HashKey’s Historic IPO Bid: A New Era for Hong Kong’s Crypto Market

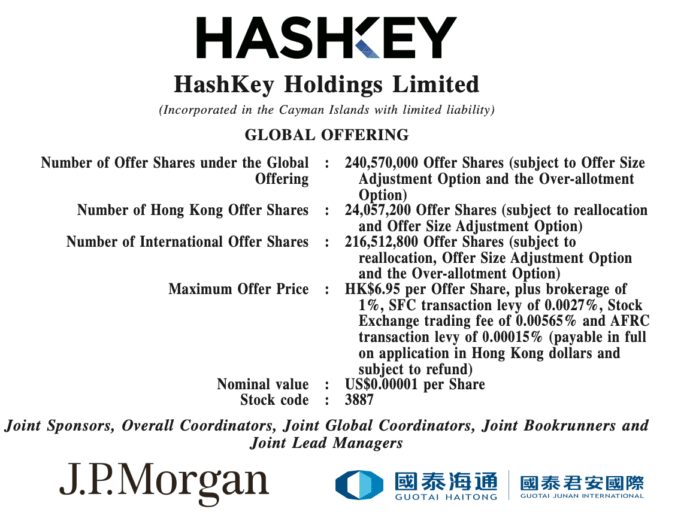

HashKey, a leading crypto exchange, is poised to make history by becoming Hong Kong’s first fully crypto-native initial public offering (IPO). The company aims to list 240.57 million shares under the city’s virtual asset regulatory regime, marking a significant milestone in Hong Kong’s efforts to establish itself as a hub for digital assets.

The IPO is not just a notable event for HashKey, but also a test of the city’s regulatory framework and its ability to attract investors to the crypto market. With a proposed stock code of 3887, HashKey’s listing is expected to begin trading on December 17, with a price range of 5.95 to 6.95 Hong Kong dollars per share. If successful, the offering could raise up to HK$1.67 billion (approximately $215 million), valuing the company at several billion dollars.

Key Insights into HashKey’s Business Model

HashKey’s business model extends beyond a traditional spot exchange, offering a comprehensive platform that includes trading, custody, institutional staking, asset management, and tokenization. The company has already established itself as a major player in Hong Kong’s crypto market, with tens of billions of Hong Kong dollars in staked assets and platform assets under management.

HashKey’s institutional staking and node services, offered through its HashKey Cloud platform, have received approval to support staking for Hong Kong’s spot Ether exchange-traded funds (ETFs). The company’s asset management division provides crypto funds and risk strategies, with approximately HK$7.8 billion in assets under management as of September 30, 2025.

Revenue Growth and Losses: A Compliance-First Approach

HashKey’s revenue has grown significantly, increasing from HK$129 million in 2022 to HK$721 million in 2024. However, the company has incurred substantial losses due to heavy investments in technology, compliance, and market expansion. Net losses almost doubled over the same period, from HK$585.2 million in 2022 to HK$1.19 billion in 2024.

Despite these losses, HashKey’s management believes that its compliance-first approach will ultimately lead to long-term success. The company’s focus on building a licensed, compliant, and scalable digital asset platform is expected to pay off as the market continues to grow and mature.

Utilizing IPO Proceeds for Growth and Expansion

HashKey has outlined its plans to use the proceeds from the IPO to drive growth and expansion. Approximately 40% of the net proceeds will be allocated to technology and infrastructure modernization, including scaling the exchange’s HashKey Chain and matching engine, as well as strengthening its custody, security, and back-office systems.

An additional 40% will be used for market expansion and ecosystem partnerships, focusing on moving into new jurisdictions and scaling crypto-as-a-service arrangements. The remaining 20% will be split between operations and risk management (10%) and working capital and general corporate purposes (10%).

What’s Next for HashKey and Hong Kong’s Crypto Market?

The outcome of HashKey’s IPO will be closely watched, as it will provide valuable insights into the viability of Hong Kong’s regulatory framework and the appetite of investors for crypto assets. If successful, the listing could pave the way for other exchanges, banks, and tokenization projects to go public in the city.

For more information on HashKey’s historic IPO bid and its implications for Hong Kong’s crypto market, visit https://cointelegraph.com/news/how-hashkey-plans-to-become-hong-kong-s-first-crypto-ipo