The DeFi landscape has undergone significant transformations over the past five years, evolving from a niche concept to a viable, albeit volatile, alternative to traditional finance. As of November 2025, the total value locked (TVL) in DeFi ranges from $100 billion to $120 billion, indicating a notable decline from its peak in 2021. This decrease can be attributed to the collapse of synthetic returns, which were driven by token emissions rather than real economic activity.

The Rise and Fall of Synthetic Returns

In 2021, DeFi’s TVL exceeded $250 billion, largely due to a simple mechanism where tokens were minted, labeled as rewards, and presented as sustainable returns. However, this model was inherently fragile, as the value of tokens relied on continuous inflows of new capital. Once inflows slowed, the value of tokens dropped, yields plummeted, and users began to exit. This led to a long overdue structural change in the market, paving the way for real returns to take center stage.

Real Returns Take Center Stage

Real returns, unlike synthetic ones, depend on actual demand and reflect direct participation in economic activities such as transaction fees, protocol revenue, or productive computation. Bitcoin (BTC) is a prime example of a network where yield is tied to actual production, with mining converting energy into verifiable computational work. Tokenized hashrate has emerged as a means to connect physical energy and digital capital, allowing users to access industrial-level Bitcoin production without having to operate mining infrastructure themselves.

Tokenized Hashrate: A New Paradigm

Tokenized hashrate involves converting computing power into tradable digital assets, giving users a share of the actual work done by a facility. This model has become increasingly relevant, particularly in the context of Bitcoin mining, which has grown to become a significant industrial sector. In Texas alone, crypto mining facilities have exceeded 2,000 megawatts of registered electricity capacity, demonstrating the scale and energy needs of the industry.

Proof-of-Work vs. Proof-of-Stake: Competing Yield Architectures

The sustainability of yield over time depends on the underlying network architecture. In the case of Bitcoin, proof-of-work (PoW) secures the network through energy expenditure and calculation, anchoring the yield to a real input. In contrast, Ethereum’s proof-of-stake (PoS) model, while capital efficient and less resource intensive, may lead to stagnation as the base layer becomes more conservative. This is evident in Vitalik Buterin’s statement that Ethereum’s base layer should become more conservative, implying a slower development phase and potentially stagnant revenue.

What’s Next for the DeFi Cycle?

As the DeFi landscape continues to evolve, it is likely that production-based models, such as tokenized hashrate, will play a more prominent role. These models, which rely on real production and infrastructure, are better positioned to provide resilient returns. In contrast, the Ethereum system, while efficient, may face stagnation due to its conservative base layer. As the industry moves forward, it is essential to prioritize real yield, supported by production and infrastructure, to avoid the mistakes of the past and create a more sustainable DeFi ecosystem.

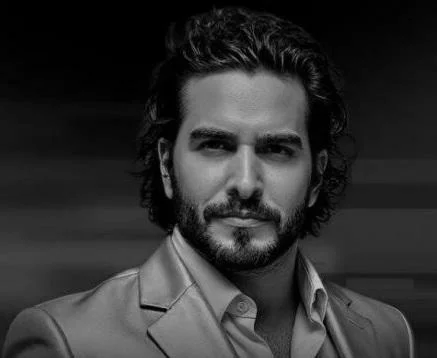

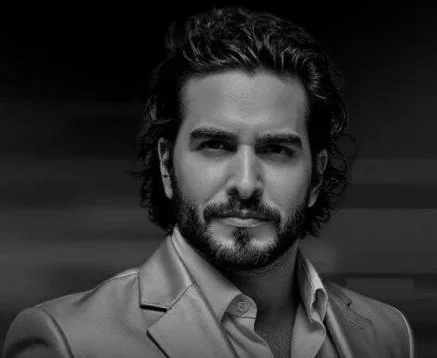

Hunter Rogers, co-founder of the global Bitcoin yield protocol TeraHash, emphasizes the importance of establishing TeraHash as the institutional standard for Bitcoin native yields and transforming physical hashrate into transparent, liquid, and composable financial products. With his experience in ecosystem partnerships, institutional engagement, and community growth initiatives, Rogers is well-positioned to navigate the evolving DeFi landscape.

Read more about the evolution of DeFi and the role of Bitcoin in taking it further at https://crypto.news/ethereum-built-defi-now-bitcoin-is-taking-it-further/.