Introduction to USDKG: Kyrgyzstan’s Gold-Backed Stablecoin

Kyrgyzstan, a Central Asian country with a population of approximately 7 million, has made a significant entry into the stablecoin market with the launch of USDKG. This innovative stablecoin is pegged to the US dollar, but what sets it apart is its unique reserve model, which utilizes physical gold as collateral instead of traditional cash deposits and short-term US Treasury bonds.

The initial offering of 50 million USDKG tokens, equivalent to $50 million at the proposed peg, has been deployed on the Tron network, with plans for expansion to Ethereum in the future. This development marks a notable shift in the stablecoin landscape, particularly in emerging markets where trust, credibility, and reliable assets are paramount.

Understanding the USDKG Stablecoin

USDKG is designed to maintain a 1:1 peg with the US dollar, ensuring that each token retains a value of $1. The stablecoin’s collateral is backed by physical gold, providing a unique twist on traditional stablecoin models. The issuer structure is also noteworthy, with a 100% state-owned company responsible for issuing the token, while day-to-day operations, including gold management, are handled by a private company registered in Kyrgyzstan.

The project’s transparency page indicates an audit, and ConsenSys Diligence has published a review of USDKG’s smart contracts, providing valuable insights into the token’s security and operational risks. However, it is essential to note that contract security and reserve verification are two separate aspects that require distinct checklists and evaluations.

The Significance of USDKG in Emerging Markets

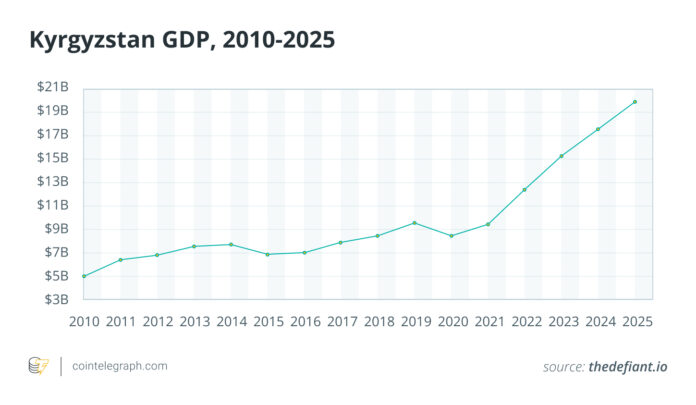

In emerging markets, stablecoins like USDKG can play a vital role in facilitating cross-border payments, settlements, and remittances. Kyrgyzstan’s economy, in particular, relies heavily on remittances, with the World Bank estimating that remittances accounted for nearly 30% of the country’s GDP in 2021. The introduction of USDKG can potentially provide a more efficient, cost-effective, and reliable means of transferring value across borders.

The use of gold as collateral and the involvement of a state-owned issuer can contribute to increased trust and credibility in the stablecoin, particularly in regions where gold is a widely recognized and valued asset. This approach may also help to mitigate concerns related to currency substitution, capital flight, and monetary sovereignty.

Regulatory Compliance and the Future of USDKG

Kyrgyzstan’s Virtual Assets Law of 2022 provides a framework for the issuance, storage, and circulation of virtual assets, including stablecoins like USDKG. The law also establishes a licensing system for virtual asset service providers, which is essential for ensuring compliance with regulatory requirements.

As USDKG expands its operations and seeks to establish itself as a viable stablecoin, it will be crucial to demonstrate adherence to regulatory standards, including those related to anti-money laundering (AML) and know-your-customer (KYC) protocols. The project’s ability to provide clear, independent signals from third-party auditors and regulators will be essential in building trust and credibility among users.

Evaluation and Due Diligence

To assess the viability and reliability of USDKG, it is essential to consider several key factors, including:

-

Redemption reality: The process of redeeming USDKG tokens for physical gold or fiat currency must be transparent, efficient, and subject to clear rules and fees.

-

Custody and audit: The storage and custody of the gold collateral must be secure, with regular independent audits to verify the existence and value of the reserves.

-

Code security vs. reserve checking: The security of USDKG’s smart contracts must be evaluated separately from the verification of the gold reserves, with a focus on ensuring the integrity of both on-chain and off-chain components.

-

Control and governance: The administrative permissions and governance structure of USDKG must be transparent, with clear procedures for pause, freeze, and blacklist functions, as well as a standard of due process for fund freezes.

-

Distribution and liquidity: The availability and liquidity of USDKG on exchanges, over-the-counter desks, remittance corridors, and merchant infrastructure will be critical in determining the token’s success and usability.

Conclusion

The development of USDKG represents a significant evolution in the stablecoin landscape, particularly in emerging markets. As the project continues to grow and expand, it will be essential to monitor its progress, evaluate its adherence to regulatory standards, and assess its ability to provide a reliable, efficient, and trustworthy means of transferring value across borders. For more information, visit https://cointelegraph.com/news/kyrgyzstan-s-usdkg-shows-how-real-asset-stablecoins-are-evolving-in-emerging-markets?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound