Crypto Organizations Reject Citadel’s Call for Stricter DeFi Regulations

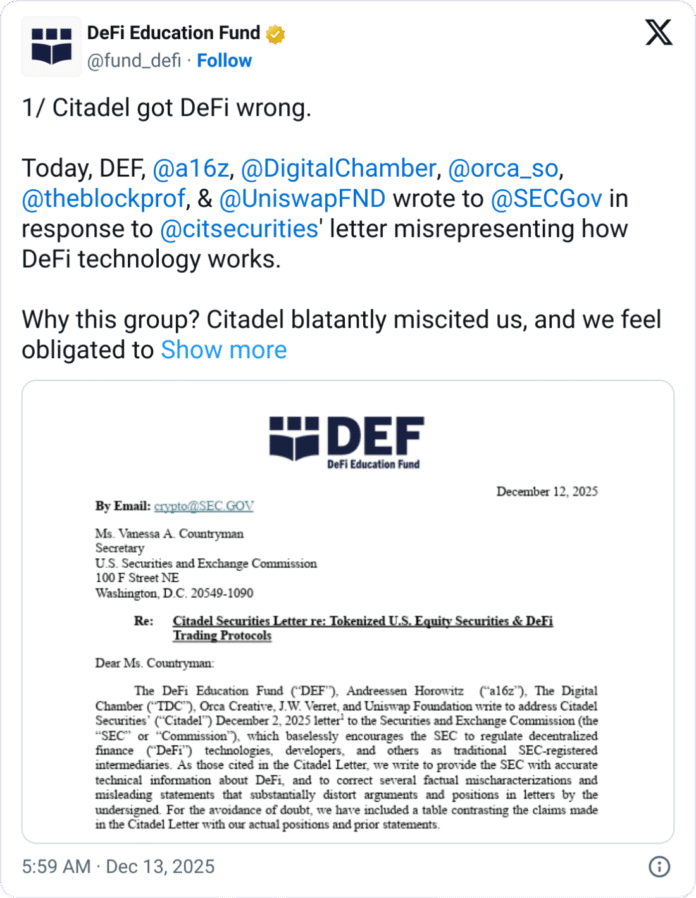

A group of prominent crypto organizations, including Andreessen Horowitz, the Uniswap Foundation, and crypto lobby groups DeFi Education Fund and The Digital Chamber, has pushed back against Citadel Securities’ recent call for the Securities and Exchange Commission (SEC) to tighten regulations on decentralized finance (DeFi) platforms that offer tokenized stocks.

In a letter to the SEC, the group argued that Citadel’s proposal is based on a flawed analysis of securities laws and would be impractical to implement. They claimed that regulating DeFi platforms under traditional securities laws would capture a wide range of on-chain activities that are not typically considered to be the provision of exchange services.

Impracticality of Citadel’s Request

The group emphasized that DeFi technology is a new innovation designed to address market risk and resilience in a different way than traditional financial systems. They argued that DeFi protects investors in ways that traditional financial systems cannot, and that autonomous software cannot be considered an intermediary in a financial transaction because it is not a person capable of exercising independent discretion or judgment.

Source: DeFi Education Fund

Source: DeFi Education Fund

Citadel had argued that exempting DeFi platforms from securities laws could harm investors because the platforms would lack protections such as venue transparency, market surveillance, and volatility controls. However, the crypto organizations countered that achieving investor protection and market integrity does not always require registration as a traditional SEC intermediary.

SEC’s Approach to Regulating Tokenized Stocks

The SEC is currently seeking feedback on how to approach regulating tokenized stocks, and the agency’s chairman, Paul Atkins, has stated that the U.S. financial system could adopt tokenization in “a few years.” Tokenization has gained significant popularity this year, but NYDIG has warned that assets moving on-chain will not immediately be of much use to the crypto market until regulations allow them to be deeper integrated into DeFi.

The letters from Citadel and the crypto organizations come as the SEC’s Crenshaw has been taking aim at crypto at the agency in recent weeks. The SEC’s approach to regulating DeFi and tokenized stocks will have significant implications for the crypto market, and the ongoing debate highlights the need for clear and practical regulations that balance investor protection with innovation.

For more information on this topic, visit https://cointelegraph.com/news/crypto-slams-citadel-call-tighter-defi-tokenization-rules?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound