US Federal Reserve Withdraws 2023 Crypto Guidance for Banks

The US Federal Reserve has withdrawn its 2023 guidance that limited the way Fed-supervised banks, including uninsured ones, deal with cryptocurrencies. This move is seen as a significant step forward for the adoption of digital assets in the US financial system. The 2023 guidance required uninsured banks to follow the same rules as federally insured institutions, based on the principle that similar activities pose similar risks and should be subject to identical regulation.

This guidance prevented uninsured banks from engaging in activities not permitted for national banks, such as crypto services that automatically disqualified Fed membership because the institution’s core activities were not permitted. However, the Fed has now recognized that the financial system has evolved since 2023, and the guidance is no longer applicable.

Evolution of the Financial System

The Fed stated that a key reason for withdrawing the guidance was that it was outdated, and “the financial system and the Board’s understanding of innovative products and services have evolved.” As a result, the 2023 Policy Statement is no longer appropriate and has been withdrawn. This decision reflects the Fed’s commitment to embracing innovation and adapting to the changing landscape of the financial system.

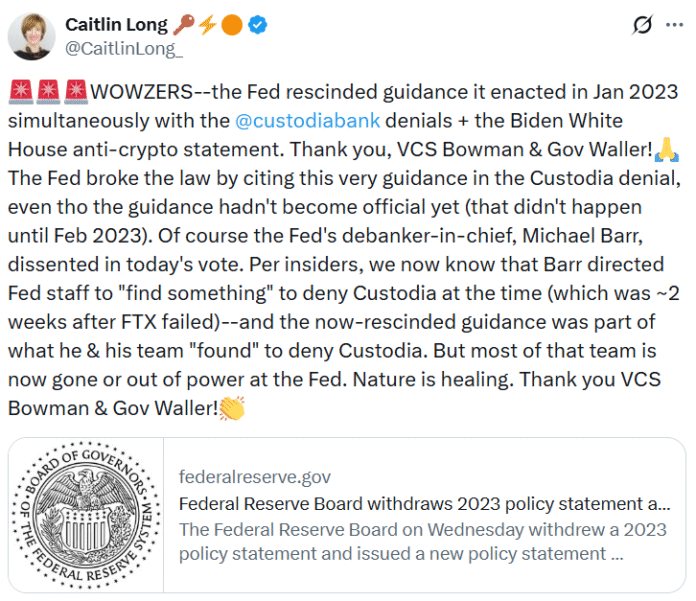

Caitlin Long, CEO of cryptocurrency-focused Custodia Bank, welcomed the move, explaining that the 2023 guidance was the reason her institution’s application for a primary account was previously rejected. A main Fed account allows a financial institution to hold funds directly with the Federal Reserve and access its core payment systems, enabling payments to be settled in central bank money rather than relying on another bank as an intermediary.

Long noted that the Fed broke the law by citing the guidance in Custodia’s denial, even though it had not yet become official. However, she expressed gratitude towards VCS Bowman and Gov Waller, indicating that the decision is a positive step forward for the industry.

New Guidelines for Banking Innovation

The Fed issued new guidance to create a formal path for both insured and uninsured federal member banks supervised by the Federal Reserve to pursue “innovative activities” such as cryptocurrencies, provided risk management expectations are met. Michelle Bowman, the Fed’s vice chair for supervision, stated that “by creating a pathway for responsible, innovative products and services, the Board is helping to ensure that the banking sector remains safe and sound while remaining modern, efficient and effective.”

However, not all Fed officials agree with the decision. Fed Governor Michael Barr objected to the withdrawal of the guidance, arguing that the principle of equal treatment of banks helps maintain a level playing field and prevent regulatory arbitrage. Barr stated that this principle remains valid today and that he cannot agree with a repeal of the current policy statement.

Implications and Reactions

The withdrawal of the 2023 guidance and the introduction of new guidelines are expected to have significant implications for the cryptocurrency industry. The move is seen as a positive development for banks and financial institutions looking to engage with digital assets. As the financial system continues to evolve, it is essential for regulatory bodies to adapt and provide clear guidance to ensure the safe and sound development of innovative products and services.

For more information, visit https://cointelegraph.com/news/fed-withdraws-crypto-guidance-banks-innovation?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound