Bitcoin (BTC) has experienced a significant decline of 10% over the last 30 days, with various groups of wallet holders transitioning from distribution to accumulation. This shift in behavior is noteworthy, as it may indicate a potential change in momentum for the cryptocurrency.

Data from reputable sources suggests that this accumulation, coupled with record realized losses, could be a sign of a larger trend. The Bitcoin Accumulation Trend Score (ATS) is a key metric to consider, as it provides insight into the behavior of large investors.

Key Takeaways

Several key points stand out in the current Bitcoin market:

- Bitcoin whales and middle-market holders are aggressively accumulating their BTC holdings at current levels.

- Whales and sharks are now absorbing almost 240% of the newly mined BTC supply, indicating a significant shift in market dynamics.

- Bitcoin’s realized losses reached nearly $5.8 billion on November 22, the largest since FTX, a classic sign of capitulation.

Strong Bitcoin Accumulation at Current Levels

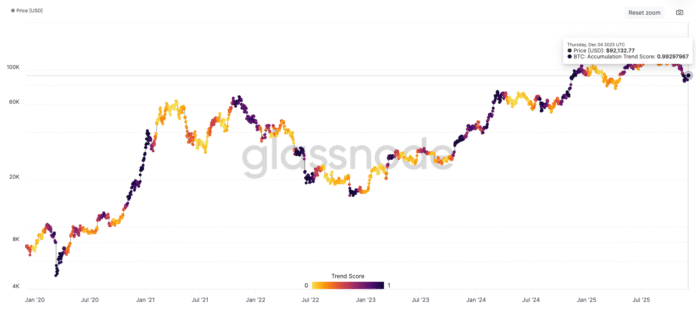

Bitcoin whales have increased their risk appetite following the recent decline to $80,000, using the decline as an opportunity to accumulate more BTC. According to Glassnode data, the Bitcoin Accumulation Trend Score (ATS) is close to 1, indicating strong accumulation by large investors.

An ATS closer to 1 (dark blue) indicates that whales are accumulating more Bitcoin than they are distributing, and a value closer to 0 (light yellow) indicates that they are distributing or not accumulating. The increase in the trend value indicates a transition from distribution to accumulation in almost all cohorts.

Bitcoin accumulation trend assessment. Source: Glassnode

Additional data from Glassnode shows a resurgence in purchases by small and medium-sized companies holding between 10 and 1,000 BTC, which have been accumulating aggressively in recent weeks.

Bitcoin accumulation trend assessment by cohort. Source: Glassnode

Bitcoin Whales Absorb Nearly 240% of New Supply

This accumulation trend is reinforced by the annual absorption rate metric, which shows that whales and sharks are now absorbing around 240% of annual BTC issuance, while exchanges are losing coins at a historic pace.

Notably, Bitcoin’s annual absorption rate by exchanges has fallen below -130% due to continued outflows. This signals a growing preference for self-custody or long-term investments.

Annual Bitcoin Absorption Rates. Source: Glassnode

Meanwhile, larger holders (100+ BTC) are absorbing almost one and a half times the new issuance, which is the fastest accumulation rate among sharks and whales in Bitcoin history.

Annual Bitcoin Absorption Rates by Whales and Sharks. Source: Glassnode

Bitcoin’s Realized Losses Exceeded $5.7 Billion

Additional data from Glassnode showed that Bitcoin’s recent decline “triggered the largest spike in realized losses since FTX’s collapse in late 2022.”

The chart below shows that BTC’s realized losses by short-term holders (STHs) reached $3 billion on November 22, while losses by long-term holders (LTHs) reached $1.78 billion. Total realized losses by all holders amounted to $5.78 billion after Bitcoin fell to $80,000 on November 21st.

Bitcoin suffered losses from LTHs and STHs. Source: Glassnode

As reported by Cointelegraph, short-term Bitcoin traders have come under the most pressure from the current downturn in terms of unrealized losses, with ETFs accounting for a maximum of 3% of the recent selling pressure.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks and readers should conduct their own research when making their decision.

While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information. For more information, please visit https://cointelegraph.com/news/bitcoin-accumulation-trends-strengthen-realized-losses-5-7b