Introduction to Tether’s Gold Purchases

Tether, the issuer of the world’s largest stablecoin, USDT, has been making headlines with its significant gold purchases. In the third quarter of 2025, the company bought 26 tons of gold, surpassing the quarterly acquisitions of many central banks. This move has sparked interest in the financial community, with many wondering what this means for the global gold market and the role of non-governmental institutions in it.

Key Insights into Tether’s Gold Holdings

Tether’s gold holdings now total 116 tons, making it one of the 30 largest gold holders in the world. This is a significant development, as it marks a shift in the global demand for gold, which was once dominated by central banks. Stablecoin issuers, sovereign wealth funds, corporations, and technology companies are increasingly active in the gold markets, changing the landscape of gold demand.

Central banks also continue to add to their gold reserves, with a 28% increase in the third quarter of 2025 compared to the second quarter. Countries such as Kazakhstan, Brazil, Turkey, and Guatemala have achieved significant growth in their gold reserves, despite record prices. Tether’s purchases, however, come from profits and are used to support the diversification, resilience, and collateralization of USDT.

A Private Company Outperforming Central Banks in Gold Purchases

Tether’s 26-ton gold purchase in the third quarter of 2025 exceeded the official gold purchases of many mid-sized central banks during the same period. This reflects a broader trend of large private players becoming significant participants in markets once dominated by governments. According to an analysis by investment bank Jefferies, Tether’s gold holdings would place it among the top 30 gold reserves in the world if it were listed alongside countries on the International Monetary Fund’s (IMF) official gold reserves list.

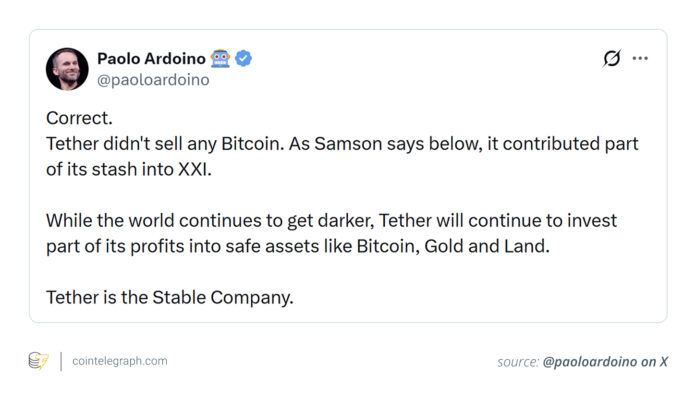

Research by the World Gold Council has also pointed to increasing non-governmental demand for gold. Tether CEO Paolo Ardoino emphasized that these gold purchases are made from profits and not from customer reserves backing USDT, and that diversifying into physical assets strengthens long-term resilience.

Independent Certifications and Gold Breakdowns

Tether publishes independent certifications from major accounting firms on a quarterly basis, providing insight into the company’s reserves. As of September 30, 2025, gold and precious metals accounted for approximately 7% of Tether’s total consolidated reserves. This figure includes both gold-backed USDT and gold allocated to Tether Gold (XAUT), Tether’s tokenized gold product.

XAUT has a market value of around $1.6 billion, which is less than 12 tons of gold. More than 100 tons of reported gold is not tied to XAUT and is part of Tether’s broader corporate reserves and investments. Tether’s USDT became the first stablecoin to reach a market cap of $100 billion, a notable development in digital finance.

Comparison to Central Banks

The World Gold Council’s report “Gold Demand Trends – Q3 2025” shows that global central banks added a net 220 tonnes of gold in the third quarter of 2025. This was 28% higher than the second quarter figure and 6% higher than the five-year quarterly average. In comparison, Tether’s 26-ton gold purchase in the third quarter of 2025 exceeded the official gold purchases of many mid-sized central banks during the same period.

Central banks such as the National Bank of Kazakhstan, Brazil’s central bank, Turkey’s central bank, and the Bank of Guatemala have also increased their gold reserves. However, it’s essential to remember that central banks have different goals when purchasing gold, primarily for national monetary strategy, whereas Tether holds gold as part of its corporate reserves for collateralization and diversification.

The Rise of Non-Governmental Gold Buyers

The demand for gold was once primarily driven by central banks, the jewelry industry, and commodity investors. However, in recent years, a growing share of gold purchases have come from private institutions, sovereign wealth funds, stablecoin issuers, and corporate treasuries. This shift is driven by geopolitical uncertainty and fluctuations in currency values, with stablecoin issuers becoming significant participants in the gold market.

Major technology companies and investment funds are also adding gold to their portfolios as part of broader strategies. With the rapid expansion of non-governmental gold buyers, they now account for a noticeable portion of overall gold demand, changing the pattern of global gold demand.

What Tether’s Gold Purchase Does Not Indicate

To avoid misunderstandings, it’s crucial to clarify what Tether’s gold accumulation does not mean. It does not indicate liquidity problems or impending insolvency, as independent certification confirms the relationship between assets and liabilities. The purchase of gold by a non-governmental actor does not imply a market forecast or directional view, nor is it a monetary policy decision, as private companies manage their reserves according to different objectives and rules.

Tether undergoes quarterly independent reserve attestation by a leading global accounting firm, which reviews assets, liabilities, reserve composition, and exposure. This helps put Tether’s gold purchase into proper context and supports a better understanding of what this move means.

Conclusion

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information. For more information, visit https://cointelegraph.com/news/why-tether-is-buying-more-gold-than-many-central-banks-and-what-it-signals?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound