Bitcoin (BTC) has been experiencing a period of significant price fluctuations, and its short-term trend could be heavily influenced by developments in Binance’s order flow and on-chain activity. To better understand the potential direction of BTC’s next big move, it’s essential to analyze three key metrics linked to Binance: the increasing selling pressure, changing liquidity behavior, and the market’s preparation for volatility. These factors will play a crucial role in determining whether BTC can maintain its current support level or if it will undergo a deeper correction.

Understanding the Metrics

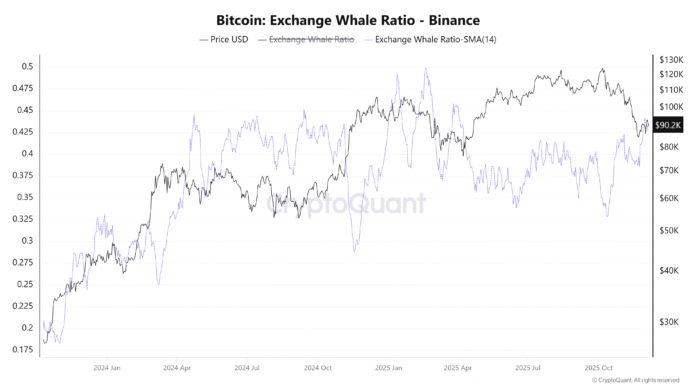

A closer examination of the data reveals that Bitcoin whales’ deposits on exchanges are increasing, which often indicates a higher risk of profit-taking. This trend is particularly evident on Binance, where the Exchange Whale Ratio has risen to 0.47 across all exchanges, with the 14-day exponential moving average (EMA) reaching 0.427, its highest level since April. Bitcoin exchange whale ratio on Binance. Source: CryptoQuant

This increase in whale deposits typically precedes distribution phases, as large holders prefer to utilize Binance’s liquidity to deposit size. With BTC struggling to break above $93,000, this shift implies growing resistance at the ceiling. If this trend continues, the price is more likely to consolidate or retest support before attempting another breakout.

On-Chain Data Analysis

On-chain data has shown that the 30-day simple moving average (SMA) of BTC inflows to Binance reached 8,915 on November 28, close to the March 3 peak of 9,031. Historically, similar inflow spikes have been followed by sharp downward movements. Bitcoin exchange inflow (total) on Binance. Source: CryptoQuant

This increase suggests that holders are actively preparing to de-risk or exit Bitcoin after the rally. As the market attempts to secure a position above the $96,000 resistance, Binance’s growing inventory acts as an immediate headwind. Until the oversupply is absorbed, any upside could be limited.

Stablecoin Inflows and Volatility

Binance also recorded 946,000 USDt (USDT) deposit transactions in seven days, far surpassing OKX (841,000) and Bybit (225,000). Rising stablecoin inflows generally indicate that traders are preparing to take action, either to buy aggressively on price declines or to reposition themselves on rapid moves. USDt flows onto Tron from various exchanges. Source: CryptoQuant

Given the current backdrop of whale selling and increased BTC inflows, this surge is more of a sign that traders are gearing up for reactive trading rather than passive accumulation. During times of uncertainty, stablecoin inflows often lead to increased volatility and short-term price pullbacks. If BTC loses $90,000, this liquidity could accelerate the downtrend. However, if support holds, it could result in a significant counter-trend bounce.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information on Bitcoin’s market trends and analysis, visit Cointelegraph.