Evidence-of-Stake (PoS) belongings have not too long ago confronted a noteceable shift. In line with a file, the marketplace capitalization of PoS belongings took some roughly beating, losing via 7% within the 3rd quarter of the presen, with the entire price shrinking to $254 billion. This subside has raised questions in regards to the efficiency and week potentialities of PoS belongings.

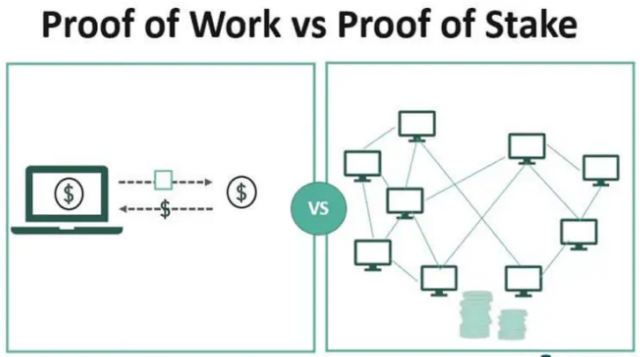

PoS belongings are one of those cryptocurrency that operates on a unique idea than Evidence-of-Paintings (PoW) belongings like Bitcoin. In PoS, the validation of transactions and starting of fresh blocks don’t seem to be depending on energy-intensive mining processes. Rather, validators, or “stakers,” are selected to develop fresh blocks and examine transactions according to the collection of cash they retain and are prepared to “stake” as collateral.

This shift clear of PoW to PoS belongings displays a rising fear for the environmental have an effect on of energy-consuming blockchain networks, as PoS is extra energy-efficient.

Evidence-Of-Stake: Marketplace Capitalization And Staking Rewards

The file additionally unmistakable that day the marketplace capitalization of PoS belongings diminished, the entire price of staked belongings larger via 3% to achieve $74 billion. Staking rewards, at the alternative hand, noticed a short of seven%, losing to $4.1 billion every year.

Symbol: Wall Boulevard Mojo

The typical PoS staking turnover averaged at 10.2%, representing a 4% short in comparison to the former quarter. Those statistics counsel a posh terrain for PoS belongings, with some signs shifting in opposing instructions.

After we take a look at the proportion of PoS belongings compared to the entire cryptocurrency marketplace capitalization, the file signifies that it now stands at 22%, which is a 2% short in comparison to the former quarter. This means that PoS belongings have perceptible a relative subside in prominence throughout the broader cryptocurrency marketplace, which is ruled via belongings like Bitcoin.

ETH marketplace cap lately at $215.531 billion at the day by day chart: TradingView.com

Evidence-Of-Stake: Insights And Implications

The fluctuations seen in proof-of-stake belongings right through the 3rd quarter of the presen lend decent insights into the continuously evolving terrain of cryptocurrencies.

Age the short in marketplace capitalization might carry some considerations, a better take a look at the numerous building up in staked belongings, particularly throughout the Ethereum ecosystem, items a extra positive point of view.

This rising pattern of belongings being staked, specifically in a leading blockchain like Ethereum, signifies a sustained and powerful passion within the proof-of-stake style.

The transferring dynamics of the marketplace and the have an effect on of Layer 2 networks on Ethereum’s efficiency are boxes that require related tracking within the coming quarters. Because the cryptocurrency ecosystem continues to go ahead, adaptability and innovation stay key to the luck of PoS belongings and networks.

Featured symbol from Getty Photographs