The cryptocurrency market has witnessed significant developments in recent times, with stablecoins being a major point of discussion. Coinbase CEO Brian Armstrong has expressed strong opposition to any attempts to reinstate the GENIUS Act, which he believes would be a “red line” and an unfair attempt by banks to block competition from stablecoins and fintech platforms.

Banking Industry’s Concerns and Motivations

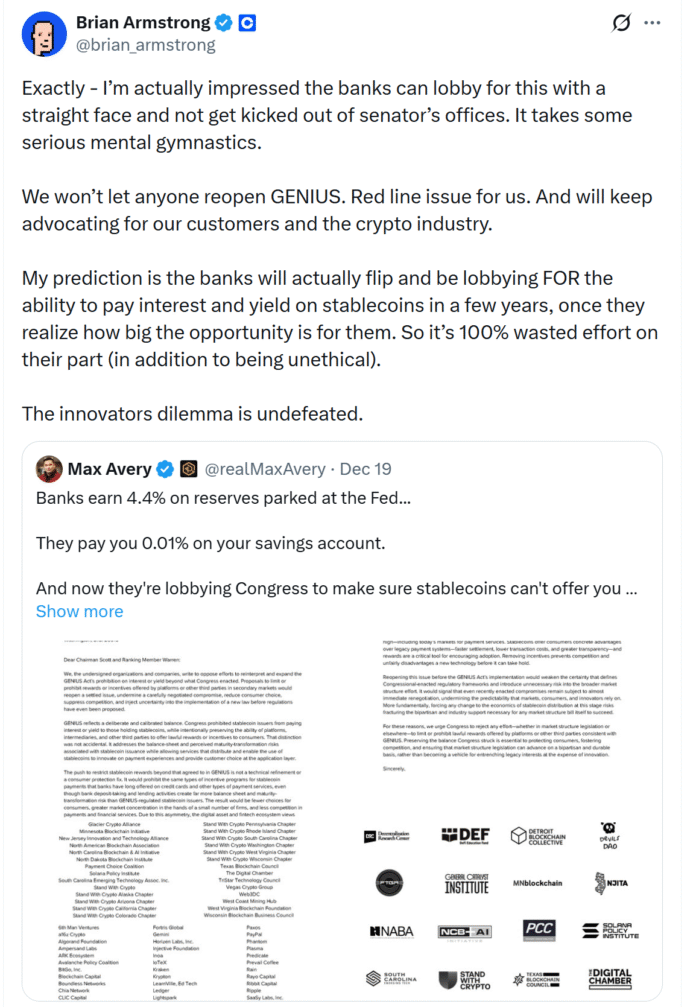

Armstrong’s comments came in response to a post by Max Avery, a board member and business development director at Digital Ascension Group, who outlined the banking industry’s efforts to urge lawmakers to reconsider the legislation. Avery argued that the proposed changes would not only ban direct interest payments by stablecoin issuers but also restrict “rewards” more broadly, affecting indirect yield-sharing mechanisms offered by platforms and third parties.

The banking industry’s concerns stem from the fact that stablecoin platforms jeopardize their traditional model of earning interest on reserves while offering little to no interest to consumers. Avery pointed out that banks currently earn about 4% on reserves parked at the Federal Reserve, while consumers often earn close to zero on traditional savings accounts. He noted that independent investigations have shown no evidence of disproportionate deposit outflows from community banks, contradicting the banking industry’s claims of a “security risk.”

Stablecoin Market and Cryptocurrency Adoption

The stablecoin market, valued at $310 billion, reveals a significant aspect of cryptocurrency adoption. The market’s growth and the increasing demand for stablecoins have led to a shift in the way people perceive and use cryptocurrencies. As Armstrong predicted, banks may eventually embrace the opportunity to pay interest and yield on stablecoins, recognizing the potential benefits for themselves and their customers.

Meanwhile, US lawmakers have proposed tax breaks for stablecoin payments, aiming to reduce the tax burden on everyday crypto users. The proposal, introduced by Reps. Max Miller and Steven Horsford, would exempt small stablecoin transactions from capital gains taxes, allowing payments of up to $200 in regulated dollar-pegged stablecoins to avoid recognizing gains or losses.

Coinbase CEO warns against reopening GENIUS Act. Source: Brian Armstrong

Cryptocurrency Regulation and the Future of Stablecoins

TheGENIUS Act, passed after months of negotiations, prohibits stablecoin issuers from paying interest directly but allows platforms and third parties to offer rewards. As the cryptocurrency market continues to evolve, it is essential to strike a balance between regulation and innovation. The proposed tax breaks and the growing demand for stablecoins are indicative of the industry’s potential for growth and adoption.

For more information on the GENIUS Act and the stablecoin market, please visit https://cointelegraph.com/news/coinbase-ceo-genius-act-red-line-bank-lobbying-stablecoins?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound