SEC Releases Crypto Wallet and Custody Guide for Investors

The U.S. Securities and Exchange Commission (SEC) has taken a significant step towards educating investors about the best practices and risks associated with cryptocurrency storage. On Friday, the SEC released a crypto wallet and custody guide investor bulletin, which outlines the benefits and risks of various methods of crypto custody. This move is seen as a transformative change in the agency’s approach to digital assets, which was previously hostile under the leadership of former SEC Chairman Gary Gensler.

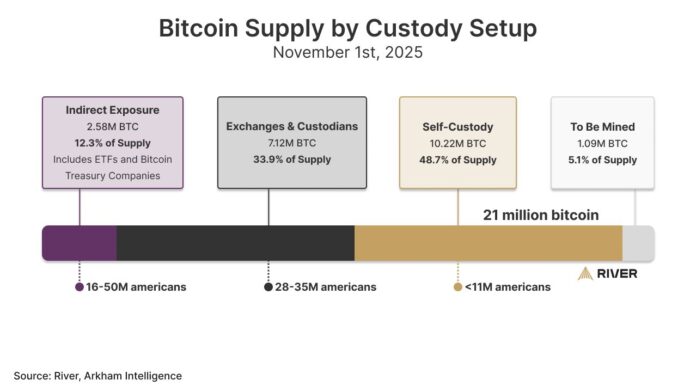

The SEC’s bulletin lists the pros and cons of self-custody versus allowing third parties to hold digital assets on behalf of the investor. If investors choose third-party custody, they should understand the custodian’s policies, including whether it “rehypothecates” the assets in custody through lending or whether the service provider pools customer assets into a single pool rather than holding the cryptocurrencies in separate customer accounts.  The Bitcoin supply broken down by type of custody agreement. Source: River

The Bitcoin supply broken down by type of custody agreement. Source: River

Crypto Wallet Types and Risks

Crypto wallet types are also described in the SEC guide, which breaks down the pros and cons of hot wallets connected to the internet and offline storage in cold wallets. Hot wallets pose the risk of hacking and other cybersecurity threats, according to the SEC, while cold wallets pose the risk of permanent loss if offline storage fails, a storage device is stolen or the private keys are compromised.

The SEC’s Crypto Custody Guide highlights the importance of understanding the risks and benefits of various crypto storage methods. The guide is seen as a valuable resource for investors, providing them with the knowledge they need to make informed decisions about their digital assets.  Source: Paul Atkins

Source: Paul Atkins

Industry Reaction and Regulatory Changes

The crypto community is hailing the SEC guidance as a transformative change in the agency. “The same agency that spent years trying to kill the industry is now teaching people how to use it,” Truth For the Commoner (TFTC) said in response to the SEC’s crypto custody guidance. According to Jake Claver, CEO of Digital Ascension Group, a company that provides services to family offices, the SEC provides “tremendous value” to crypto investors by educating potential crypto holders about custody and best practices.

SEC regulators released the guidance a day after SEC Chairman Paul Atkins said the legacy financial system was moving on-chain. On Thursday, the SEC gave the Depository Trust and Clearing Corporation (DTCC), a clearing and settlement firm, the green light to tokenize financial assets, including stocks, exchange-traded funds (ETFs), and government bonds. For more information, visit https://cointelegraph.com/news/securities-exchange-commission-crypto-custody-guide?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound