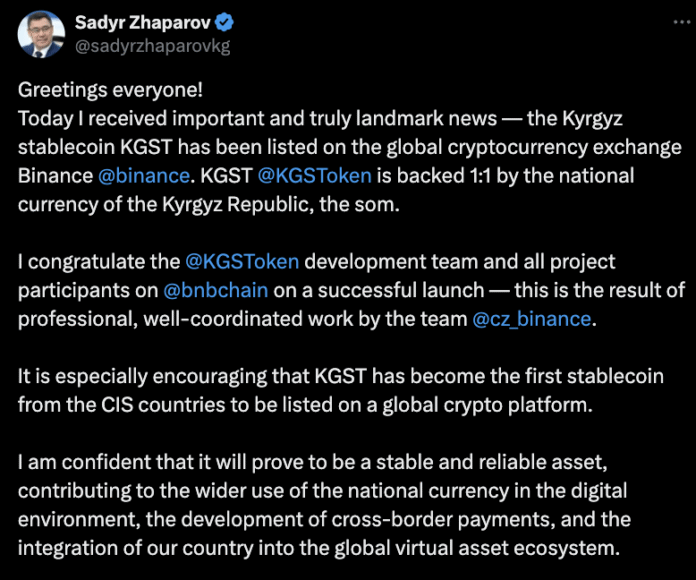

Kyrgyzstan’s President Sadyr Japarov has announced that a recently launched stablecoin, pegged to the country’s fiat currency, has been listed on the popular cryptocurrency exchange Binance. This development marks a significant milestone in the country’s efforts to promote the adoption of digital assets. In a post on social media, Binance CEO Changpeng “CZ” Zhao expressed his enthusiasm for the listing, stating that “many more” government-backed stablecoins would be coming to exchanges in the future.

Zhao has been advising the Central Asian country since April, providing technical expertise and advisory services under an agreement. Kyrgyzstan, a mountainous and landlocked country with a population of approximately 7 million, is increasingly bullish on digital assets. In September, the country put forward legislation aimed at creating a state crypto reserve and expanding its digital asset industry. The country has also launched USDKG, a US dollar-pegged stablecoin backed by physical gold, with an initial supply of 50 million units on the Tron network, and plans to expand it to the Ethereum blockchain.

Countries Embracing Stablecoins

While dollar-pegged stablecoins, such as Tether’s USDT and Circle’s USDC, account for the majority of market capitalization, several countries and economic blocs are launching or planning to launch their own currency-backed stablecoins. This trend is driven by the potential benefits of stablecoins, including reduced volatility and increased stability. In October, Tokyo-based fintech firm JPYC launched Japan’s first yen-pegged stablecoin, which is backed by bank deposits and Japanese government bonds. The stablecoin is intended to be traded at parity with the yen.

In December, SBI Holdings and Startale Group signed a memorandum of understanding to develop a regulated yen-denominated stablecoin, which is planned to be issued and redeemed by Shinsei Trust & Banking in the second quarter of 2026. Additionally, a consortium of 10 European banks announced plans to launch a euro-pegged stablecoin in the second half of 2026 through Amsterdam-based Qivalis, with the approval of the Dutch central bank. The UAE telecommunications group e& also signed a memorandum of understanding with Al Maryah Community Bank to explore the use of a dirham-pegged stablecoin for consumer payments.

Stablecoin Market Growth

As of Wednesday, the current stablecoin market cap is $308.9 billion, according to data from DefiLlama. This growth is driven by increasing adoption and the potential benefits of stablecoins. The listing of Kyrgyzstan’s state stablecoin on Binance is expected to further promote the adoption of digital assets in the country and potentially drive growth in the stablecoin market.

Source: Sadyr Zhaparov

Stablecoin market cap. Source: DefiLlama

For more information on this development, visit https://cointelegraph.com/news/kyrgyzstan-state-stablecoin-launch-binance?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound