Bitcoin Price Stuck in Neutral as Holiday Trading Drains Market Liquidity

As the holiday season approaches, Bitcoin’s price remains range-bound, unable to break free from the $85,000 support and $93,000 resistance levels. According to QCP Capital, thinning liquidity and year-end de-risking have pushed traders to the sidelines, resulting in a $3 billion drop in perpetual open interest for Bitcoin and a $2 billion drop for Ethereum overnight. This reduction in leverage has left markets vulnerable to sharp moves in either direction.

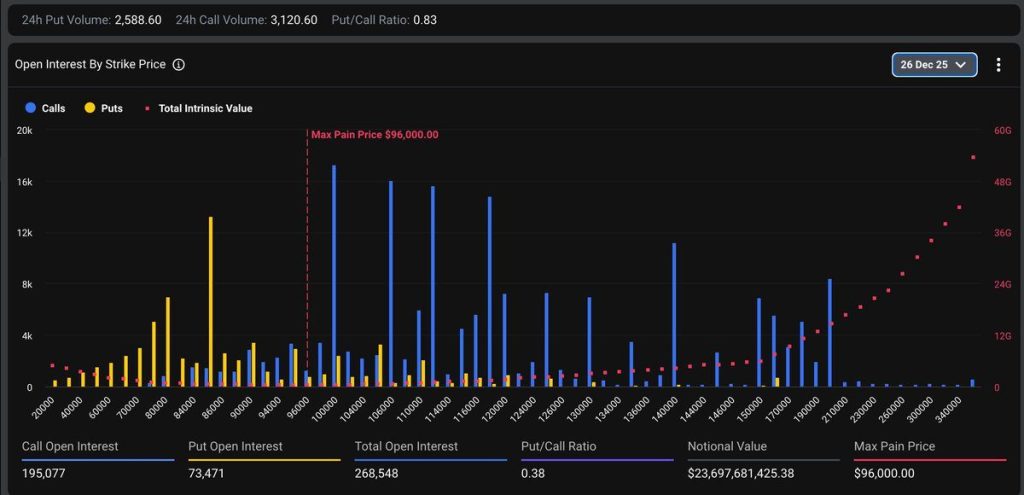

Meanwhile, gold has surged to fresh all-time highs, gaining 67% year to date, while Bitcoin has failed to match this performance, closing out its weakest year-end performance in seven years. The upcoming Boxing Day options expiry on Friday is expected to be a significant event, with roughly 300,000 Bitcoin option contracts worth $23.7 billion and 446,000 IBIT option contracts set to expire, representing over 50% of Deribit’s total open interest.

Year-End Flows Amplify Volatility Risk

Bitcoin risk reversals show easing bearish sentiment compared to the past 30 days, gradually normalizing toward pre-October levels as downside positioning softens. However, tax-loss harvesting ahead of the December 31 deadline could amplify short-term volatility, particularly since crypto investors can realize losses and immediately re-establish positions without wash-sale rule restrictions that apply to equities.

According to QCP, holiday-driven moves have historically tended to mean-revert, with Christmas week price action typically fading as liquidity returns in January. On-chain data reveals weakening buying pressure across multiple metrics, with CryptoQuant analysis showing a declining buy-volume divergence in Binance futures markets, resembling the 2021 cycle structure.

Institutional Holders Stay Steady Despite Drawdown

Despite a more than 30% drawdown from October highs, U.S. spot Bitcoin ETF holdings have declined by less than 5%, indicating institutional allocators are largely holding through the current downturn. According to Ray Youssef, CEO of NoOnes, selling pressure is primarily retail-driven from leveraged and short-term participants.

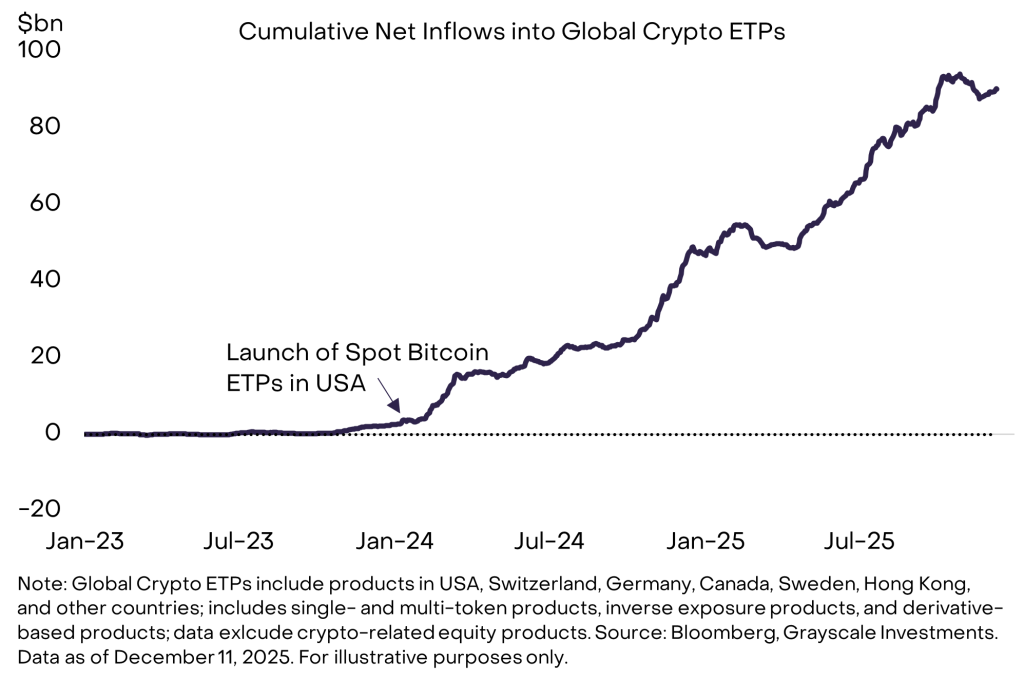

Recent data show that global crypto ETPs have attracted $87 billion in net inflows since U.S. Bitcoin ETPs launched in January 2024. Farzam Ehsani, Co-founder and CEO of VALR, noted that the end of this year remains one of the more challenging periods for cryptocurrencies in recent years, amid seasonal weakness, persistent overbought conditions, and a return of investor interest to more conservative instruments, primarily US government bonds.

Recovery Timeline Extends Into 2026

John Glover, Chief Investment Officer of Ledn, expects continued volatility with prices dipping to between $71k and $84k, which will form the bottom of Wave IV before the fifth and final wave begins. His Wave V remains at $145k to $160k, though completion of the current correction will take months to finish.

Ehsani sees scope for Bitcoin to revisit the $100,000–$120,000 range in the second quarter of 2026, noting that a renewed historical price high could occur as early as the first half of 2026. Michael Van De Poppe also observed that rejection at $90,000 isn’t a bad sign, as of yet, with markets clearly wanting $86K to hold as support to provide enough momentum to challenge resistance zones.

For more information, visit the original source: https://cryptonews.com/news/bitcoin-trapped-until-2026-as-holiday-trading-drains-market-liquidity-qcp/