and Future Outlook

The current market situation is characterized by general weakness, with many cryptocurrencies experiencing declines. However, the inflows into Solana ETFs suggest that institutional investors are accumulating the token at lower levels. This could be a sign of a potential reversal in the trend, but it is essential to consider the broader market conditions and other factors that may influence the price of Solana.

SOL ETF data: SoSo Value

SOL ETF data: SoSo Value