Trump-Linked USD1 Sees $150 Million Surge After Binance Unveils 20% Yield Promotion

World Liberty Financial’s USD1 stablecoin, linked to the family of former US President Donald Trump, has experienced a significant increase in market capitalization following Binance’s introduction of a high-yield promotion for the token. According to recent data, USD1’s market cap rose by approximately $150 million, from $2.74 billion to $2.9 billion, after Binance announced its “USD1 Boost Program” on Wednesday.

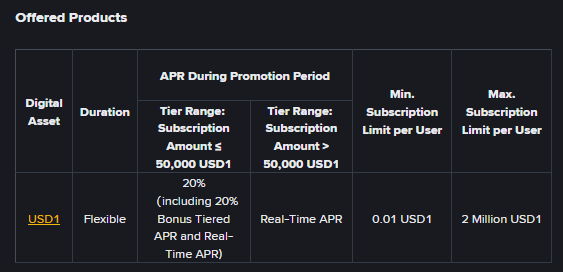

The promotion, which runs from December 24, 2025, to January 23, 2026, offers users up to 20% per year for USD1 held in Binance’s Simple Earn Flexible products. This campaign aims to help USD1 holders increase their passive returns during the limited window, with subscriptions allocated on a first-come, first-served basis.

Binance Targets Passive Yield Seekers with Time-Limited USD1 Boost

Under the program, users who subscribe to USD1 Flexible products can earn rewards across two streams: the Real-time APR, which accrues minute by minute and is automatically added to users’ Earn accounts, and the Bonus APR, which is calculated separately and credited to users’ Spot accounts daily. The minimum subscription amount is set at 0.01 USD1, with a limit of 2 million USD1 per user.

Binance has positioned the USD1 Boost as part of its broader range of “Boost” programs, which aim to optimize capital utilization and encourage activity within its ecosystem. Other Boost offerings include BNB Boost and LiquidityBoost programs, which reward users with preferential rates and fee discounts.

Incentives, Airdrops, and Deals Fuel USD1’s Rapid Ascent on Binance

The latest development comes amid a series of initiatives that have expanded USD1’s footprint. In June, World Liberty Financial announced an airdrop of approximately $4 million worth of USD1 to holders of its WLFI token, distributing about $47 in USD1 to every eligible wallet outside certain jurisdictions. Binance has also increased its support for the stablecoin, adding fee-free USD1 trading pairs and converting collateral for its Binance USD product to USD1 at a one-to-one ratio.

These integrations have helped catapult USD1 into the rankings of the world’s largest stablecoins by market cap, pushing it to seventh place globally, behind PayPal’s PYUSD. According to recent reports, World Liberty Financial’s crypto operations, including USD1, generated approximately $802 million in revenue in the first half of 2025.

For more information on the USD1 Boost and Binance’s other initiatives, please visit https://cryptonews.com/news/trump-linked-usd1-binance-20-percent-yield-boost/