US Teachers Union Urges Senate to Withdraw Market Structure Bill Over Crypto Concerns

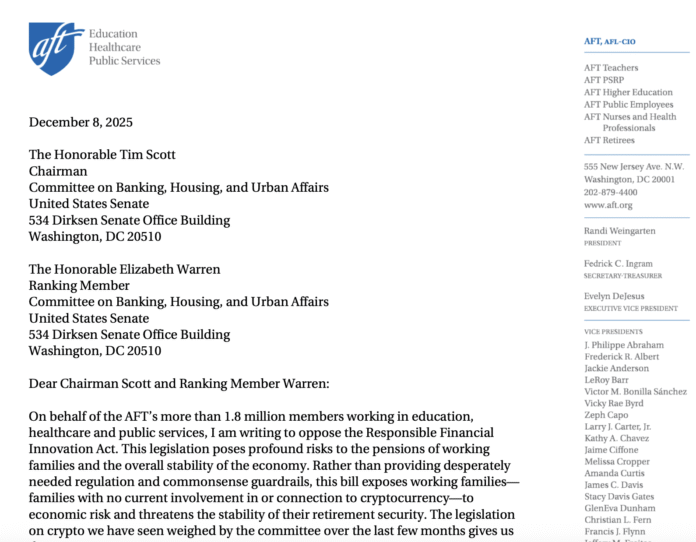

The American Federation of Teachers (AFT), a prominent union representing 1.8 million members in education, healthcare, and public services, has expressed strong opposition to the Senate’s proposed market structure bill. In a letter to Republican and Democratic leaders on the Senate Banking Committee, the AFT claimed that the bill poses “significant risks” to economic stability and retirement plans, particularly with regards to the inclusion of cryptocurrencies.

The AFT’s concerns center around the Responsible Financial Innovation Act, which they argue does not provide a regulatory structure for crypto assets and stablecoins equivalent to that of other fixed-income holdings. The union stated that most pensions do not include crypto assets due to their risk, and that the legislation’s purported stability and wide distribution of these assets are not accurate.

Retirement Savings at Risk

The AFT is not alone in its concerns, as the American Federation of Labor and the Congress of Industrial Organizations also expressed similar worries about the Market Structure Act in a letter to the Banking Committee in October. The group claimed that the legislation would increase workers’ vulnerability by allowing retirement plans, such as 401(k)s and pensions, to hold risky crypto assets. According to the National Association of State Retirement Administrators, total public pension assets, including teachers, were over $6.5 trillion in the second quarter of 2025, while the Investment Company Institute reported that total US retirement assets were approximately $45.8 trillion in September.

The AFT’s opposition to the bill is significant, given the substantial assets at stake. The union represents a large portion of the education sector, and its concerns about the potential risks of crypto assets in retirement plans are shared by other major labor organizations. As the Senate considers the market structure bill, it is essential to weigh the potential benefits of crypto assets against the potential risks to retirement savings.

Executive Orders and Regulatory Shifts

Separate from the Senate’s efforts, US President Donald Trump has attempted to change policy to allow the inclusion of cryptocurrencies in 401(k) retirement plans through executive orders. In August, Trump signed an executive order directing the Department of Labor to reevaluate restrictions on alternative assets in defined contribution plans, including digital assets. Wealth management firms, such as Morgan Stanley, have already begun to incorporate digital assets into individual retirement arrangements (IRAs) and 401(k)s.

State-managed pension funds, like those in Michigan and Wisconsin, also have exposure to cryptocurrencies through exchange-traded funds linked to digital assets. As the regulatory landscape continues to evolve, it is crucial to consider the potential implications of crypto assets on retirement savings and the overall financial stability of the US economy.

For more information on this topic, visit https://cointelegraph.com/news/us-teachers-union-senate-withdraw-market-structure?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound