Tether CEO Rejects S&P Global’s Downgraded Rating of USDT’s Dollar Peg

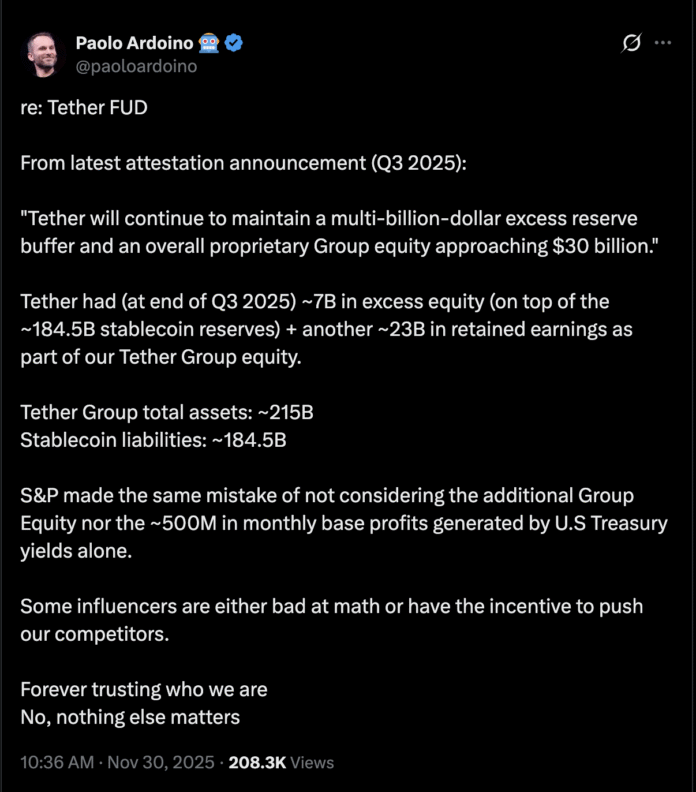

Tether CEO Paolo Ardoino has pushed back against S&P Global’s recent downgraded rating of USDT’s ability to maintain its U.S. dollar peg, arguing that the rating agency failed to consider all of Tether’s assets and revenue. According to Ardoino, Tether Group’s total assets stood at around $215 billion at the end of the third quarter of 2025, while total stablecoin liabilities stood at around $184.5 billion, as per Tether’s third quarter confirmation report.

Ardoino highlighted that Tether had approximately $7 billion in excess equity at the end of the third quarter of 2025, in addition to approximately $184.5 billion in stablecoin reserves and an additional approximately $23 billion in retained earnings as part of its Tether Group equity. He also noted that S&P Global made a mistake by not taking into account the additional corporate equity nor the approximately $500 million in monthly basis profits generated by U.S. Treasury yields alone.

Source: Paolo Ardoino

S&P Global’s downgrade of USDT’s dollar peg to “weak” sparked fear, uncertainty, and doubt among some analysts about the company’s ability to maintain its peg. However, Ardoino and other market analysts have rejected this assessment, citing Tether’s strong financials and revenue streams.

Analysts Debate Tether’s Accounting Fundamentals

Arthur Hayes, a market analyst and founder of crypto exchange BitMEX, has speculated that Tether is buying large amounts of gold and BTC to make up for lost income caused by falling U.S. Treasury yields. According to Hayes, as the Federal Reserve cuts interest rates, gold and BTC are likely to rise in value, but a sharp correction in these assets could spell trouble for Tether.

A roughly 30% decline in gold and BTC positions would wipe out Tether’s equity, and then USDT would theoretically become insolvent, Hayes warned.

Source: Arthur Hayes

However, Joseph Ayoub, the former lead digital asset analyst at financial services giant Citi, has dismissed Hayes’ analysis. Ayoub, who spent “hundreds” of hours researching Tether as an analyst for the company, argues that Tether has excess assets beyond its disclosures, a highly lucrative business that generates billions of dollars in interest income with just 150 employees, and is better collateralized than traditional banks.

Conclusion

The debate surrounding Tether’s accounting fundamentals and ability to maintain its dollar peg continues to be a topic of discussion among market analysts. While some have raised concerns about the company’s exposure to gold and BTC, others argue that Tether’s strong financials and revenue streams make it well-positioned to weather any potential storms. For more information, visit https://cointelegraph.com/news/tether-ceo-rails-sp-tether-fud?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound