European Commission’s Proposal to Expand ESMA Powers Raises Concerns

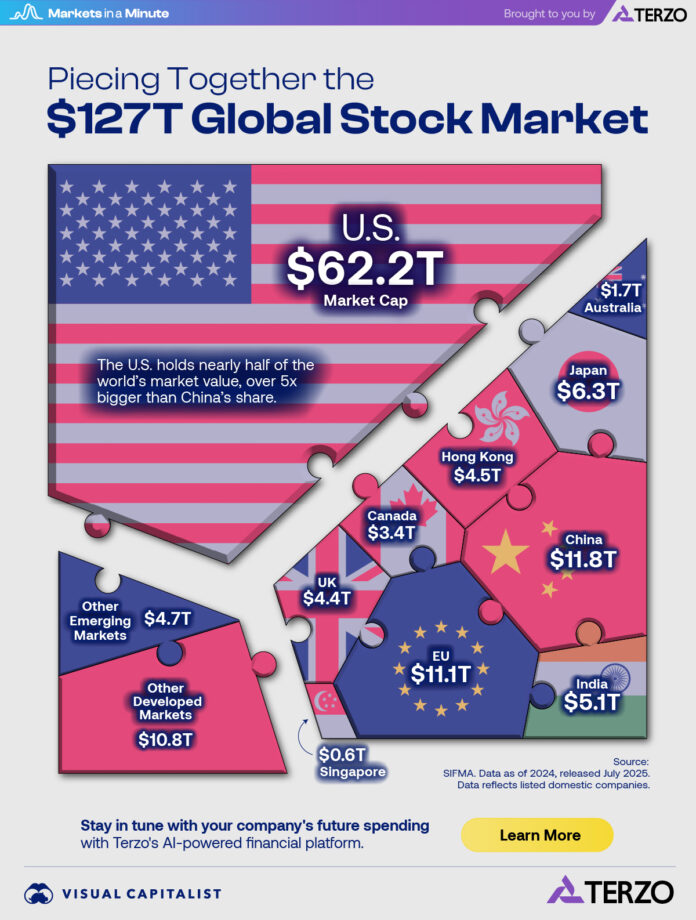

The European Commission’s recent proposal to grant the European Securities and Markets Authority (ESMA) more powers has sparked concerns about the potential centralization of the bloc’s licensing system. This move is part of a broader effort to enhance the competitiveness of the EU’s capital markets, which currently lag behind those of the United States. According to data from Visual Capitalist, the US stock market is worth approximately $62 trillion, accounting for 48% of the global stock market, while the EU stock market is valued at around $11 trillion, representing 9% of the global share.

The proposal, which was released on Thursday, suggests granting ESMA “direct supervisory authority” over key aspects of the market infrastructure, including crypto asset service providers (CASPs), trading venues, and central counterparties. Faustine Fleuret, head of public affairs at decentralized lending protocol Morpho, expressed concerns that this expansion of ESMA’s jurisdiction could lead to slower licensing systems and hinder the development of startups. “I am even more concerned that the proposal makes ESMA responsible for both the authorization and supervision of CASPs, not just supervision,” she stated.

Implications for the Crypto and Fintech Industries

The proposed centralization of licensing under ESMA has raised concerns among industry experts, who fear that it could slow down the development of the crypto and fintech industries. Elisenda Fabrega, general counsel at asset tokenization platform Brickken, noted that while the intention behind the proposal is to address differences in national supervisory practices and unequal licensing systems, it may ultimately have the opposite effect. “Without sufficient resources, this mandate could become unmanageable, resulting in delays or overly cautious assessments that could disproportionately impact smaller or innovative companies,” she warned.

The effectiveness of this reform will depend on various factors, including ESMA’s operational capacity, independence, and cooperation with member states. As the proposal still requires approval from the European Parliament and the Council, it remains to be seen how it will be implemented and what impact it will have on the EU’s capital markets. The EU’s goal is to boost wealth creation for its citizens by making its capital markets more competitive with those of the US.

Global Stock Market Value Comparison

A comparison of the global stock market value by country, as illustrated by Visual Capitalist, highlights the significant gap between the US and EU markets. The US stock market dominates the global landscape, with a value of approximately $62 trillion, while the EU stock market trails behind at around $11 trillion. This disparity underscores the need for the EU to enhance its capital markets and create a more favorable environment for businesses to grow and thrive.

Global stock market value by country. Source: Visual Capitalist

For more information on the European Commission’s proposal and its potential implications for the crypto and fintech industries, visit https://cointelegraph.com/news/european-sec-proposal-licensing-concerns?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound